As of August 20, Vietcombank currently lists an average lending interest rate of 5.7%/year.

Meanwhile, Agribank announced that the normal short-term loan interest rate is at least 5%/year; the normal medium and long-term loan interest rate is at least 5.5%/year.

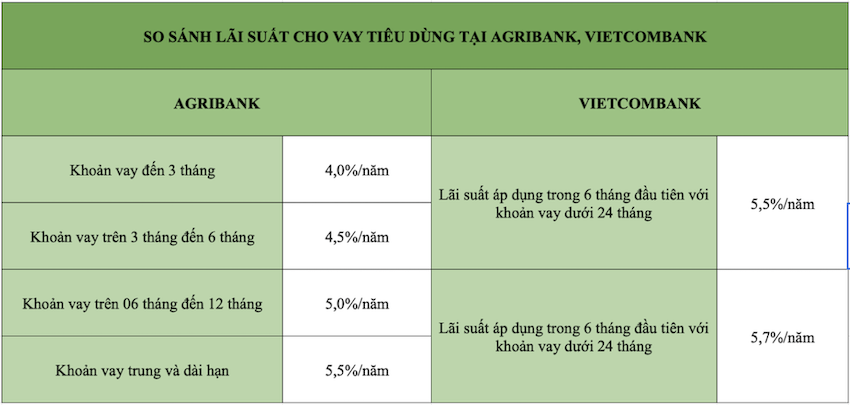

Compare interest rates Consumer loans at Agribank and Vietcombank

Currently, Agribank applies interest rates for loans serving consumer life such as buying houses, land, cars, motorbikes, televisions... as follows:

From 4.0%/year for loans up to 03 months.

From 4.5%/year for loans over 03 to 06 months.

From 5.0%/year for loans over 06 to 12 months.

From 5.5%/year for medium and long term loans.

Meanwhile, Vietcombank is lending for real estate (home purchase), car purchase and other consumption with interest rates from 5.5%/year.

Loan interest rate from 5.5%/year for the first 6 months for loans under 24 months.

Interest rates from 5.7%/year for the first 12 months for loans over 24 months.

This interest rate is part of Vietcombank's preferential package, applicable until March 31, 2025 or until the program's scale is exhausted.

In addition, individual customers receiving salary through Vietcombank who need to borrow capital will have their interest rate reduced by an additional 0.2%/year compared to the normal loan interest rate.

In general, consumer loan interest rates at Agribank are cheaper than Vietcombank's lending interest rates.

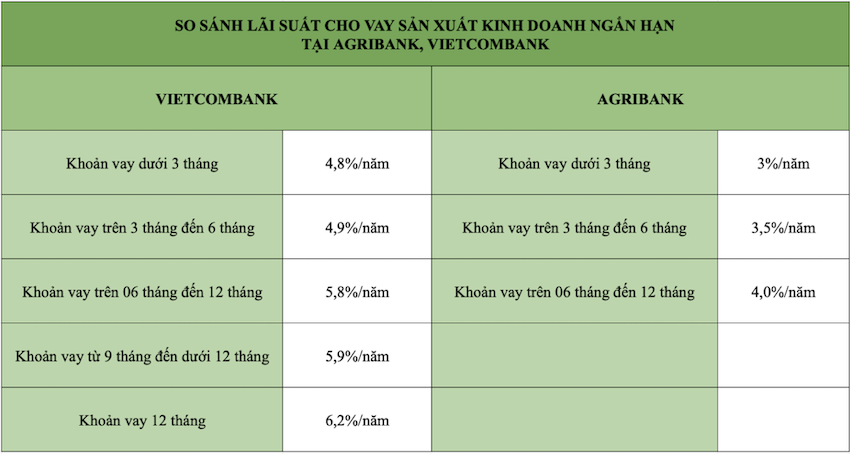

Compare interest rates for production and business loans at Agribank and Vietcombank

At Agribank , medium and long-term production and business loans have interest rates from 6.0%/year with loans of 12 months or more.

Meanwhile, for short-term loans, lending interest rates at Agribank range from 3.0%/year for loans up to 03 months;

From 3.5%/year for loans over 03 to 06 months;

From 4.0%/year for loans over 06 to 12 months.

At Vietcombank , short-term production and business loan interest rates are as follows:

Only from 4.8%/year with loan under 3 months.

Only from 4.9%/year with loans from 3 months to less than 6 months.

Only from 5.8%/year with loans from 6 months to less than 9 months.

Only from 5.9%/year with loans from 9 months to less than 12 months.

Only from 6.2%/year with a loan term of 12 months.

Agribank and Vietcombank's lending interest rates for small and medium enterprises (SMEs)

Vietcombank has allocated VND100,000 billion for SMEs to borrow. The program runs from April 1, 2024 to March 31, 2025 or until the program is fully funded. Vietcombank's lending interest rates are as follows:

Only from 4.2%/year for loans with loan term under 3 months.

