Ho Chi Minh City Stock Exchange (HoSE) announced that shares of SMC Investment and Trading Joint Stock Company may be delisted.

Ho Chi Minh City Stock Exchange (HoSE) announced that shares of SMC Investment and Trading Joint Stock Company may be delisted.

The main reason is that the Company recorded a loss after tax of up to VND 286.71 billion in 2024, marking 3 consecutive years of losses.

According to Decree No. 155/2020/ND-CP, an enterprise may be subject to compulsory delisting if it suffers losses for 3 consecutive years or if the total accumulated losses exceed the equity in the most recent audited financial statements prior to the review period.

Therefore, HoSE noted the possibility of mandatory delisting of SMC shares if the audited financial statements for 2024 continue to record losses.

Currently, SMC is under securities control according to Decision No. 155/QD-SGDHCM dated April 3, 2024 because the after-tax profit of the parent company's shareholders on the audited consolidated financial statements in the last 2 years (2022, 2023) is a negative number.

Recently, SMC also announced the Report on the situation of overcoming the situation of securities being warned and controlled in 2024. According to SMC, in 2024, although seriously implementing many solutions to improve the situation and efficiency of production and business activities, promoting the liquidation of assets and financial investments, closely following the macro situation and the steel industry to have a suitable business strategy; actively handling outstanding debts.

However, the domestic and foreign steel markets still face many difficulties, steel prices and steel consumption demand continuously decrease sharply, domestic real estate is not really stable, so it affects business.

SMC continues to implement business solutions, collect outstanding debts and consider restructuring the business to increase efficiency in 2025.

The main reason for SMC’s prolonged losses is that its business sector is heavily dependent on the construction and real estate markets. At the same time, SMC is suffering from bad debts of more than VND1,000 billion from construction and real estate businesses.

According to the financial report, as of December 31, 2024, SMC's total assets were VND4,511 billion, down nearly 27% compared to the beginning of the year. The company's bad debt decreased mainly in short-term debt, with an original value of VND1,289 billion.

Of which, Delta - Valley Binh Thuan Company Limited owes 441 billion VND, Dalat Valley Real Estate Company Limited owes 169 billion VND, The Forest City Company Limited (132 billion VND), Hung Thinh Incons Joint Stock Company (63 billion VND) and other entities (484.6 billion VND).

Delta - Valley Binh Thuan Company Limited, Da Lat Valley Real Estate Company Limited and The Forest City Company Limited, which are part of the Novaland (NVL) ecosystem, have a total bad debt of nearly VND 742 billion, with a provision of VND 357 billion, an increase of VND 59 billion compared to the provision at the end of September 2024.

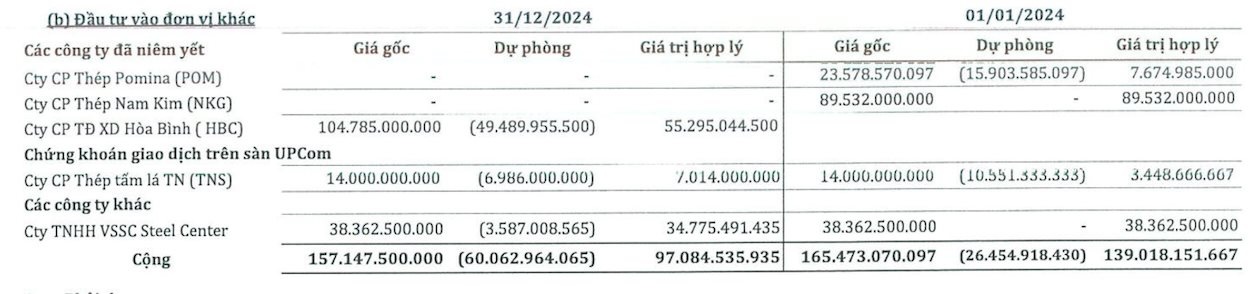

Notably, SMC is temporarily losing more than 47% on its investment in HBC shares of Hoa Binh Construction after converting from a debt worth VND104.7 billion in June 2024.

|

| Source: SMC financial statement notes |

Source: https://baodautu.vn/smc-nhan-canh-bao-huy-niem-yet-do-lo-3-nam-lien-tiep-d244757.html

Comment (0)