In the first months of 2025, local credit institutions have increased solutions to attract idle cash flow from the population to create more resources for lending to the economy. However, the capital mobilized by the banking sector in the first quarter generally only grew slightly. The reason is that the deposit interest rate in the first months of the year was lower than the same period in previous years.

Previously, implementing the direction of the Government, the Prime Minister and the State Bank of Vietnam on stabilizing lending interest rates to support the economy, "banks" proactively reduced capital mobilization interest rates. Meanwhile, in the first quarter of 2025, other investment channels such as gold, real estate, etc. recorded a lot of potential and room for development, so a part of the population tended to withdraw bank deposits to invest in these markets.

By March 31, 2025, the total mobilized capital of Ha Tinh Banking industry is estimated to reach about 112,420 billion VND, an increase of about 3.5% compared to the end of 2024.

Entering the second quarter of 2025, the demand for loans for production and business investment of enterprises, cooperatives and people is forecast to increase. Therefore, credit institutions in Ha Tinh will continue to synchronously deploy solutions to attract idle cash flow from the population.

Accordingly, major banks such as: Agribank Ha Tinh II Branch, Agribank Ha Tinh Provincial Branch, BIDV Ha Tinh... continue to prioritize implementing savings programs with many valuable prizes; the non-state-owned joint stock commercial bank sector will attract customers by applying more flexible and attractive capital mobilization interest rates.

At the same time, banks will encourage, advise and guide customers to prioritize online savings to enjoy higher interest rates.

Source: https://baohatinh.vn/nguon-von-huy-dong-cua-cac-ngan-hang-ha-tinh-dat-112420-ty-dong-post285077.html

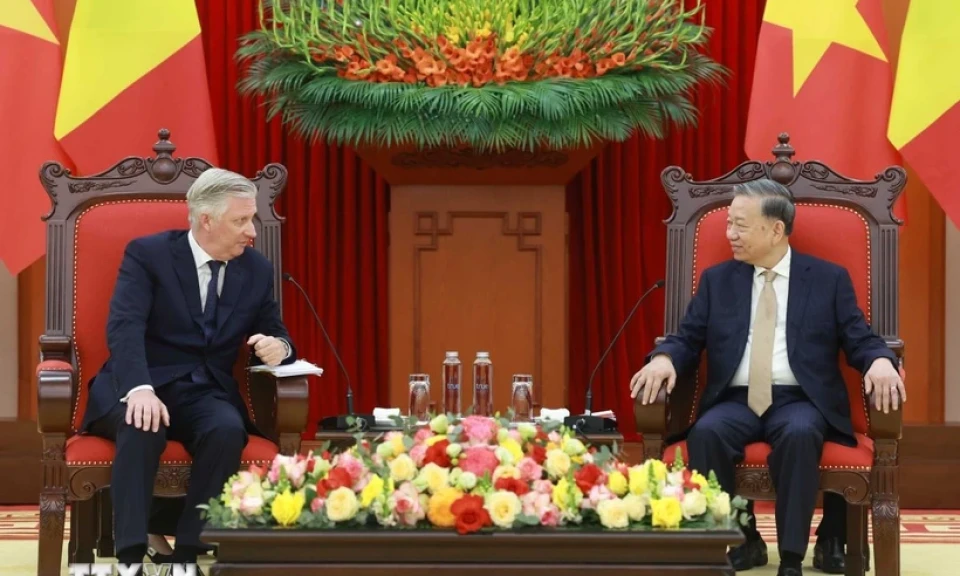

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)