Continue to promote individual and SME customer segments

Superior technology, industry-leading data capabilities and talented human resources have helped Techcombank achieve impressive business results in 2023, with Total Operating Income (TOI) of VND40 trillion, a high Capital Adequacy Ratio (CAR) of 14.4%, the lowest non-performing loan (NPL) in the industry at 1.2%, and demand deposits (CASA) of 40%.

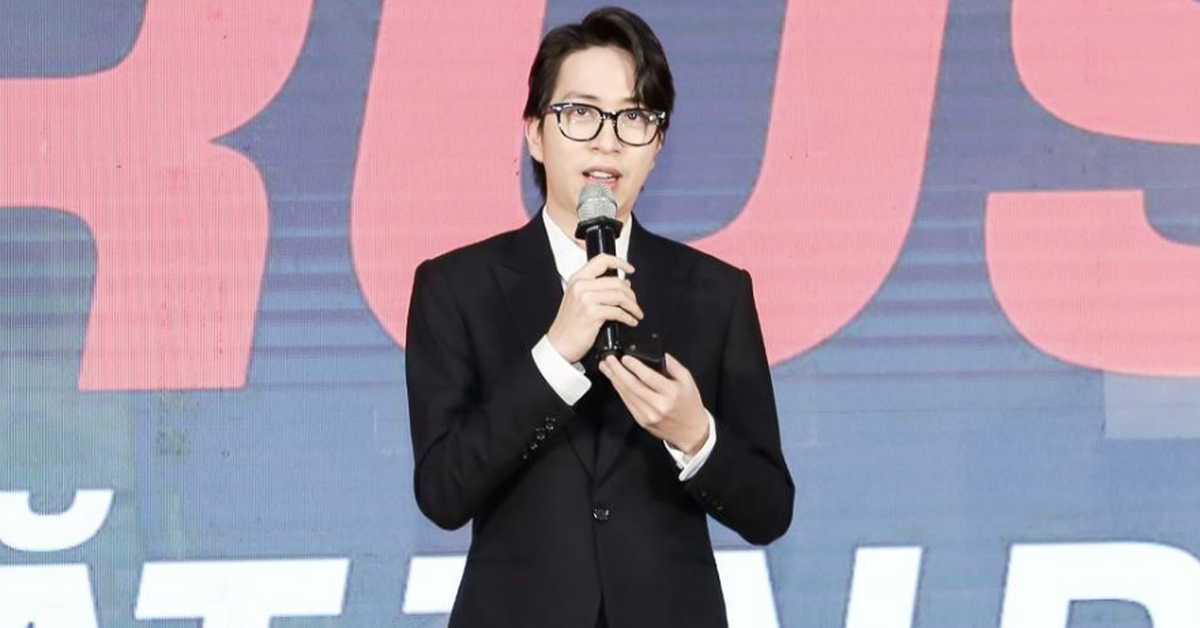

However, for Techcombank CEO Jens Lottner: "2023 is a challenging year, and the diversification of our credit portfolio is behind schedule."

"From that perspective, choosing to lend to large enterprises, instead of focusing on shifting to individual customers and small and medium enterprises (SMEs) at all costs, is a safer strategy for banks, in the context that customers in these segments do not have much demand for loans," he shared. Techcombank's CEO also added that the bank will continue to promote lending to individual customers and SME segments to diversify its credit portfolio when conditions allow.

In this diversification strategy, the bank also shifted its credit activities to emerging and fast-growing segments in the Vietnamese economy and initially achieved certain successes. The credit portfolio for non-real estate, materials and construction sectors grew by 60% by 2023.

Reach new heights

With the leading position in the Vietnamese banking industry in terms of CASA portfolio, Techcombank aims to reach 55% CASA by 2025, putting the Bank on par with the largest credit institutions in the ASEAN region such as UOB and DBS.

