After the US Federal Reserve's (FED) decision to lower interest rates, although Wall Street had a strong increase and then reversed to a decline, Vietnamese stocks still increased when opening the session on September 19.

However, due to the overwhelming selling pressure in the morning session, most stocks only increased slightly, with real estate and steel stocks... trading quite actively.

The market continued to trade sideways in the early afternoon. At the end of the session, demand began to increase, helping many stocks increase in price, creating momentum for the general index to rise.

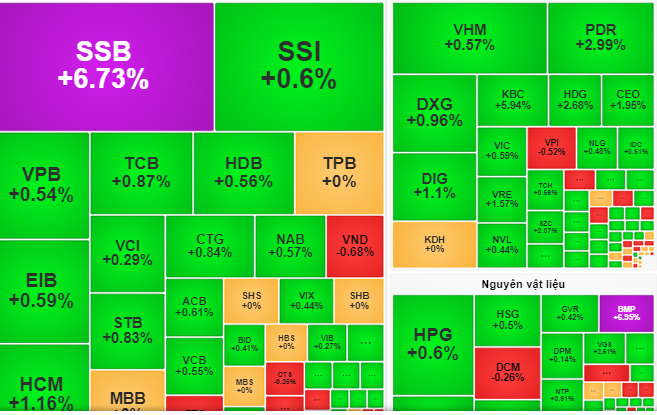

At the end of the session, the VN Index closed at 1,271 points, up 6 points, equivalent to 0.5%.

This session, foreign investors continued to net buy stocks with a total value of 485 billion VND, focusing on buying codes SSI, HCM, PDR... From there, many people expect foreign investors to increase their purchasing power, possibly stimulating domestic investors to focus capital on stocks.

Some stockbrokers said that cash flow is pouring into key stocks in the banking, securities, and real estate sectors. This was clearly shown in the session of September 19, when SSB codes increased by 6.7%, STB increased by 0.8%, SSI increased by 0.6%, HMC increased by 1.1%, DIG increased by 1.1%, and PDR increased by nearly 3%. However, investors need to monitor cash flow to avoid risks when the market has short-term fluctuations.

Vietcombank Securities Company (VCBS) recommends that investors prioritize holding stocks that attract stable cash flow in sectors such as securities, real estate, banking, etc.

Referring to the impact of the US interest rate policy on Vietnam, Ms. Do Minh Trang - Director of the Analysis Center, ACBS Securities Company, said that Vietnamese stocks had increased in several sessions before the FED lowered interest rates. Foreign investors returned to net buying stocks in many consecutive sessions.

"If the FED continues to reduce interest rates in the coming time, it will have a positive impact on Vietnam-US trade relations. Accordingly, exchange rate pressure will gradually decrease, contributing to stabilizing the USD/VND exchange rate. The State Bank will have more room to implement monetary easing policies, supporting economic growth. Low interest rates and stable exchange rates may help attract foreign capital flows into the Vietnamese stock market," Ms. Trang expected.

Source: https://nld.com.vn/chung-khoan-ngay-mai-20-9-khoi-ngoai-co-the-tang-them-suc-mua-sau-khi-fed-giam-lai-suat-196240919164455746.htm

Comment (0)