Ho Chi Minh City Stock Exchange has just decided to transfer KPF shares of Koji Asset Investment Joint Stock Company from restricted trading to suspended trading.

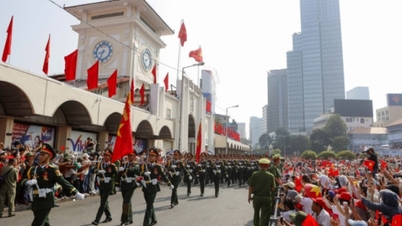

On the stock market, many stocks have prices that cannot buy a glass of iced tea, for example KPF - Photo: QUANG DINH

Specifically, the Ho Chi Minh City Stock Exchange (HoSE) said it will suspend trading of KPF shares from February 26.

The reason Koji Asset Investment Joint Stock Company is late in submitting its 2024 semi-annual audited financial report more than 6 months after the prescribed deadline, is due to the case of securities being suspended from trading.

Previously, KPF shares were restricted from trading since October last year, because the company was 45 days late in submitting its audited semi-annual financial report for 2024.

On January 21, KPF sent HoSE a plan to fix the situation of the stock being warned.

The company representative confirmed that the fourth quarter of last year had achieved some positive financial results and emphasized that there was significant progress, with debt collection as well as positive profit expectations from bond investments.

However, KPF also acknowledged that some factors such as mandatory provisions have affected overall business results, creating certain pressure on financial statements.

To improve the quality of financial reports, KPF said it will complete the provisioning in accordance with regulations, ensuring that financial reports meet full audit quality.

At the same time, set a target of debt collection by the end of fiscal year 2025, implementing strict management measures to prevent future credit risks.

The company will increase investment in core business areas, implementing potential projects to create sustainable added value for shareholders and investors.

The plans were proposed by KPF after the company announced poor financial results last year. The financial report showed that KPF had no revenue for the whole year and a record after-tax loss of VND277 billion.

Meanwhile, in 2023, the company still has 1 billion VND in net revenue plus 46 billion VND in financial revenue, with after-tax profit of more than 2 billion VND.

On the stock market, KPF shares "fell" to the price of 1,490 VND per unit, less than the price of a glass of iced tea. This is the result after "evaporating" dozens of percent last year and continuing to stay at the floor for several consecutive sessions recently after news of trading suspension.

With nearly 61 million shares in circulation, KPF's capitalization reached over 100 billion VND. It is worth noting that this code once had a period of sudden increase with an increase of 700% after 2 months in 2017.

Source: https://tuoitre.vn/mot-co-phieu-tung-tang-700-sap-bi-dinh-chi-giao-dich-thi-gia-khong-du-coc-tra-da-20250220191132204.htm

Comment (0)