Group 5 debt at most listed banks increased sharply according to the financial reports of the fourth quarter of 2024. Only 3 banks recorded a decline in group 5 debt in 2024.

As of December 31, 2024, group 5 debt (debt with potential loss of capital) of 25 listed banks amounted to VND 118,915 billion (about USD 4.75 billion), an increase of 39.30% compared to the beginning of 2024.

The above figure does not include group 5 debt at LPBank and VIB because these two banks only publish overdue debt data and do not publish details of each debt group.

With commercial banks that have published reports, it can be seen that group 5 debt accounts for the majority of bad debt. There are even banks where group 5 debt accounts for over 90% of total bad debt (group 3-5 debt).

Nam A Bank, Techcombank and ABBank have the highest increase in group 5 debt ratio, increasing by 165%, 136.9%, and 103% respectively compared to the beginning of the year.

Of which, the absolute number of bad debts at risk of capital loss of Nam A Bank is over 2,600 billion VND, accounting for nearly 70% of the total bad debt of this bank. The provision for customer loan risks therefore also increased by 500 billion VND compared to the beginning of the year, reaching 2,065 billion VND as of December 31, 2024.

Techcombank with more than VND 3,269 billion in bad debt is classified in group 5, accounting for 0.54% of total outstanding credit, and increasing by nearly 137% compared to group 5 bad debt at the beginning of 2024. Short-term debt accounts for 34.95% of total outstanding debt at Techcombank. Medium-term and long-term debt account for 14.07% and 50.98%, respectively.

Real estate business loans account for the highest proportion at Techcombank, up to 30.88% of total outstanding credit (in 2023 this ratio will be 35.21%).

At ABBank, group 5 debt increased by 103% compared to the beginning of 2024 and accounted for 57% of the bank's total bad debt.

In addition, some banks with high group 5 debt ratios include: Saigonbank (72.41%), Bac A Bank (73.4%),ACB (74%), Sacombank (81.36%), KLB (82%)...

Notably, the financial report for the fourth quarter of 2024 shows that three banks, SHB, NCB, and TPBank, recorded a decrease in group 5 debt compared to the beginning of the year.

Specifically, group 5 debt at SHB decreased by 3.67% to VND9,704 billion; group 5 debt at NCB decreased by 3.49% to VND13,665 billion, and at TPBank decreased slightly by 0.28% to VND1,115 billion.

In the case of NCB, the significant reduction in bad debt in general and group 5 debt in particular is a positive signal showing that this bank has been achieving significant achievements in the restructuring process according to the "Project on restructuring the system of credit institutions associated with bad debt settlement in the period 2021-2025" according to Decision 689/QD-TTg of the Prime Minister and guidance of the State Bank.

Some banks with the lowest increase in group 5 debt ratio include: Viet A Bank (3%), VietBank (5.2%), PGBank and SeABank (both increased by 25%), and BVBank (29%).

State-owned banks such as Vietcombank, BIDV, and VietinBank, although leading in absolute numbers due to leading the system in providing capital to the market, all 3 "big guys" are not in the top group in terms of the increase rate of group 5 debt.

Specifically, this rate at Vietcombank is 30%, VietinBank is 49%, while group 5 debt at BIDV increased by 55% compared to the beginning of 2024.

| DEBT DEVELOPMENTS OF GROUP 5 OF BANKS IN 2024 (Unit: Million VND) | ||||

| STT | BANK | GROUP 5 DEBT 2024 | GROUP 5 DEBT 2023 | % CHANGE |

| 1 | ABBANK | 2,107,037 | 1,035,207 | 103.54 |

| 2 | ACB | 6,735,014 | 3,870,725 | 74.00 |

| 3 | BAC A BANK | 893,900 | 515,493 | 73.41 |

| 4 | BIDV | 18,960,261 | 12,211,783 | 55.26 |

| 5 | BVBANK | 1,316,955 | 1,018,931 | 29.25 |

| 6 | EXIMBANK | 2,971,904 | 1,868,082 | 59.09 |

| 7 | HDBANK | 2,213,947 | 1,616,606 | 36.95 |

| 8 | KIENLONG BANK | 821,354 | 451,397 | 81.96 |

| 9 | MB | 4,506,833 | 2,851,344 | 58.06 |

| 10 | MSB | 2,920,021 | 1,787,809 | 63.33 |

| 11 | NAM A BANK | 2,617,266 | 986,031 | 165.43 |

| 12 | NCB | 13,187,712 | 13,665,061 | -3.49 |

| 13 | OCB | 2,621,403 | 1,680,979 | 55.95 |

| 14 | PGBANK | 618,714 | 493,473 | 25.38 |

| 15 | SACOMBANK | 8,228,689 | 4,537,034 | 81.37 |

| 16 | SAIGONBANK | 400,744 | 232,424 | 72.42 |

| 17 | SEABANK | 2,697,271 | 2,150,292 | 25.44 |

| 18 | SHB | 9,347,633 | 9,704,450 | -3.68 |

| 19 | TECHCOMBANK | 3,269,527 | 1,380,121 | 136.90 |

| 20 | TPBANK | 1,111,841 | 1,115,066 | -0.29 |

| 21 | VIET A BANK | 518,959 | 503,722 | 3.02 |

| 22 | VIETBANK | 1,498,070 | 1,423,071 | 5.27 |

| 23 | VIETCOMBANK | 10,228,970 | 7,835,714 | 30.54 |

| 24 | VIETINBANK | 13,741,489 | 9,221,230 | 49.02 |

| 25 | VPBANK | 5,379,910 | 3,205,810 | 67.82 |

| Total: | 118,915,424 | 85,361,855 | 39.31 | |

Responding to questions before the National Assembly in November 2024, State Bank Governor Nguyen Thi Hong said that bad debts in credit institutions due to the impact of the COVID-19 pandemic have seriously impacted all aspects of life and society; businesses and people are facing difficulties, reduced income, leading to more difficult debt repayment.

To control bad debt, the State Bank also proposed a number of solutions. For credit institutions, when lending, they need to carefully assess and evaluate the borrower's ability to repay the debt, ensuring control of newly arising bad debt.

For existing bad debts, it is necessary to actively handle bad debts through urging customers to pay debts, collecting debts, and selling bad debt assets. The State Bank also has a legal framework for debt trading companies to participate in handling bad debts.

Source: https://vietnamnet.vn/can-canh-buc-tranh-no-nhom-5-moi-nhat-cua-cac-ngan-hang-2369463.html

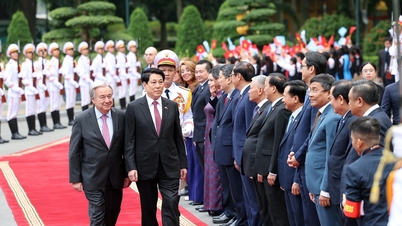

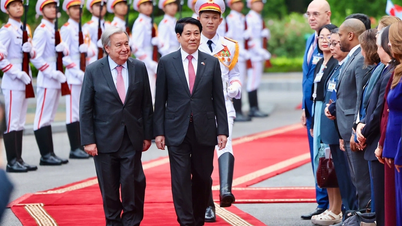

![[Photo] President Luong Cuong chaired the welcoming ceremony and held talks with United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761304699186_ndo_br_1-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs conference on breakthrough solutions for social housing development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761294193033_dsc-0146-7834-jpg.webp)

![[Photo] Solemn funeral of former Vice Chairman of the Council of Ministers Tran Phuong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761295093441_tang-le-tran-phuong-1998-4576-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and South African President Matamela Cyril Ramaphosa attend the business forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761302295638_dsc-0409-jpg.webp)

Comment (0)