(NLDO) - VN-Index is around 1,260 points, foreign investors are continuously net sellers, experts still predict that there is about to be a "wave" that could reach the highest mark of 1,400 points next year...

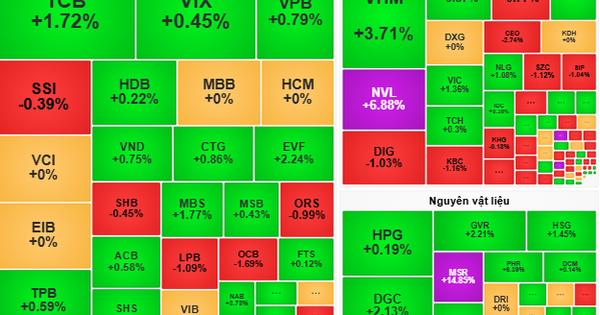

At the end of the trading session on December 17, the VN-Index fluctuated within a narrow range and closed at 1,261.72 points, down 2.07 points compared to the previous session. The HNX-Index decreased slightly by 0.15 points to 226.89 points, while the UPCoM-Index increased by 0.13 points to 92.77 points.

Liquidity on the HOSE continued to be weak, with a trading value of just over VND12,000 billion. The number of stocks that decreased in price dominated, while stocks that increased to the ceiling price were almost absent, causing the market to lack a clear leading industry group.

Net selling pressure from foreign investors continues to be a big minus point. This session, foreign investors net sold more than 660 billion VND on HOSE, focusing on MWG, HPG and NLG codes.

At the recent VPBankS Talk 4 conference, Mr. Vu Huu Dien, Chairman of the Board of Directors and General Director of VPBankS Securities Company, commented that 2024 will be a challenging year for Vietnamese stock investors.

He said foreign investors net sold about 3.1 billion USD (equivalent to 90,000 billion VND) in the first 11 months of 2024, a record high in the past 24 years. The VN-Index mainly moved sideways in the range of 1,200 - 1,300 points, causing difficulties for investors as the market faced competition from other investment channels such as real estate, gold and cryptocurrencies.

Stock market continues to fluctuate despite positive macroeconomic information

Ms. Tran Khanh Hien, Director of Analysis at MBS Securities, forecasts that the market trend this week may slow down due to the lack of breakthrough factors despite receiving positive economic information. Cash flow is heading to promising sectors such as technology, telecommunications, banking, exports (textiles, seafood), chemicals/fertilizers and industrial park real estate. Supporting factors include prospects for market upgrade, GDP growth, public investment and infrastructure projects such as the North-South high-speed railway.

Forecasting 2025, VPBankS experts expect that listed companies' profits could increase by over 20-25%, depending on the US interest rate cut roadmap and tariff policy. Mr. Tran Hoang Son, VPBankS Market Strategy Director, said that the market could continue to fluctuate in the first half of 2025 before entering the next big wave. Vietnam has met 7/9 of FTSE's upgrading criteria, and by March 2025, FTSE will collect foreign investors' opinions on new regulations.

If Vietnam is upgraded, the market could attract $1.7 billion in passive capital and $6-7 billion in active capital. Mr. Son predicts that the VN-Index could reach 1,400 points by the end of 2025, marking an opportunity to accumulate cheap stocks in the first half of the year.

Source: https://nld.com.vn/khoi-ngoai-ban-rong-31-ti-usd-chuyen-gia-van-du-bao-song-vn-index-1400-diem-196241217154817889.htm

Comment (0)