Mergers and acquisitions (M&A) value in the first 10 months decreased by 23% compared to the same period in 2022, but there was progress in quality and many prospects in the future.

The information was announced by KPMG Vietnam at the 15th "Vietnam Mergers and Acquisitions Forum 2023" (M&A Vietnam Forum 2023) organized by Investment Newspaper on the afternoon of March 28.

Over the past ten months, the market has witnessed 265 transactions worth more than 4.4 billion USD, and is in a cooling phase following the global trend due to many unfavorable economic factors. With this development, KPMG predicts that the M&A value this year will hardly be equal to that of 2022.

However, the bright spot was the average deal value of $54.5 million, the second highest since 2008. Mr. Warrick Cleine, Chairman & CEO of KPMG Vietnam and Cambodia, said there was a shift towards strategic investments. "The higher average value reflects the quality of the deals," he commented.

The five largest M&A deals include: Sumitomo Mitsui Banking Corporation (SMBC) buying 15% of VPBank shares (1.4 billion USD); ESR Group buying strategic shares of BW Industrial (450 million USD); Thomson Medical Group (buying control of the French-Vietnamese hospital (381 million USD); Gamuda Land buying Tam Luc (316 million USD); and Bain Capital pouring at least 200 million USD into Masan.

The three sectors attracting the most capital were finance, real estate and healthcare, accounting for 47%, 23% and 10% respectively. Mr. Warrick Cleine explained that this was due to investors having confidence in the health of the financial sector, being interested in industrial real estate and the shift of the economy towards services.

Foreign investors have led the capital flow in recent times, with a strong return from Japan (1.6 billion USD). Next are Singapore (1.1 billion USD), the US (472 million USD), Malaysia (316 million USD) and Thailand (262 million USD).

"Recently, Vietnam has attracted many regional investors, but European companies are clearly absent. There are some from the US, but not many," said Mr. Masataka Sam Yoshida, Global Director of Cross-border M&A Services at RECOF Corporation and General Director of RECOF Vietnam.

In addition, due to financial costs, capital availability and confidence, domestic enterprises are also less likely to participate in M&A, according to Mr. Warrick Cleine. "When the capital bottleneck is resolved, the domestic sector will return," he said.

Forecasting the upcoming prospects, experts believe that it will not be until the first half of next year that the Vietnamese M&A market will know whether it can escape the decline zone or continue the general downward trend of the world.

Ms. Binh Le Vandekerckove, Founder and CEO of ASART, a business advisory firm, believes that 2024 will still be difficult. Mr. Warrick Cleine said that investors are paying attention to the US Federal Reserve's (Fed) moves. If interest rates drop quickly, there will be more opportunities for the Vietnamese market.

In fact, the Fed’s actions have had a significant impact on global M&A in recent times. The continuous increase in interest rates has increased financial costs and reduced asset prices. This has caused the total number of M&A deals to decrease by 16.8% year-on-year through October 2022, according to GlobalData.

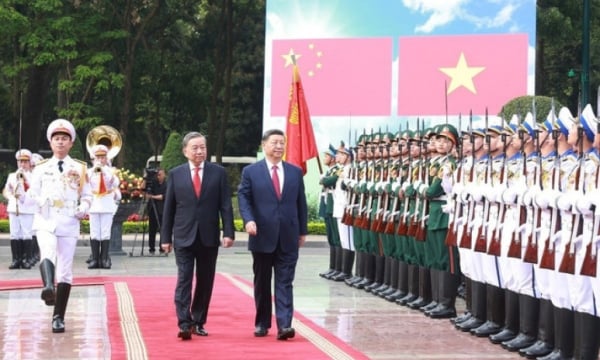

Experts discuss at the Forum on the afternoon of November 28. Photo: Investment Newspaper

In the medium and long term, experts believe that the Vietnamese M&A market has a lot of potential. Ms. Binh Le Vandekerckove cited history showing that the market bottomed out in 2012 but was positive in the period 2016 - 2018.

In 2017 alone, an estimated $16 billion was poured into Vietnam, including deals that were not widely announced. "This means that opportunities are always there. In about three years, we will see Vietnam's M&A market reach $20 billion," she predicted.

Deputy Minister of Planning and Investment Tran Duy Dong said that as the economy continues to recover, consumer confidence improves, the business growth picture becomes clearer, and foreign investment accelerates, M&A activities will become bustling again.

"Vietnam's M&A market continues to be considered attractive by international investors thanks to its political stability, impressive economic growth rate, and rapidly growing domestic consumer market," said Mr. Dong.

As of November 20, investment capital through capital contribution and share purchase reached nearly 5.97 billion USD, an increase of 46.4%. Mr. Khanh Vu, Deputy General Director of VinaCapital Vietnam Opportunity Fund, said Vietnam is among the few markets with great profit prospects, where investors move their money to seek higher profits.

"Vietnam is at the right stage for Japanese companies to enter or expand. Therefore, 85% of our activities are serving deals from Japan here," said Mr. Masataka Sam Yoshida of RECOF.

This market is also located in Southeast Asia, which is attracting the attention of investors in the context of conflicts arising in many other places, according to Mr. Sebastien Laurent, CEO of Asia at consulting firm Financière de Courcelles. "There is no longer any concern about Southeast Asia, but only which market to start from here," he assessed. So what can Vietnam do to increase its attractiveness?

The first is to continue improving policies to make capital inflows and outflows convenient and quick. Currently, investing in Vietnam takes longer than in other markets. Mr. Masataka Sam Yoshida gave an example: Japanese enterprises conduct domestic M&A in about 3 months, in Western markets it takes 6 months, and in Vietnam it takes more than 5 months. "Recently, the time to complete a deal has been getting longer," added Ms. Vo Ha Duyen, Chairman of VILAF Law Firm.

The second is asset quality. According to Mr. Warrick Cleine, Vietnamese companies have advantages in the quality of goods, services, people, and good profit margins, but their balance sheets are often not good, with debts and mobilization costs being too high.

Weaknesses of Vietnamese enterprises will also be revealed when facing difficulties, such as the quality of the board of directors and the quality of the management board's explanation. "We are more concerned about the resilience of enterprises. It is true that more quality assets are needed," added Mr. Sebastien Laurent.

In addition, experts recommend that sellers adjust their valuation expectations - which are often too high. At the same time, they need to pay attention to ESG (environmental, social and governance criteria). "Today, 2 out of 5 deals have ESG requirements," said Binh Le Vandekerckove.

Telecommunications

Source link

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

Comment (0)