(NLDO) - Many real estate stocks increased in price, helping the VN-Index escape the red zone. Investors expect this trend to not stop.

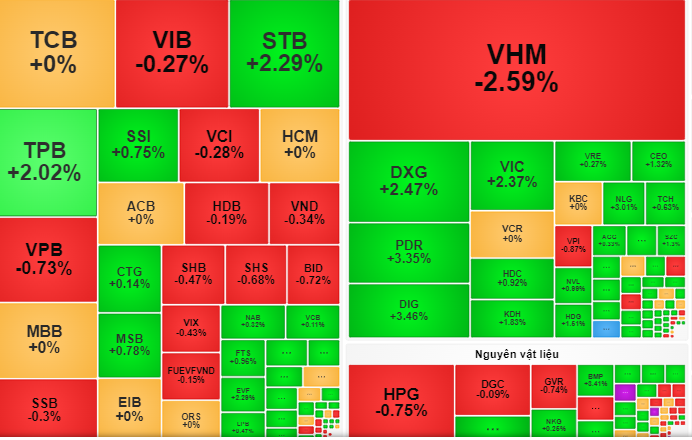

At the end of the session on October 23, the prices of real estate stocks such as VIC increased by 2.37%, DIG increased by 3.4%, PDR increased by 3.3%...

Vietnamese stocks were green right at the opening of the trading session on October 23. However, the market quickly retreated to the red zone with the lowest level of 1,263 points, then started to reverse and turned green at the end of the session.

At the end of the session, the VN-Index increased by 1 point (+0.08%), closing at 1,270 points. Liquidity decreased with 535.8 million shares matched on the HOSE floor.

According to Dragon Capital Securities Company (VDSC), with the market's efforts to increase points, many stock groups have regained green but the increase in points is very small, notably the vibrant performance of real estate stocks. In addition, food, technology, banking stocks, etc. also have slight support for the market.

ACBS Securities Company said that in the session of October 23, the demand for stocks focused on some codes in the real estate, technology, banking industries... Accordingly, the codes that increased points and had a positive impact on the market included: VIC (+2.37%), DIG (+3.4%), PDR (+3.3%) NLG (+3%), FPT (+0.83%), STB (+2.29%),...

Cash flow in this session was mostly maintained in real estate and banking stocks. Notably, the matched volume of Vinhomes (VHM) shares increased dramatically to 33.3 million units, equivalent to a value of VND 1,569 billion. In addition, VHM shares also had 2 negotiated transactions with a total volume of more than 4.1 million shares, equivalent to a value of VND 200 billion.

This is also the first trading session according to the plan to buy back 370 million VHM treasury shares announced by this company. From there, many investors expect that VHM code can make waves in the upcoming sessions, possibly dragging this trend to many other real estate stocks.

Therefore, VCBS Securities Company recommends that investors eliminate stocks that do not have a recovery phase, take advantage of fluctuations in the following sessions to partially disburse stocks that attract cash flow in the real estate and securities sectors...

Meanwhile, VDSC commented that liquidity on October 23 decreased compared to the previous session, indicating that the supply of stocks has cooled down. However, because the cash flow into the market is not strong, investors should avoid falling into a state of overbuying and consider recovery periods to restructure their stock portfolio in a way that minimizes risks.

Source: https://nld.com.vn/chung-khoan-ngay-mai-24-10-ky-vong-co-phieu-bat-dong-san-day-song-196241023175443545.htm

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] The beauty of Ho Chi Minh City - a modern "super city" after 50 years of liberation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/81f27acd8889496990ec53efad1c5399)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

Comment (0)