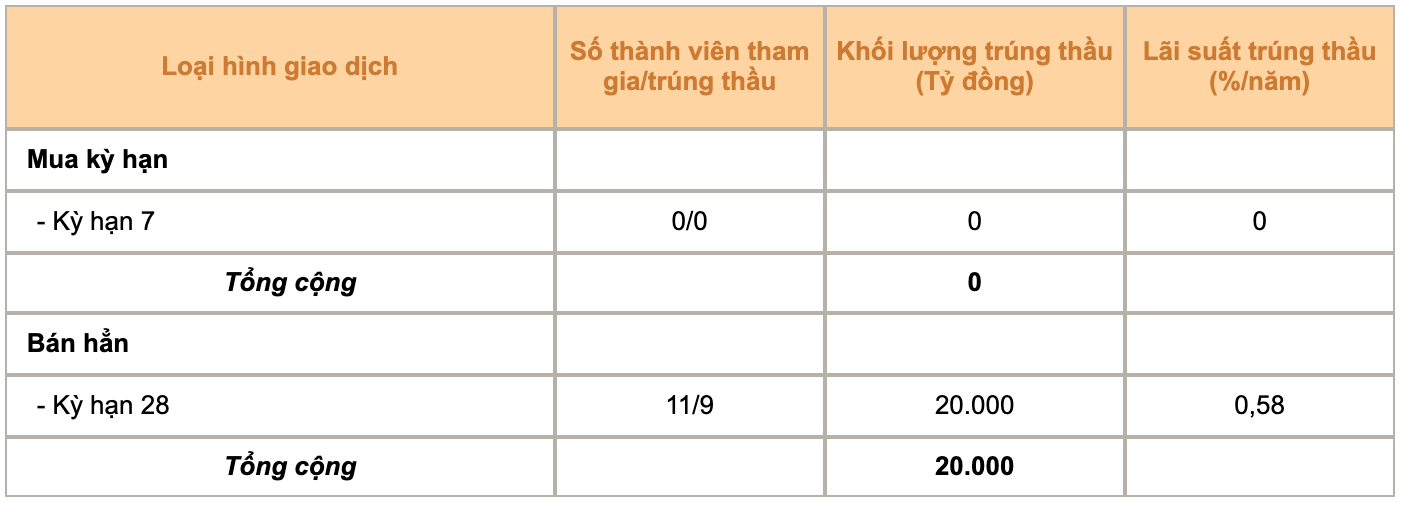

Recently, the State Bank of Vietnam (SBV) announced the results of the open market auction on September 26. Accordingly, the agency continued to offer 28-day treasury bills under the interest rate auction mechanism. As a result, 9/11 participating members won the bid with a total volume of VND20,000 billion, interest rate of 0.58% - higher than the September 25 session (0.49%).

Previously, in the last 3 consecutive sessions of September 21, 22 and 25, the State Bank successfully bid a total of VND 30,000 billion worth of 28-day bills and did not conduct any transactions in the open market; thereby withdrawing the corresponding amount of money from the banking system.

Thus, in the last 4 trading sessions, the State Bank has withdrawn a total of nearly 50,000 billion VND from the banking system through the treasury bill channel.

The State Bank has reopened the channel to withdraw money through treasury bills after more than 6 months of suspension amid excess liquidity in the system and interest rates on the interbank market continuously maintained at record lows. This move is assessed by experts as contributing to stabilizing the USD/VND exchange rate - which is under great pressure due to the contrasting monetary policies between the US and Vietnam.

Open market auction results on September 26 (Source: SBV).

According to Dragon Capital Securities (VDSC), the low interest rate level is a significant difference compared to the net withdrawal period of the State Bank in February-March 2023. However, low interest rates can also be a barrier that makes the winning bid rate much lower than the previous period.

Because the number of participating members is quite large (11-17 members), the rate of winning members is low, only 2 members won the bid with an interest rate of 0.69%/year on September 21 and 5 members won the bid with an interest rate of 0.5%/year on September 22, 4 members won the bid with an interest rate of 0.49%/year on September 25 and 9 members won the bid with an interest rate of 0.58% today.

VDSC believes that the interbank interest rate has remained low for a long time and the level of interest when the SBV reopened the channel to issue treasury bills confirms the fact that the banking system has excess money. However, the analysis team also implicitly understands that the capital supply-demand balance point of each bank has a large difference when comparing the developments of the SBV's recent treasury bill issuance and that at the beginning of the year.

Sharing the same view, experts from SSI Securities also commented that the move to reissue treasury bills by the State Bank can be seen as a way to adjust the short-term liquidity status in the system. This is a common activity from central banks and does not mean that the State Bank has reversed its monetary policy .

Source

![[Photo] Panorama of the rehearsal of the parade to celebrate the 50th anniversary of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/afd7e872ef6646f288807d182ee7a3da)

![[Photo] Attractive extracurricular lessons through interactive exhibition at Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/1f307025e1c64a6d8c75cdf07d0758ce)

![[Photo] April 30, 1975 - Steel imprint engraved in history](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b5a0d7f4f8e04339923978dfe92c78ef)

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

Comment (0)