Since India suspended non-basmati rice exports and dry weather threatened output in second-biggest exporter Thailand, rice prices in Asia have soared - hitting their highest in nearly 15 years.

According to data from the Thai Rice Exporters Association on August 9, Thai 5% broken white rice - the standard measure in Asia - has increased to $648 per ton, the most expensive since October 2008. That figure is equivalent to an increase of nearly 50% over the past year.

Meanwhile, in third-ranked exporter Vietnam, traders forecast high-quality rice prices could soon hit $700 a tonne, after 5% broken rice prices recently hit $550-$575, according to customs data.

Prices have risen on concerns about a global shortage of rice. Hot, dry weather is threatening crops in Thailand, while India, the world’s largest rice exporter, banned some rice exports last month.

Rice is a staple food for billions of people in Asia and Africa, so rising prices could add to inflationary pressures in these countries while also driving up import costs.

Higher prices will also strain global food supplies, which have been hit by severe weather and reduced grain supplies due to the Russia-Ukraine conflict.

The price increase is likely to continue as countries that rely on rice imports such as the Philippines and Indonesia are stockpiling, especially as Indonesia prepares to hold elections in February next year.

Asia’s rice production has been hit this year. Deadly heat waves caused by El Nino have swept across the region, causing drought that has damaged crops and disrupted supplies.

Last month, India suspended exports of non-basmati white rice to ensure domestic supplies and curb rising rice prices due to crop failure, according to Asia New Network .

India alone accounts for 40% of the world's rice exports. About 30% of India's rice exports - equivalent to 12% of total global trade - are affected by the ban.

Paul Hughes, chief agricultural economist and director of research at S&P Global Commodity Insights, said 12% is a potentially significant shortfall compared to normal.

Other countries including the United Arab Emirates (UAE) have responded to India’s move by temporarily banning and re-exporting rice, while Thailand has expressed optimism about gaining a larger export market from India.

The Thai Rice Exporters Association expects exports to increase by up to 20 percent as Thailand plans to ship about 8 million tonnes of rice to the world market this year, partly making up for the gap left by India.

But across Thailand’s rice-growing heartlands — where a kilogram of rice now costs around 11 baht ($0.30) — farmers are bracing for an unwelcome shock after years of falling prices.

Bualin Komkla, chairman of the Surin local rice mill cooperative, said that while rising prices are usually good news, in recent years prices have fallen so much that farmers have had to sell their stocks to pay off debts and have no more to sell. The only ones who will benefit will be rice millers with large stocks, he said.

In addition, the upcoming harvest in Thailand is expected to be affected by drought. Key rice-growing areas in central Thailand could see up to 40% less rainfall this year. As a result, Thailand’s rice output is forecast to fall by 5%, according to the Commerce Ministry.

A prominent rice broker in Thailand said that Thai rice is one of the good options, but it cannot fill the gap left by India. Last year, India exported about 22 million tons of rice, while Thailand and Vietnam together exported less than 15 million tons.

The FAO Rice Price Index increased by 2.8 percent in July from the previous month, averaging 129.7 points, according to a report by the Food and Agriculture Organization of the United Nations (FAO). This represents an increase of approximately 20 percent year-on-year and marks the highest increase since September 2011.

Minh Hoa (reported by Lao Dong, Tin Tuc Newspaper, Thanh Nien)

Source

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

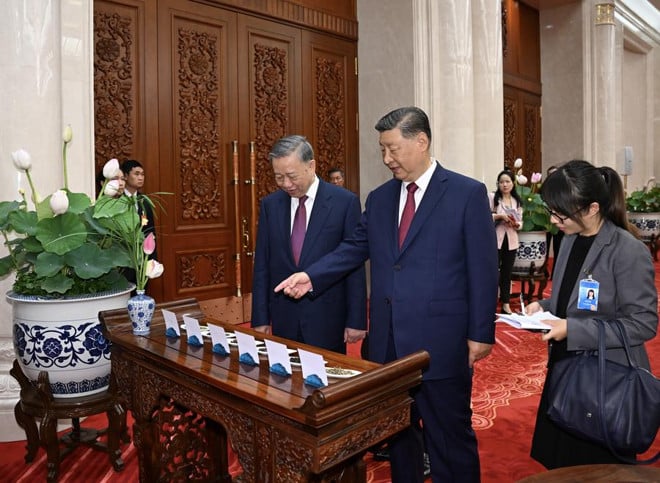

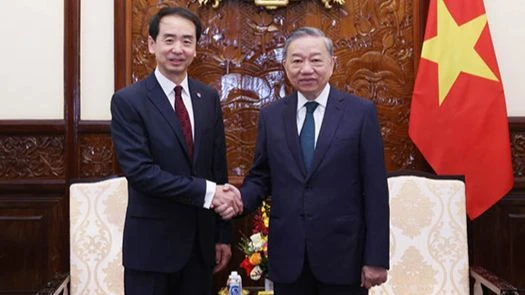

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

Comment (0)