(NLDO) – Investors can prioritize stocks in public investment, construction, construction materials, banking, textile and garment export, seafood, etc.

The stock market closed the week in a positive state after Tet, when VN-Index increased by 10.15 points to 1,275.2 points; HNX-Index increased by 6.48 points to 229.49 points. Banking is the industry that contributed to the market's growth, with a series of actively traded stocks such as CTG, TCB, BID... Some other stocks in the VN30 basket caused the market to decrease such as FPT, VHM, VNM, SAB...

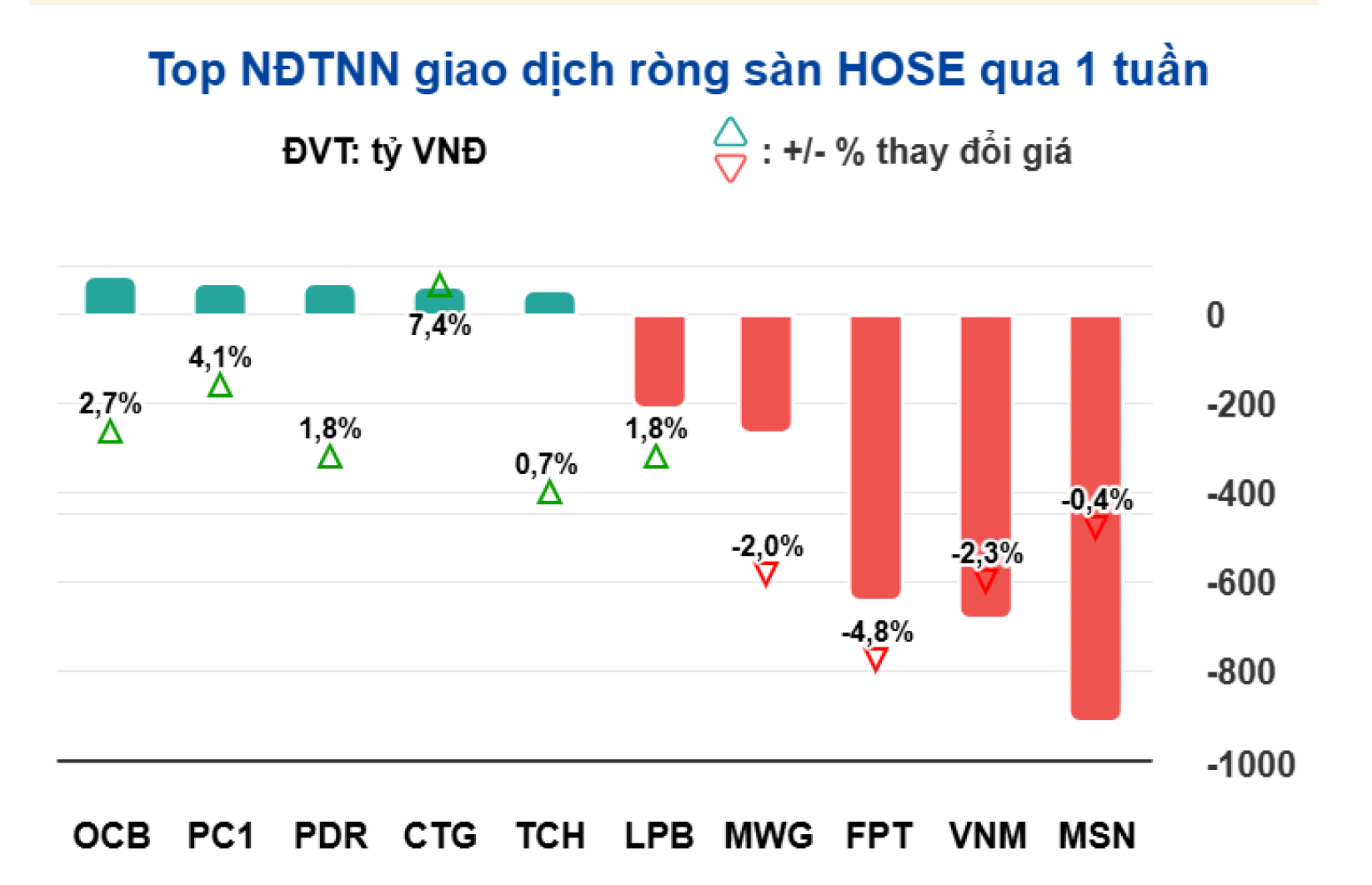

Market liquidity has been more positive as the trading value on the HOSE increased by more than 27% compared to last week. A downside is that foreign investors are still net sellers, as last week, more than VND 4,100 billion continued to be net withdrawn from the VN-Index, focusing on MSN, VNM, FPT...

At one point, the VN-Index nearly reached 1,280 points in the last session of the week. The market was supported by positive domestic information such as the Government's plan to submit to the National Assembly to adjust the GDP growth target for 2025 from 6-6.5% to 8%; and loosen the inflation target (CPI) to 4.5-5%.

Fiscal policies, especially monetary policies, will continue to be strongly expanded in 2025. This trend will have a positive impact on asset channels, including stocks.

Top stocks that foreign investors sold off strongly last week. Source: BETA

Experts from Pinetree Securities Company assessed that the stock market had a relatively favorable start in the first week of the Year of the Snake.

Liquidity in the last 7 sessions has clearly improved compared to before Tet, returning to above 13,000 billion VND/session. This is an important factor for continued growth.

However, next week the market will temporarily lose momentum from the story of Q4/2024 business results when many businesses and banks have "clarified" the profit picture.

"Macro variables such as the strong increase in the USD/VND exchange rate again, objective variables such as the next move between the US and China causing the risk of a tense trade war... can restrain the growth of the VN-Index. It is expected that the market will have a correction when the VN-Index approaches the 1,290 point area" - Pinetree experts predicted.

Stock market trading flourished in the first week of the year of the Snake.

According to Mr. Dinh Quang Hinh, Head of Macro and Market Strategy, VNDIRECT Securities Company, next week the VN-Index will test the resistance zone of 1,280 - 1,300 points. This is a very strong resistance zone that the market has not been able to overcome in 2024. Foreign investors continue to net sell and domestic cash flow is not strong enough to pull the market alone, the VN-Index needs to accumulate for a while before it has enough strength to bounce back above the strong resistance zone above.

Investors should maintain a moderate stock ratio and consider the investment portfolio structure, prioritizing groups with strong supporting information such as public investment, construction, construction materials, banking, textile and garment exports, and seafood.

Mr. Vo Kim Phung, Head of Analysis, BETA Securities Company, said that investors need to be cautious about short-term profit-taking pressure and net withdrawal of foreign investors. Shaky sessions may occur when the market approaches important resistance zones, requiring flexible trading strategies.

Short-term investors should consider partial profit-taking in stocks that have increased sharply and the momentum has gradually decreased. It is necessary to monitor the development of interest rates and exchange rates to promptly adjust the portfolio accordingly.

Source: https://nld.com.vn/chung-khoan-tuan-toi-tu-10-den-14-2-nen-uu-tien-mua-co-phieu-nganh-nao-196250209103235908.htm

Comment (0)