Pressure decreases quite steadily, VN-Index slightly decreases for the second week

The War tariff US President Donald Trump's rhetoric continued to escalate last week, raising concerns among investors. This is expected to get even hotter as investors anxiously await new statements from Mr. Trump this week. Along with that, the US economy is showing some signs of slowing growth, causing the US stock market to have another week of declines.

During the week, some regional markets recovered such as Indonesia, India... while Thailand and the Philippines remained in a downward trend.

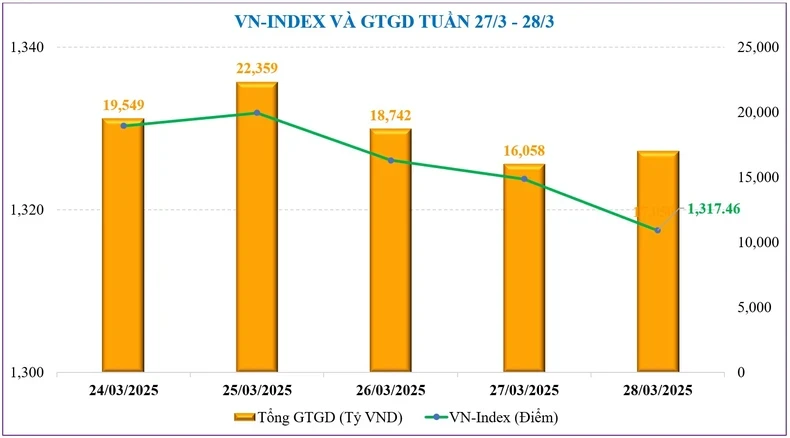

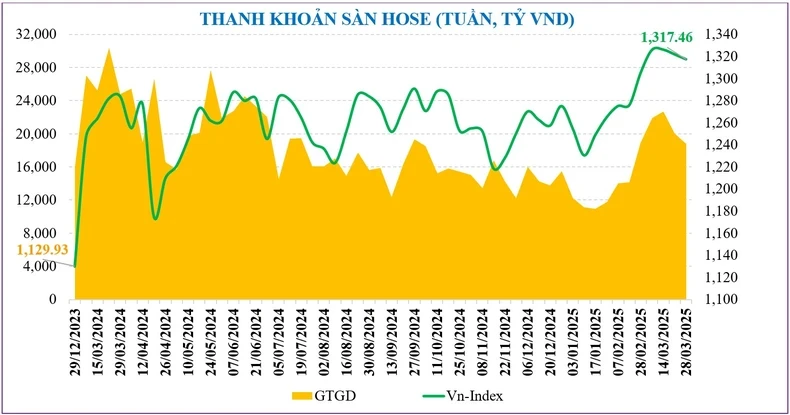

The Vietnamese stock market last week (March 24-28) performed quite closely to previous forecasts. The domestic market remained under pressure to correct and fell for the second consecutive week after reaching a short-term peak of 1,340 points.

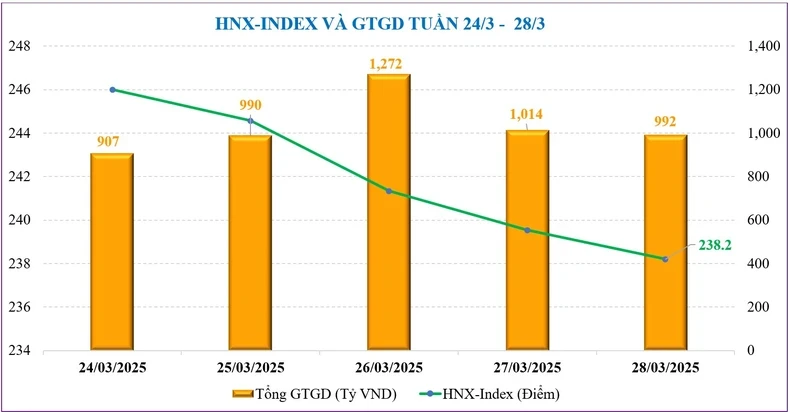

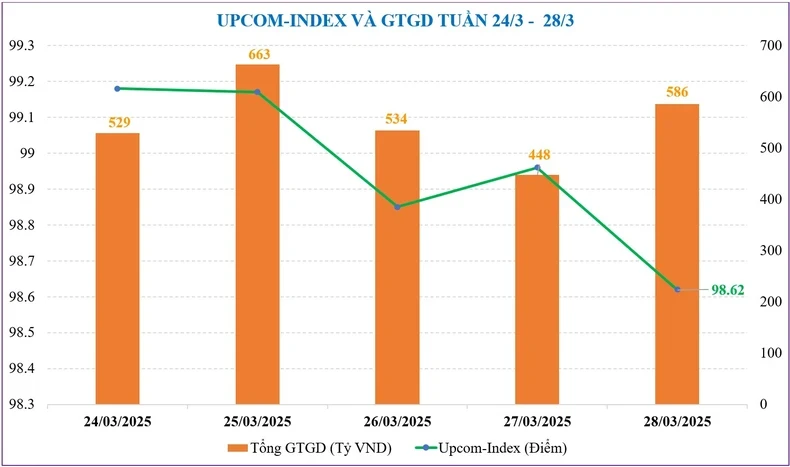

At the end of the week, the VN-Index closed the week at 1,317.46 points, down -4.42 points, equivalent to a decrease of -0.33% compared to the previous week. On the HNX floor, the HNX-Index also suffered stronger downward pressure, losing 7.62 points, equivalent to 3.10%, closing at 238.2 points. The UPCoM-Index also had a correction week when it decreased -0.7%, to 98.62 points at the end of the week.

