ANTD.VN - Saigon - Hanoi Bank (SHB) has just announced its consolidated financial report for the third quarter of 2023 with pre-tax profit completing 80% of the plan assigned by the General Meeting of Shareholders.

The Bank's total assets reached VND596 trillion, up 8.13% compared to the beginning of the year; Capital mobilization from market 1 reached nearly VND475 trillion; Equity capital according to Basel II reached VND67,801 billion.

Implementing the policy of the Government and the State Bank of Vietnam on increasing access to credit for people, since the beginning of 2023, SHB has promoted capital provision for production and business sectors, priority development sectors such as rural agriculture, small and medium enterprises, supporting industries, infrastructure, chain finance, etc. As of September 30, 2023, SHB's outstanding credit balance reached VND 430 trillion, an increase of 10% compared to the end of 2022.

Always accompanying businesses and people, SHB has implemented many credit programs such as reducing loan interest rates from 1%-3%, preferential limits, shortening procedures and credit granting processes... The scale of incentive packages is up to tens of thousands of billions of VND for both existing and new customers in many fields and industries of the economy, loyal customers and those using many services of SHB.

|

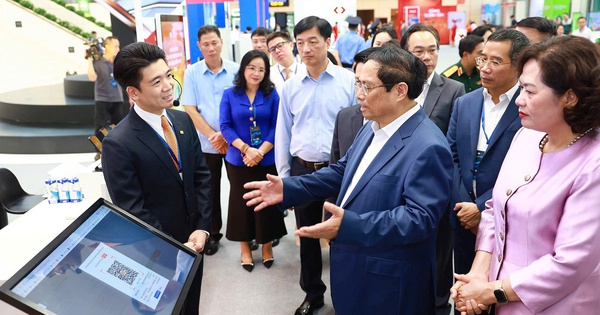

SHB completed 80% of profit plan |

In addition, SHB actively participates in bank-business connection programs chaired by the State Bank, working sessions with Business Associations to listen to the difficulties and obstacles of businesses in accessing capital, together find solutions to join hands to remove difficulties for customers, apply digital transformation solutions, modern technology to the lending process to shorten appraisal time, timely grant credit to customers, improve access to bank credit capital.

In the third quarter of 2023, SHB issued more than 552 million shares to pay 2022 dividends in shares at a rate of 18%, thereby increasing its charter capital to VND 36,194 billion, ranking in the Top 4 largest private commercial banks in the system.

SHB's safety, liquidity, and risk management indicators all comply with and are better than the regulations of the State Bank of Vietnam. SHB has fully complied with the 3 pillars of Basel II standards and since the beginning of 2023, SHB has applied Basel III standards in liquidity risk management.

Consistent with the goal of becoming a leading modern retail bank in the region, SHB is implementing a "dual" strategy, both promoting digital transformation and expanding the retail network.

Recently, SHB has launched a new digital bank SHB SAHA, integrating all the necessary features of a digital bank and being a superior financial assistant for individual customers, especially business households. At the same time, the Bank launched the "SHB Card Family - Connecting Love", bringing family members closer together, creating a close bond, bonding with harmony on a unified common platform.

Also in 2023, SHB expanded its network by 5 more branches and 25 transaction offices, bringing the total number of domestic and international transaction points to 569. Traditional business points such as branches and transaction offices will help SHB increase brand recognition and banking utilities, contributing to reaching a large number of customers. In addition, these business points will provide modern banking utilities closer to customers not only in urban areas but also in rural areas, where banking services are still limited.

2023 marks the 30-year milestone of SHB accompanying the country's development, and is also the year marking a strong and comprehensive transformation with core cultural values of "Heart - Trust - Faith - Knowledge - Intelligence - Vision", the Bank will continue to bring the best human values to customers, partners, shareholders, the community and the economy.

Source link

Comment (0)