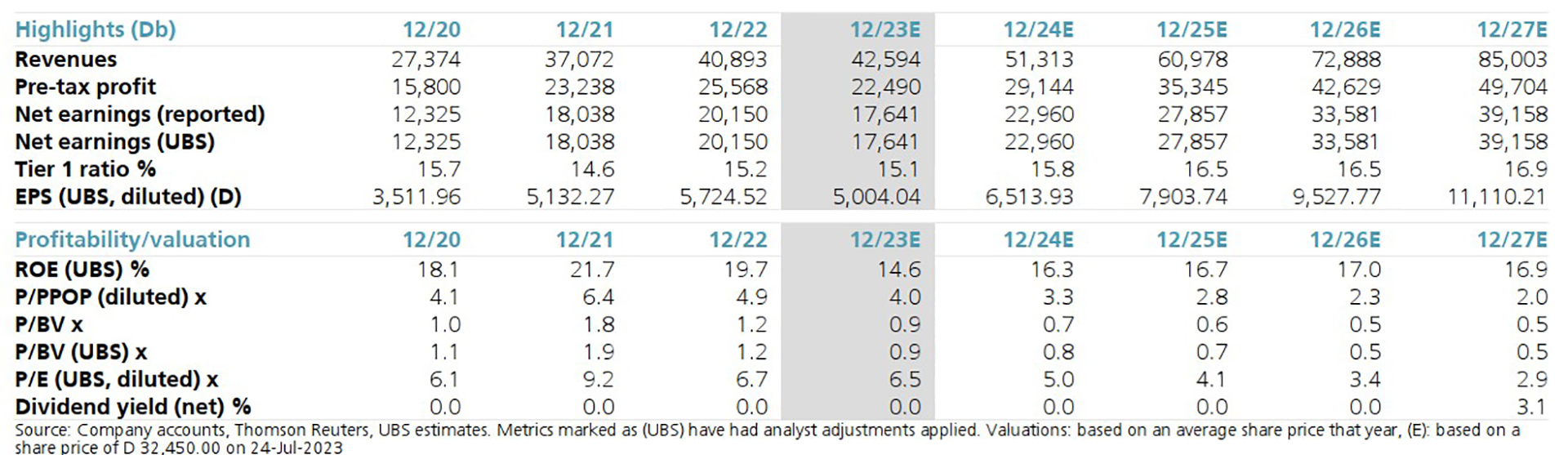

In the second quarter of 2023, Vietnam Technological and Commercial Joint Stock Bank (Techcombank, HOSE: TCB) recorded positive business results, in the context of the general economic challenges. Specifically, Techcombank's net profit in the second quarter of 2023 reached VND 4,455 billion, 43% higher than JPMorgan's expectation, and pre-tax profit (VND 5,649 billion) exceeded UBS's forecast by 6%.

According to international organizations, this result was achieved thanks to lower-than-expected credit costs along with better-than-expected asset quality. The world's leading analysts at JPMorgan and UBS highly appreciated and commented that this is a "locally knowledgeable bank with a wide network, diverse products and an excellent management team".

Techcombank gradually affirms its position in the regional banking group

After Techcombank announced its Q2/2023 profit far exceeding forecasts, JPMorgan continued to give an overweight rating to this bank.

"Techcombank has gradually become one of the most profitable banks in ASEAN, with an average ROA of 3.2% over the past three years," JPMorgan said.

A highlight in the Q2/2023 business results comes from demand deposits (CASA). Techcombank's CASA ratio is at 35%, witnessing an increase after 4 quarters of going against the trend. This positive result comes from a strong digital transformation strategy, a free electronic transfer transaction program and a 1% cashback for customers shopping with debit cards (Debit cashback 1%). Despite increasingly fierce competition, the bank has continued to invest heavily in digitalization, affirming its leading position on the transformation journey and creating a great advantage for Techcombank.

According to JPMorgan, Techcombank's asset quality remains good, with bad debt ratio and credit costs both lower than forecast.

"Techcombank's asset quality has been better than our forecast for two consecutive quarters, with both NPL ratios and provisioning levels lower. This trend suggests that Techcombank's asset quality may be better than forecast and that capital losses remain under the bank's control," JPMorgan said.

For the above reasons, JPMorgan recommends TCB shares with a target price of VND38,000/share, higher than the level of VND33,550/share on July 25.

UBS notes Techcombank's core asset quality

Similarly, UBS, the world's leading financial group headquartered in Switzerland, also highly appreciates Techcombank and maintains a "Buy" recommendation for TCB shares.

"Techcombank recorded pre-tax profit in the second quarter of 2023, 6% higher than UBS's forecast and 23% higher than the consensus estimate of the institutions," UBS said.

UBS attributed Techcombank's superior performance to lower-than-expected credit costs. In Q2/2023, credit costs were 69 basis points, 130 basis points lower than UBS's estimate.

In addition to business results, UBS assessed that Techcombank's core asset quality remains good, although it has slightly declined compared to before. In addition, Techcombank's CASA also recovered positively in the second quarter of 2023, reaching 35%.

"Although Vietnam's macro backdrop still faces many headwinds, we believe that the Vietnamese Government's recent support policies and monetary policy easing will reduce systemic risks and improve market sentiment," UBS said.

Maybank Securities believes Techcombank's 2023 profit could exceed plan

Although Techcombank's first-half profit growth was negative, Maybank Securities believes that this is within market expectations, according to the Bank's plan previously announced at the General Meeting of Shareholders. Techcombank has steadily achieved 51% of its annual plan, despite difficulties during the period. "This positive result, together with growth drivers such as CASA and asset quality, gives us confidence in Techcombank's impressive growth prospects in the second half of the year, and it is entirely possible to exceed the management's 2023 plan."

According to Maybank, CASA's positive recovery is due to its efforts to accelerate customer acquisition through its partnership with Masan and innovative value propositions targeting Generation Z customers. Techcombank marked the first half of 2023 with a customer base of 12.2 million, attracting 1.4 million new customers during the period, more than the whole of 2022 combined.

Source link

Comment (0)