At the conference to inform about activities in the second quarter of 2024, Ho Chi Minh City Social Insurance (HCMS) said that the person receiving the highest pension in the city is more than 140 million VND, 70 times higher than the person receiving the lowest pension.

The above information is surprising because many people do not think that the difference in workers' pensions is so large.

According to Vietnam Social Security, the person with the highest pension in Ho Chi Minh City is Mr. PPNT, who is also the person with the highest pension in Vietnam.

The reason Mr. T. has a high pension is because for many years he held a management position at a foreign-invested enterprise, the monthly salary used as the basis for social insurance contributions is nearly 250 million VND/month.

Therefore, when he retired in 2015, Mr. T's pension was 87 million VND/month. After many adjustments to increase the state's salary, Mr. T's pension increased to 124,700,000 VND/month in 2022.

The most recent time was in 2023, when the Government issued Decree No. 42/2023/ND-CP adjusting pensions, social insurance benefits and monthly allowances. According to the above Decree, Mr. T.'s pension was increased by another 12.5%.

According to the instructions in Circular No. 06/2023/TT-BLDTBXH, Mr. T's new pension level applied from July 1, 2023 is equal to the old pension level multiplied by 1.125; that is, more than 140 million VND.

It is expected that in the near future, at the same time as salary reform is implemented from July 1, pensions will also be adjusted to increase once more, so Mr. T's pension may increase even more.

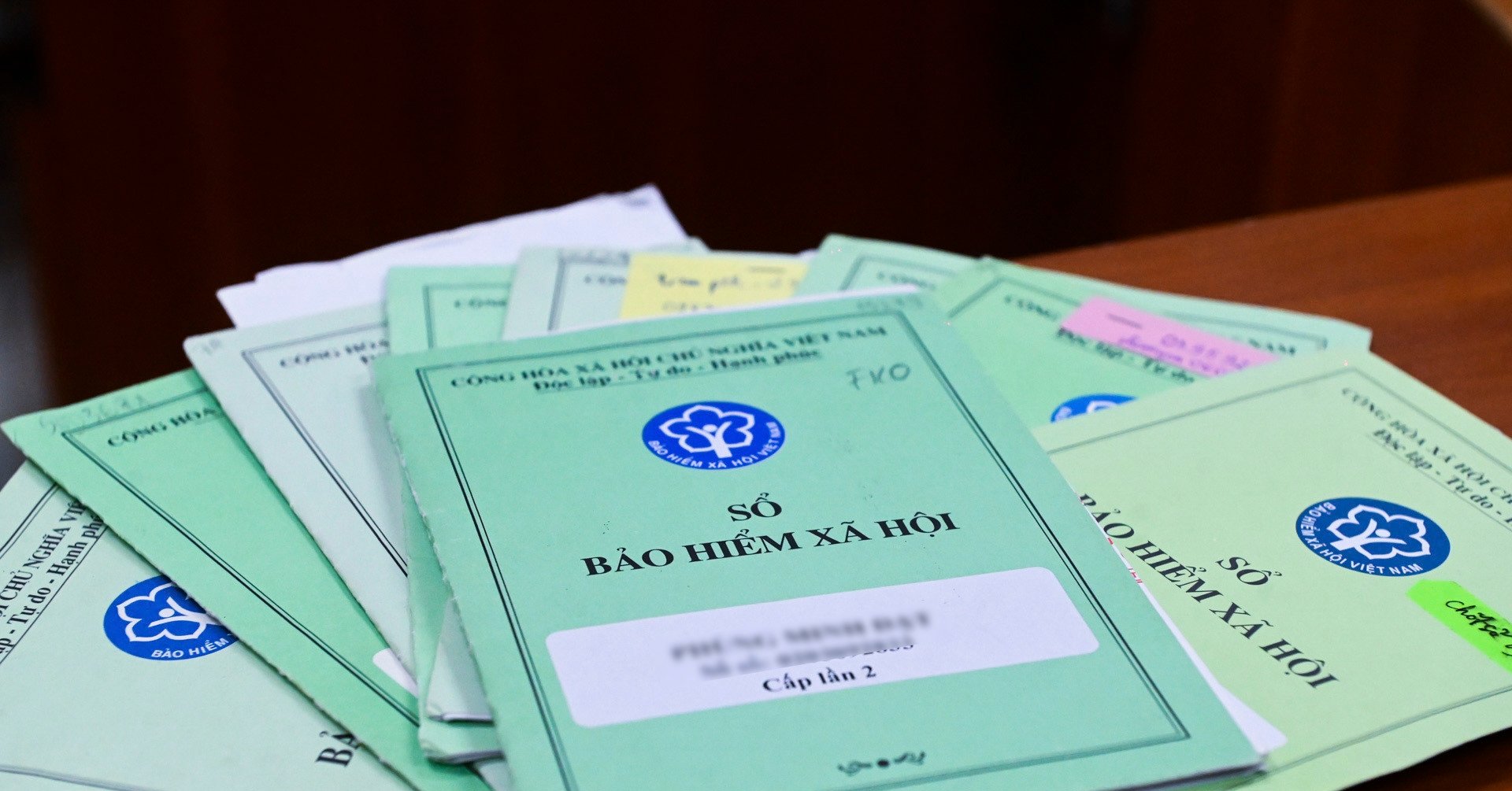

The Government has adjusted the periodic pension to increase it to ensure the living standard of retirees (Illustration: Social Insurance of Ho Chi Minh City).

However, those who participated in social insurance after 2006 (when the Social Insurance Law 2006 took effect) will not be able to have a high pension like Mr. T.

According to the provisions of the Law on Social Insurance, the pension level is calculated by multiplying the pension rate by the average monthly salary used as the basis for social insurance contributions.

Regardless of how many years of social insurance participation, the maximum pension rate for employees is 75% of the average monthly salary used as the basis for social insurance contributions. The monthly salary used as the basis for social insurance contributions is also regulated to have a ceiling of 20 months of basic salary, regardless of the actual salary of the employee.

The effective date of the 2006 Social Insurance Law was July 1, 2007. At that time, the basic salary was 450,000 VND/month, so the monthly salary used as the basis for maximum social insurance contributions was 9 million VND/month.

Currently, the basic salary is 1.8 million VND/month, so the monthly salary used as the basis for social insurance payment is 36 million VND/month.

In the near future, when the basic salary is abolished, the Government will issue a reference level to calculate the monthly salary as the basis for maximum social insurance contributions. However, there may not be a sudden increase compared to the current basic salary.

Thus, from July 1, 2007, there are no longer people who can pay social insurance with a salary of up to 250 million VND/month like Mr. T.

Therefore, there will be no people receiving pensions of hundreds of millions of dong, 70 times higher than the lowest pensioner like Mr. T. now.

From July 1, when the basic salary is abolished, the Government will guide the use of reference levels for calculation instead of the basic salary.

In the draft Law on Social Insurance (amended), the drafting agency dedicated Article 8 to regulate this reference level.

Accordingly, the reference level is used to calculate the contribution level and the benefit level of some social insurance regimes. The reference level is applied at the basic salary level until the basic salary level is abolished. From the time the basic salary level is abolished, the reference level is not lower than the basic salary level.

In addition, the reference level is also adjusted based on the increase in the consumer price index and economic growth, in accordance with the capacity of the state budget and the social insurance fund.

Source: https://dantri.com.vn/an-sinh/lam-sao-de-co-luong-huu-hon-140-trieu-dongthang-20240618053242024.htm

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)