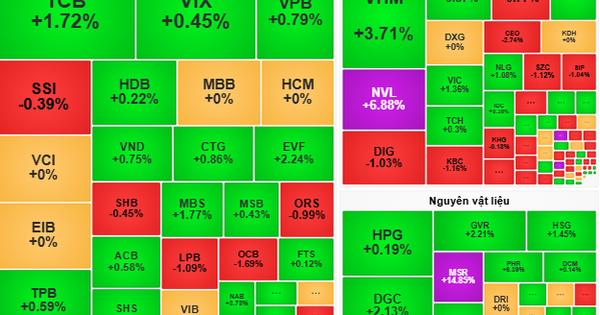

► Stock market commentary for the week of September 23-27: Uptrend is dominating

Positive recommendation for CTG stock

Vietcap Securities Company (VCSC) maintained its target price of VND40,000/share but lowered its recommendation from buy to outperform for Vietnam Joint Stock Commercial Bank for Industry and Trade (CTG) as CTG's share price has increased by about 8% in the past 3 months.

Overall, VCSC maintains its 2024-2028 total return forecast (2%/0%/-1%/0%/0% in 2024/2025/2026/2027/2028, respectively).

VCSC slightly revised up its 2024 net profit forecast by 2% to VND22.8 trillion (+14.7% YoY), mainly due to VCSC raising its non-interest income (NOII) forecast by 6% on expectations that CTG will record higher recoveries from resolved bad debts. At a recent investor meeting, management said the bank expects income from resolved bad debt recovery to reach VND7 trillion (+50% YoY).

Buy recommendation for VPB stock

VCSC maintains a buy recommendation and target price of VND24,500/share for Vietnam Prosperity Joint Stock Commercial Bank (VPB).

VCSC raises its 2024-2028 net profit after tax (NPAT) forecast by 9% (+6%/18%/9%/9%/6% for 2024/2025/2026/2027/2028, respectively), offsetting a reduction in VCSC’s target P/B multiple from 1.4x in its previous forecast to 1.3x due to slower-than-expected improvement in asset quality with the non-performing loan (LLR) coverage ratio remaining low, indicating persistent pressure on credit costs.

VCSC increased its 2024 NPAT after minority interest forecast by 6.1% to VND14,200 billion (+41% YoY), driven by a 14% decrease in operating expenses (OPEX), offsetting a 5% increase in provision expenses. VPB targets a strong 114% YoY increase in profit before tax (PBT) in 2024 compared to VCSC’s 2024 forecast of 65% YoY.

Neutral recommendation for POW stock

According to KB Securities Vietnam (KBSV), in the second quarter of 2024, PetroVietnam Power Corporation (POW) recorded revenue and profit after tax of VND 9,382 billion (up 11.3% over the same period) and VND 441.46 billion (up 143.6%), respectively. Gross profit margin increased by 3.28 percentage points over the same period, reaching 7.83% thanks to the recovery of Nhon Trach 2 thermal power plant output and impressive output growth of Vung Ang and Ca Mau 1&2 thermal power clusters, which continued to be maintained until the end of the second quarter of 2024.

In the second quarter of 2024, POW's gas-fired power output reached 2,832 million kWh, down slightly by 4.8% but still the third highest in the 2021-2023 period. The pressure of gas shortage in the Southeast region is expected to be reduced thanks to the expiration of the gas supply contract with BOT Phu My 2.2 and 3, thereby helping NT2 become one of the few remaining factories using cheap domestic gas.

The Board of Directors plans to conduct the first ignition of Nhon Trach 3 Power Plant on October 15, 2024. Nhon Trach 3 Power Plant will be connected to the grid for the first time on October 22, 2024. In the conservative scenario, KBSV believes that NT3 will begin to contribute revenue from the first quarter of 2025 due to delays in price negotiations and problems related to the construction of power lines and transformer stations to release capacity.

Based on SOTP and EV/EBITDA valuation, business outlook as well as considering possible risks, KBSV recommends neutral for POW stock, target price is VND 13,300/share.

Source: https://vov.vn/thi-truong/chung-khoan/mot-so-co-phieu-can-quan-tam-ngay-239-post1122919.vov

Comment (0)