Investors are "gifted" more than 100,000 billion VND

After the long April 30 - May 1 holiday, the stock market returned to trading with strong fluctuations in investor sentiment, from positive to fearful, then positive again.

This week, VN-Index opened with excitement right from the beginning of the week. Green spread across the electronic trading board in most industry groups, helping VN-Index bounce to the important area of 1,050 points.

However, the increase slowed down in the following sessions when the general index approached the 1,060 point mark. Investors became more cautious. There were many times when the Vn-Index changed from green to red.

By the end of the week, investors returned to a state of excitement, helping VN-Index have the strongest increase of the week with liquidity also at the highest level.

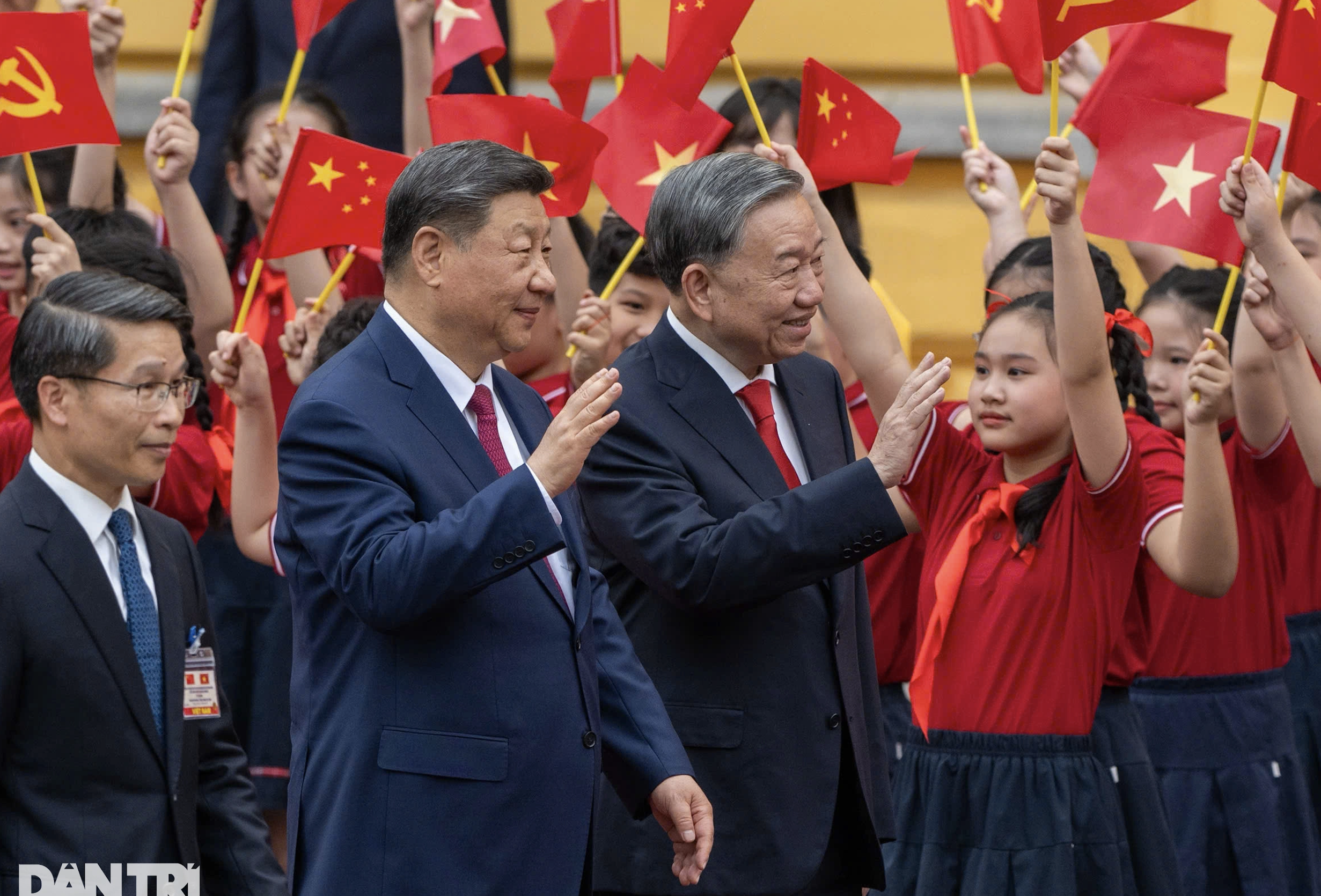

Thanks to the interest rate reduction, VN-Index broke out, helping stock investors earn more than 100,000 billion VND after 1 week of trading. Illustrative photo

Closing this week, VN-Index reached 1,066.9 points, up 26.59 points, equivalent to 2.56% compared to the end of last week. Market capitalization on the Ho Chi Minh City Stock Exchange increased by VND105,310 billion to VND4,254,706 billion.

This week, the stock market witnessed the rise of many small-cap real estate stocks.

At the end of the week, HAR of An Duong Thao Dien Real Estate Investment and Trading Joint Stock Company reached 4,620 VND/share, up 780 VND/share, equivalent to 20.3%; QCG of Quoc Cuong Gia Lai Joint Stock Company increased 800 VND/share, equivalent to 18.8% to 5,050 VND/share; DXG of Dat Xanh Group Joint Stock Company increased 1,450 VND/share, equivalent to 11% to 14,650 VND/share;...

Large-cap real estate stocks “gave way” to mid- and small-cap stocks throughout the week. However, just one final session was enough for blue-chips in the real estate sector to make a strong breakthrough.

In the last session of the week, VHM of Vinhomes Joint Stock Company increased sharply, increasing by VND2,050/share, equivalent to 4.17% to VND51,200/share. For the whole week, VHM increased by VND2,200/share, equivalent to 4.5%. Thanks to that, Vinhomes' market capitalization increased by VND9,580 billion.

