48% of workers who have withdrawn their social insurance (SI) once said they do not want to return to the social security system, according to a survey by the Private Economic Development Research Board (Board IV).

The survey was conducted by Board IV and VnExpress in April with 8,340 participants to identify the labor situation from now until the end of the year and propose appropriate support policies. Reporting the survey results to the Prime Minister on May 30, Board IV said that of the total number of workers who responded, 14% said they had withdrawn once, 45% were considering it, and 41% chose to keep it for pension purposes.

Of those who have withdrawn once, 48% do not want to return but choose to save money; 25% are considering it and 27% want to return to the social security system. Most workers withdraw their social insurance at one time because they do not have savings or income compensation when they are unemployed; worry about the stability of the social insurance policy; need money for immediate needs such as buying a house, paying off debts or worrying about their future pension not being enough to live on.

The IV Committee emphasized that 14% of workers withdrawing at once due to concerns about the stability of the social insurance policy "is a number of concern" for policy makers. Because social insurance is the pillar of the social security system with the ultimate goal of retirement for people after working age. Whether the goal is achieved or not depends on the high or low participation rate.

"If the policy is inconsistent and workers worry about the sustainability of the Social Insurance Fund and payment, the rate of workers withdrawing social insurance at one time will increase, making the social security goal unachievable," the report stated.

The bright spot is that nearly 22% of unemployed workers will rely on unemployment benefits, showing that the policy has played a supporting role for workers. This benefit is the fourth most important financial resource for unemployed workers after savings (41%), relying on relatives' income (33%) and borrowing (22%).

Committee IV assessed the survey results and found that the trend of withdrawing social insurance at one time will not stop when workers are placed in a "wave of staff cuts that will last until the end of this year". Most workers have little financial resources to maintain their immediate lives.

In order to support workers to overcome difficulties and minimize one-time withdrawals , Committee IV recommends that competent authorities consider allowing workers to use social insurance books as collateral or for short-term consumer loans when income decreases or employment is unstable.

The drafting committee of the revised Law on Social Insurance is studying to reduce the social insurance contribution rate or maintain the same contribution rate in the context of economic difficulties, so that workers can use part of their income to participate in other insurance funds, diversifying their savings sources for emergencies.

Committee IV also believes that the revised law should be based on age to allow workers to choose to withdraw their social insurance contributions at one time. Specifically, most unskilled workers start working very early, so if the law is to limit it, it should stipulate that those from 20 to 45 years old cannot withdraw their social insurance contributions to avoid imbalance in social security. However, it is very difficult for workers from 45 years old and up to find a new job, so they should be given the right to choose to withdraw their social insurance contributions at one time or continue to pay to receive a pension. Those who have paid social insurance contributions for 20 years or more can choose to retire early at a lower rate than those who return at the right age.

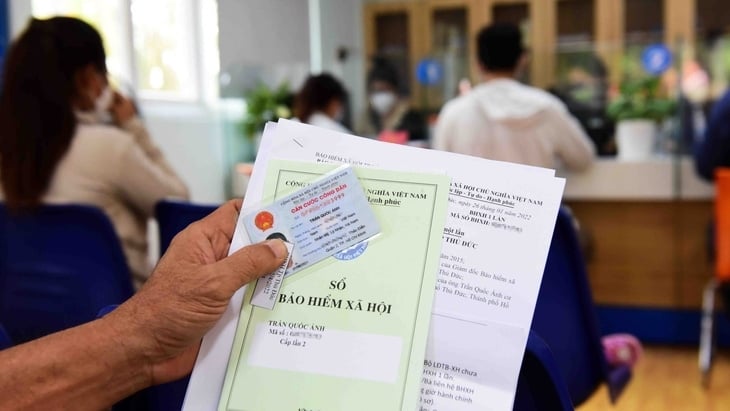

Workers apply for one-time social insurance withdrawal at Thu Duc City Social Insurance (HCMC) at the end of 2022. Photo: Thanh Tung.

The current Social Insurance Law stipulates that employees who have participated in social insurance for less than 20 years, after 12 months of unemployment without continuing to pay social insurance, can withdraw it once. The revised bill maintains this provision and adds a plan for employees to withdraw 50% of the total payment period, the remaining half is kept in the system so that they can enjoy benefits when they retire.

Commenting on the draft law, many agencies proposed banning the buying and selling of social insurance books or borrowing other people's documents to pay for insurance; and recommended removing the 12-month waiting period to withdraw insurance to limit workers from resorting to black credit.

Statistics from 2016-2021 show that more than 4.06 million people withdrew their social insurance contributions at one time, an average of nearly 700,000 workers per year. Of these, about 1.2 million people who continued to work returned to the social insurance system; 30,000 people who reached retirement age but had not paid enough social insurance for one time were able to withdraw their social insurance contributions at one time; 20,000 people who reached retirement age but had not paid enough for one time voluntarily paid for the remaining time to receive pension.

Hong Chieu

Source link

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)