| Will Vietnam's green coffee export prices be the most expensive in the world in 2024? Coffee export prices continue to rise amid concerns about supply shortages |

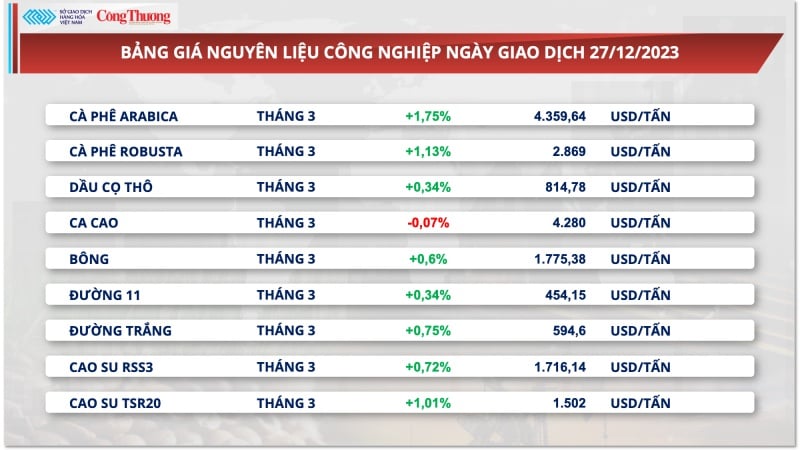

According to the Vietnam Commodity Exchange (MXV), at the end of the trading session on December 27, the prices of two coffee products increased by 1.75% for Arabica in March and 1.13% for Robusta in March. Concerns about supply shortages continue to be an important factor supporting the increase in coffee prices.

|

| Prices of two types of coffee have remained high for many consecutive days in recent days. |

In the closing report of December 26, the standard Arabica inventory on the ICE-US remained at 247,912 60kg bags, the lowest level in more than 24 years. The new regulation on accepting standard inventory has significantly hindered the recovery of this data.

At the same time, low inventories also partly reflect a shortage of supply in the market, amid rumors that farmers are limiting coffee sales in anticipation of higher prices.

In the domestic market, recorded this morning (December 28), the price of green coffee beans in the Central Highlands and the Southern provinces fluctuated between 67,400 - 68,200 VND/kg, an increase of 100 - 200 VND/kg compared to yesterday.

The high coffee prices have made coffee growers and coffee-producing countries like Vietnam very excited. However, roasters and coffee shops will have difficulty adjusting their selling prices in the short term. The demand for coffee to pay for signed contracts is very high. Prices are forecast to continue to remain high in the first months of 2024.

|

| Coffee prices are expected to remain high from now until early 2024. |

According to Mr. Do Ha Nam, Chairman of the Board of Directors of Intimex Group Joint Stock Company, previously, Vietnamese coffee could be stored for sale all year round, but in the 2022/2023 crop, it was sold out by June, except for inventory. In 2024, it is possible that the goods will be sold out by April. Therefore, businesses are currently very limited in signing long-distance delivery contracts because they are worried about the risk of market prices increasing and being unable to purchase goods for delivery.

According to the Import-Export Department – Ministry of Industry and Trade, although Vietnam has a bumper crop, the supply is not as strong as in previous years. People are tending to limit coffee sales to wait for prices to increase, pushing domestic coffee prices to continuously increase.

The global supply shortage has made Vietnam one of the top choices for coffee importing countries. This has pushed up coffee prices. At the beginning of the 2023-2024 crop year, the price of Vietnamese coffee beans was at 60,000 VND/kg. This is unprecedented in the history of the Vietnamese coffee industry. With coffee prices in Vietnam forecast to continue to rise, an export turnover of 4.5 - 5 billion USD in 2024 is within reach.

However, to achieve the export target of 6 billion USD by 2030, while increasing the added value of Vietnamese coffee products, the coffee industry needs to be synchronously concerned with comprehensive solutions, including boosting the output and quality of raw coffee growing areas, while increasing the rate of deep processing.

According to the Department of Crop Production – Ministry of Agriculture and Rural Development, the country currently has more than 710,000 hectares of coffee. However, less than 1/4 of the area has achieved sustainable production certification, with international standard certifications.

According to businesses, localities need to plan key coffee growing areas; promote replanting, and apply sustainable coffee production processes with VietGAP, 4C, Rainforest, and organic certifications to meet the strict export standards of today's markets.

Source link

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)