Military Commercial Joint Stock Bank (MB) is the first unit in Vietnam to deploy the feature of identifying fraudulent account information from the end of June 2024. This feature is considered particularly useful in the context of rapidly developing information technology and increasingly sophisticated forms of fraud.

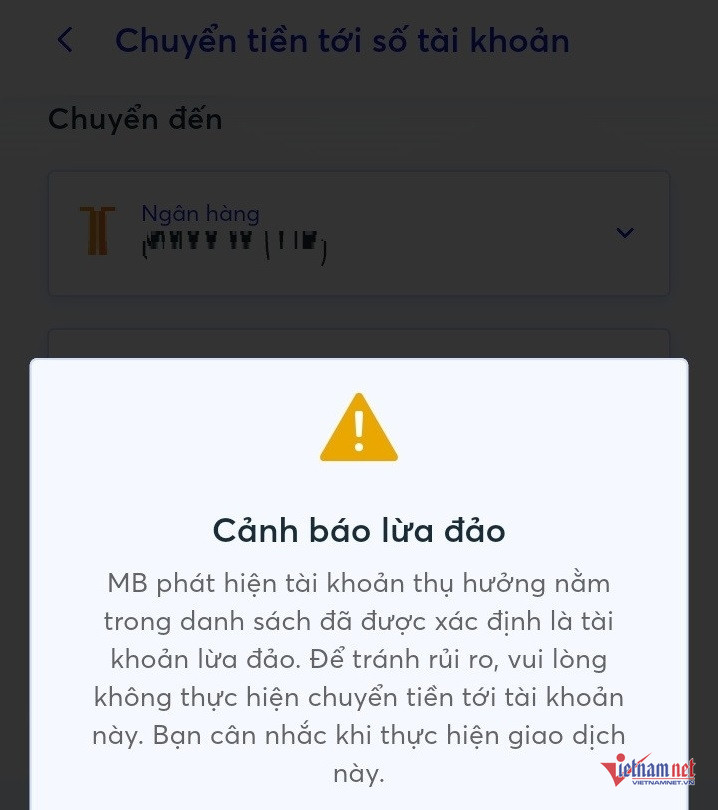

When making a money transfer, customers will receive a warning in case the recipient is a potentially fraudulent account. This allows customers to easily stop suspicious transactions, helping to protect the safety of their accounts and assets.

At the investor conference organized by MB on the afternoon of August 5, answering VietNamNet 's question, Mr. Vu Thanh Trung, Vice Chairman of the Board of Directors in charge of Digital Transformation of MB, shared more details about this feature.

According to Mr. Trung, the fraud detection and warning feature is the result of coordination between MB and the Department of Cyber Security and High-Tech Crime Prevention (A05), Ministry of Public Security. MB and A05 update the list of all accounts participating in or related to fraud nationwide. This list currently has about more than 3,000 accounts, and will be updated daily. Before each money transfer transaction of MB customers, the bank will quickly check to identify whether the account is on the suspicious list or not.

“I confirm that this is just a list of suspected accounts, including real fraudulent accounts, but also suspicious accounts. We clearly warn customers before transferring money that the receiving account is on the suspect list,” Mr. Trung informed.

In July 2024 alone, as soon as this feature was deployed, MB warned 2,700 customers and after receiving the news, 1,500 customers proactively stopped transactions.

The Vice Chairman of the Board of Directors of MB added that at the conference to review the implementation of the Project on developing applications of population data, identification and electronic authentication to serve national digital transformation in the period of 2022-2025, with a vision to 2030 of the Government (Project 06) and the Coordination Plan No. 01/KHPH-BCA-NHNNVN between the Ministry of Public Security and the State Bank of Vietnam (SBV) on implementing the tasks in Project 06, the feature of detecting and warning of fraudulent accounts was urgently agreed by all banks to be put on the system in coordination with A05.

In response to the question of why the bank did not proactively close the account if it was discovered to be a fraudulent account opened at MB, Mr. Vu Thanh Trung said that the bank could only issue a warning, the closing or opening of a customer's account must be done in accordance with the law, it cannot be closed spontaneously.

Regarding the plan to receive the compulsory transfer of a weak bank, Mr. Luu Trung Thai, Chairman of the Board of Directors of MB, said that the bank has completed the plan and proposal for receiving the transfer to the State Bank. The State Bank has also reported to the Government and is in the process of collecting opinions from relevant ministries, departments and branches.

According to the plan, in the third quarter of 2024, there will be the Government's opinion, if everything goes smoothly, it is expected to be approved this year.

Source: https://vietnamnet.vn/mot-ngan-hang-gui-2-700-canh-bao-tai-khoan-lua-dao-1-500-khach-dung-giao-dich-2308968.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Podcast] News on March 27, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/de589137cda7441eb0e41ee218b477e8)

Comment (0)