The downward pressure on the VN-Index came from all industry groups such as VN30, small-cap stocks and mid-cap stocks. However, the market was strongly differentiated with the decline mainly concentrated in the groups: Seafood (-5.12%), Viettel (-3.72%), Technology (-3.16%). Going against the market trend were the groups: Natural Rubber (+7.83%), Vingroup (+7.54%), Aviation (+1.90%)...

Similar to the score, the liquidity of the whole market last week maintained a downward trend as caution became more evident. The total average trading value of the whole market was only 20,338 billion VND/session, down -6.5% compared to the previous week, in which the matched liquidity also dropped -11.4%, to 16,981 billion VND/session.

Statistics show that the average market liquidity in March reached VND 22,733 billion/session, up +27.3% compared to February but still -23.6% lower than the same period. Accumulated from the beginning of the year, the total market liquidity reached VND 17,806 billion/session, down -15.5% compared to the average in 2024.

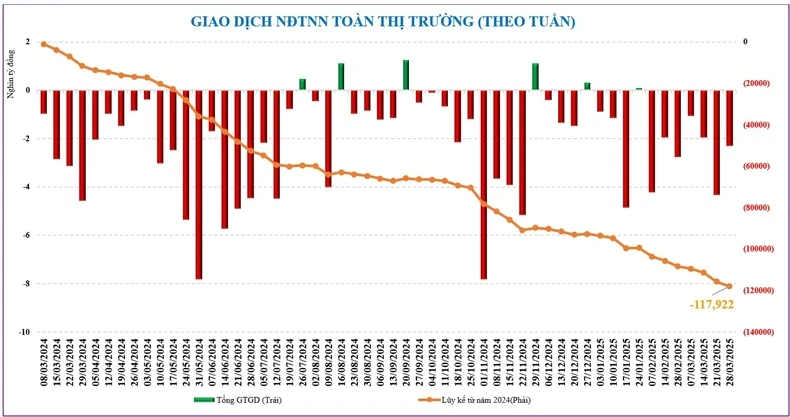

Although the net selling pressure of foreign investors decreased compared to the previous week, this group continued to be a reason for the market to increase its adjustment. Accordingly, foreign investors net sold more than -2,284 billion VND last week on the whole market, increasing the cumulative net selling since the beginning of the year to -26,191 billion VND.

The group of stocks that were net sold last week focused on TPB (-563 billion VND), FPT (-530 billion VND), PNJ (-272 billion VND)... while net buying was for VRE (+455 billion VND), VIX (+226 billion VND), VPI (+178 billion VND)...

Currently, the market's P/E (ttm) has increased from 13.5 times in mid-February to 14.5 times, but is still 14.5% lower than the 5-year average.

Pressure still on waiting for tariff news, but maybe by the end of the week

The stock market is anxiously awaiting news from Donald Trump this week. April 2 is expected to be a hot spot if it marks a new escalation in the tariff war started by President Trump.

The US stock market is expected to be under further pressure as it welcomes data from the macroeconomy, most notably the PMI index, the labor market and messages from the FED leader.

Domestically, investors continue to be closely watching developments in the international market. Although the tariff policy does not have a direct impact on Vietnam, sentiment remains uncertain.

Domestic macroeconomic information will also be released this week and is expected to provide more balanced information. GDP growth in the first quarter of 2025 and other macroeconomic indicators will be announced by the General Statistics Office in the first half of next week, but the Prime Minister announced last weekend that it was approximately 7%.

In addition, news about business results and the 2025 general meeting of shareholders is also expected to have positive signals to strengthen investor sentiment.

However, from a technical perspective, short-term risks increase when the market loses the MA20 technical threshold, combined with external impacts, which could be an unfavorable signal for the market. The market is still well-protected at the lower threshold at 1,300 points. In case of correction below this zone, the opportunity to choose good fundamental stocks will appear for the medium-term investment trend.

Liquidity is still adjusted down but in general is still at a good level of over 20,000 billion VND/session. This shows caution in psychology, not yet a selling mentality due to fear of risk.

On April 2, the US is expected to announce a reciprocal tax policy targeting a group of 15 countries with high tax rates and large trade surpluses, of which Vietnam is at risk of being affected. However, some comments show that the Vietnamese market will not be affected too much by the US tariff policy. Firstly, concerns about tariffs have been largely reflected in the market's adjustment in the past 2 weeks; at the same time, the group directly affected by US tariffs is not large in the stock market.

On the other hand, Vietnam has recently taken strong, flexible and timely steps to minimize the risk of being subject to tariffs by the US, such as signing trade agreements with US partners and considering reducing tariffs on some imported products such as cars, ethanol, LNG, agricultural products, etc.

Meanwhile, in terms of domestic factors, the market still has many supporting factors, including macro signals and positive information that will appear such as business results in the first quarter of 2025 of enterprises, prospects for upgrading, implementation of the KRX system... Therefore, the support zone for the correction next week may be the 1,300-1,305 point area and there is a possibility of recovery if sentiment is lifted when domestic news appears.

Source: https://baolangson.vn/thi-truong-chung-khoan-tuan-moi-31-3-4-4-2025-co-the-test-nguong-1-300-diem-co-hoi-tai-cau-danh-muc-neu-vn-index-dieu-chinh-sau-5042609.html

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)