Not in the real estate sector, another blue-chip also made an impression in the last session of the week. That was HPG of Hoa Phat Group Joint Stock Company. Along with a significant increase (up 2.76%), HPG also recorded a sudden increase in trading volume, reaching 45.1 million shares, 18.8 million shares higher than the average trading volume of the last 10 sessions.

In the past week, HPG increased by 900 VND/share, equivalent to 4.2% to 22,350 VND/share. Hoa Phat's market capitalization increased by 5,233 billion VND.

The “gift” of interest

Commenting on the increase of VN-Index, VCBS Securities Company said that for the domestic market, the State Bank is still maintaining flexible management measures, waiting for favorable developments in the international market to achieve the goals of reducing lending interest rates to support businesses and people in accessing capital in the context of production activities still facing many difficulties.

Although the specific timing of interest rate reduction has not been determined, the market still expects the target interest rate to be not far away, with little room for interest rate increase.

Accordingly, in favorable conditions when the strength of the USD does not increase, VCBS Analysis Department believes that the State Bank can completely have another round of reducing operating interest rates in the coming months.

Regarding the market, VCBS said that last week, balance was more clearly demonstrated through improved liquidity but scores only fluctuated moderately in the last sessions of the week.

In addition, the market also recorded clear differentiation when rotating between industry groups, causing stocks to increase and decrease alternately during the session as well as the whole week.

According to statistics, the chemical and construction stocks group had the best increase last week, reaching approximately 5%.

Besides, according to VCBS, technical indicators are also supporting the uptrend as they are moving positively and there are no signs of bottoming out, indicating that VN Index will likely continue to extend its recovery.

However, the probability that VN-Index will continue to have alternating up and down sessions but zigzag upward.

“We recommend that investors who have increased their purchases in recent sessions continue to maintain their holdings but need to closely monitor the market, especially around the 1,070 point area, and not chase stocks during strong increases,” VCSB advised investors.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

Comment (0)