Only from 4.8%/year for loans with loan terms from 3 months to less than 6 months.

Only from 5.5%/year for loans with loan terms from 6 months to less than 9 months.

Only from 5.5%/year for loans with loan terms from 9 months to less than 12 months.

Only from 6.1%/year with a loan term of 12 months.

Agribank has allocated VND20,000 billion for SMEs to borrow short-term to serve production and business. The bank only said that the lending interest rate is 1.5%/year lower than the normal lending interest rate floor.

Applicable period from February 1, 2024 to December 31, 2024.

The above interest rate packages are updated from the official website of Vietcombank on August 20, 2024. The lending interest rate floor may change from time to time.

Specific lending interest rates depend on the term, target and customer policies of Agribank and Vietcombank. When borrowing capital, banks need to add the required capital cost for credit risk and credit risk provisioning costs.

Source: https://laodong.vn/kinh-doanh/lai-suat-cho-vay-agribank-va-vietcombank-thap-nhat-4nam-1382133.ldo

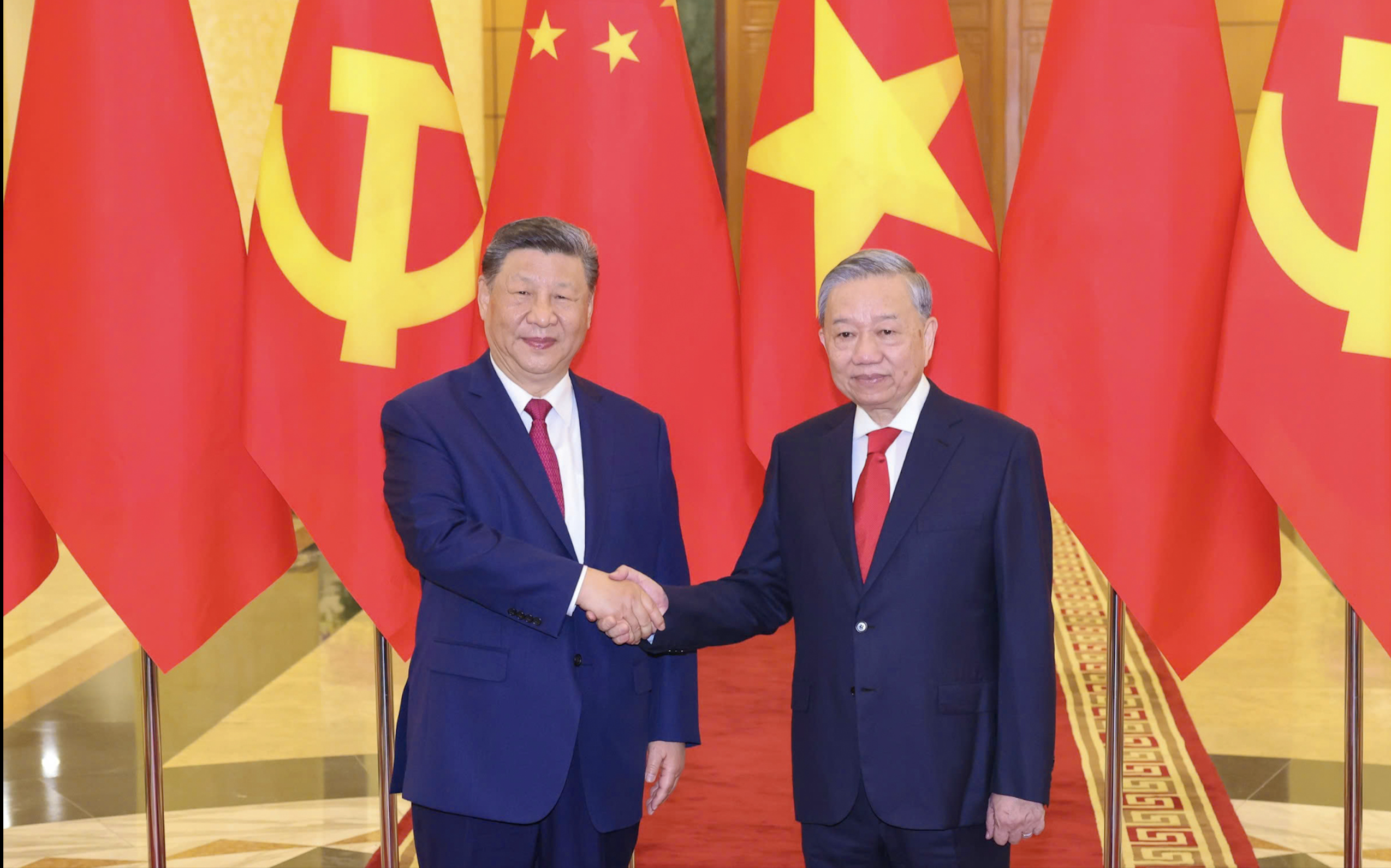

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)