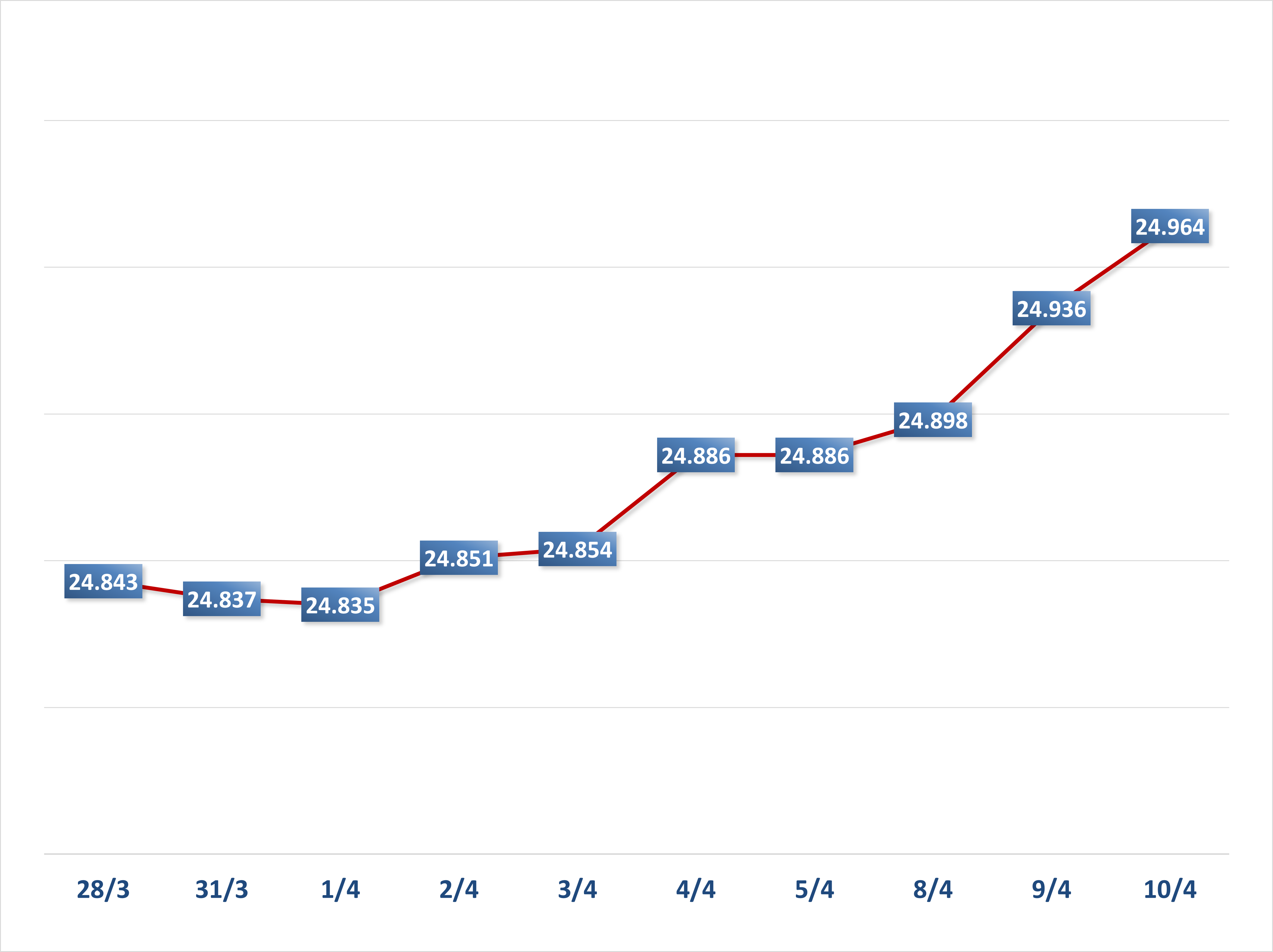

This is a completely feasible goal. According to Mr. Lottner, the bank can increase CASA thanks to some features that customers are using such as Auto-earning. At the same time, the CASA ratio is almost unaffected by fluctuations in interest rates - a factor that negatively impacts many business activities. And in the first quarter of 2024, the CASA ratio of this bank reached 40.5%, rising to the leading position in the banking industry, with CASA balance increasing sharply by 49.4% compared to the same period last year.

“The higher the CASA, the more secure the bank’s cost of capital is,” added Mr. Jens Lottner.

Techcombank shows the right direction when focusing on the "Mass Affluent" (good income) and "Affluent" (high income) customer segments. In the context of continuously increasing disposable income, the middle class is expanding, accounting for a significant proportion of the population of 100 million people in Vietnam.

Mr. Jens Lottner shared that Techcombank will not stop at attracting CASA from individual customers. "We have a more ambitious CASA plan. More specifically, we are focusing on promoting the provision of differentiated positioning packages for small and medium enterprises, micro-enterprises and merchants, making Techcombank the main transaction bank for customers," Mr. Lottner said.

With the NFI/TOI ratio currently at 26%, Techcombank hopes to soon reach the 30% threshold, while achieving a 20% return on equity.

"We believe that in 2024 and 2025 our diversification strategy will pay off and we will achieve the important milestones we have set," Mr. Jens Lottner affirmed.

Techcombank has less than two years to realize its ambition of becoming a bank with a market capitalization of $20 billion. If Techcombank succeeds, this will mark a huge increase from its current valuation of around $6-7 billion. With that market capitalization, Techcombank will rise to the top 10 banks in Southeast Asia.

Ready to welcome strategic investors

Techcombank also expressed interest in seeking strategic investors, because in addition to the value they bring, the ultimate goal is to enhance the value of the bank through the trust of one or several selected reputable partners. "We are ready to welcome strategic investors or investors with a long-term mindset to accompany us in building the brand and increasing non-capital value in many different forms. This could be one investor, but it could also be a few highly reputable institutional investors participating with a stake of 1% to 5%, and will continue to advise us on how to improve our business and operational model as well as meet ESG standards."

Techcombank has made headlines with its plan to pay a cash dividend in 2024, the first in a decade. This is clear evidence of its ability to maintain a 20% growth trajectory and a CAR of 14-15% while still being able to pay dividends.

“And we will do it sustainably,” Mr. Jens Lottner affirmed.

Becoming a new generation bank

The journey to continuously improve operational efficiency also requires openness to acquiring additional expertise. As Techcombank moves to accelerate its transformation, it has strengthened its Board of Directors by appointing three new members, who all have extensive experience in the banking sector, particularly in risk management and asset management.

More notably, Techcombank has successfully recruited former Chairman of the Board of Trustees and Deputy CEO of Bank Asia (BCA) Eugene Keith Galbraith as an independent member of the Board of Directors. His rich experience includes driving CASA, attracting high-income customers (affluent) and digital innovation at BCA during his 17-year tenure.

On the technology front, Techcombank continues to adopt revolutionary upgrades, such as moving a significant amount of workload to the cloud and building a data ecosystem that enables the bank to deliver new, unique value propositions and ultimately serve its customers more efficiently and sustainably.

Mr. Jens Lottner emphasized that ESG will be a focus for Techcombank in 2024: "We aim to become a new generation bank, so the way we operate must demonstrate respect for people, support the entire Vietnamese community and promote strong governance towards the future so that highly ethical actions and decisions will become the norm."

Source: https://thanhnien.vn/tong-giam-doc-jens-lottner-techcombank-tu-tin-vuon-tam-cao-moi-185240509154014292.htm

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)