Buy recommendation for PC1 stock

According to KV Vietnam Securities Company (KBSV), PC1 Group's (stock code PC1) second quarter 2024 after-tax profit reached VND 190 billion (compared to negative VND 21 billion in the same period) thanks to the EPC segment reaching VND 1,969 billion (up 147% over the same period), accounting for 63% of PC1's revenue in the period thanks to recording the majority of revenue from the 500kV Quang Trach - Pho Noi line; Electricity revenue recovered, boosted by revenue from Hydropower thanks to favorable hydrological conditions in the second quarter 2024.

KBSV expects Hydropower revenue to recover strongly thanks to favorable hydrological conditions, contributing to increasing PC1's gross profit. KBSV estimates that Electricity revenue will reach VND1,700/1,798 billion in 2024/2025, up 16%/6% over the same period.

The contribution to the EPC backlog from the public and private investment sectors currently accounts for 66%/34% respectively. KBSV expects the backlog to gradually recover thanks to the transitional electricity price for renewable energy projects being approved by the end of 2024, the increased demand for transmission line construction after the DPPA was issued, and projects under the Power Plan VIII being accelerated from 2025.

In the second quarter of 2024, Western Pacific (PC1 owns 30% of the equity) was approved for investment policies for 2 industrial park projects, Yen Lu - Bac Giang and Dong Van 5 - Ha Nam. In addition, Yen Lenh Industrial Park began construction in the third quarter of 2024. For Yen Phong 2A Industrial Park, KBSV expects WP to hand over the remaining land fund in 2026. Regarding Nomura Hai Phong 2, KBSV expects PC1 to receive investment policies in the first half of 2025.

KBSV recommends buying PC1, target price 33,100 VND/share, corresponding to expected return of 15% compared to closing price on September 17.

Recommendation to watch for LHG stock

According to DSC Securities Company, in the first 6 months of the year, Long Hau Joint Stock Company (stock code LHG) recorded net revenue of VND 238 billion (up 31% over the same period), after-tax profit of VND 97 billion (up 28%), completing 32% and 74% of the net revenue and after-tax profit plans for 2024, respectively.

DSC forecasts that net revenue in 2024 will reach VND 566 billion (up 43% compared to the previous year), assuming that the Industrial Park segment leases 4 hectares, the rental price is 250 USD/m2/cycle, reaching revenue of VND 250 billion, the NXXS segment continues to maintain growth momentum from the first half of the year, reaching revenue of VND 196 billion. Profit after tax reaches VND 231 billion (growth of 39%).

Using the P/B method, with a target P/B equivalent to the 5-year median P/B of 1.06x to reflect the potential and feasibility of new projects that are not yet clear, DSC determines the 2024 target price of VND39,500/share and recommends monitoring this stock.

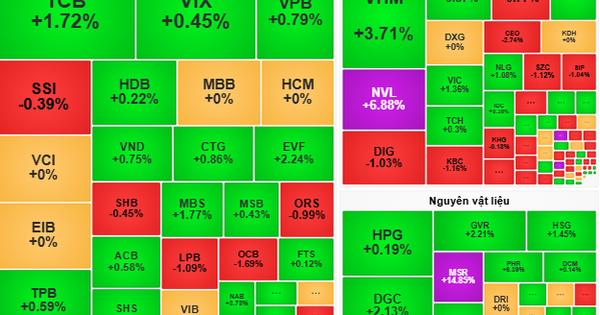

>> Stock market commentary September 18: VN-Index may challenge the resistance zone of 1,270 - 1,275 points

Source: https://vov.vn/thi-truong/chung-khoan/mot-so-co-phieu-can-quan-tam-ngay-189-post1122117.vov

Comment (0)