Cash "evaporated" 25%

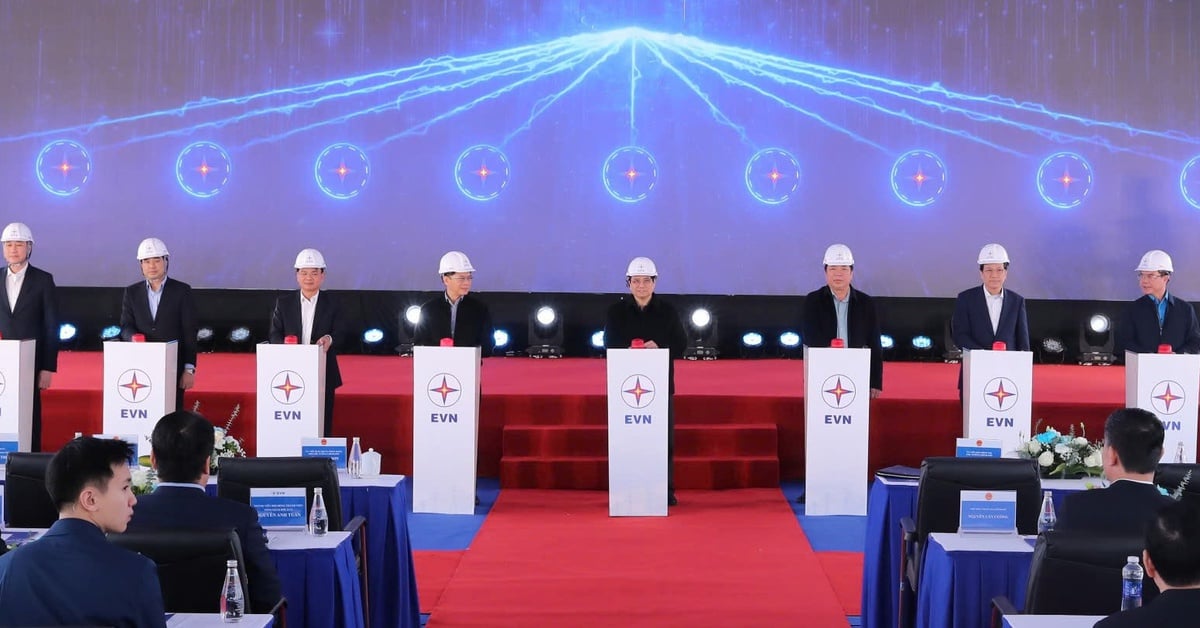

Vietnam Electricity Group (EVN) has just experienced 2 years of heavy losses, with a consolidated loss after tax of VND 20,743 billion, a net loss of VND 22,256 billion in 2022; accumulated consolidated loss in the first 6 months of 2023 reached VND 29,107 billion, the parent company lost VND 32,055 billion in the first 6 months of the year. In the whole year of 2023, the Group is expected to continue to suffer losses due to high cost of capital and electricity purchase prices.

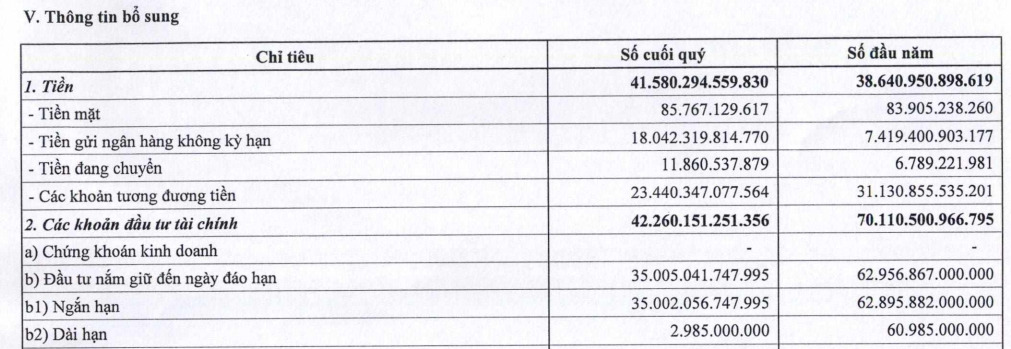

EVN's consolidated financial statements for the second quarter of 2023 recorded that as of June 30, 2023, EVN's total assets were at VND 632,418 billion, down 5% compared to the beginning of the year. Cash and cash equivalents were at a fairly high level, up to VND 41,580 billion, up 7.6% compared to the beginning of the year. Of which, demand bank deposits increased sharply by 2.4 times, to VND 18,042 billion; in contrast, cash equivalents decreased sharply by 24.7%, down to VND 23,440 billion.

As of the end of June 2023, EVN's financial investment was VND 42,260 billion, a sharp decrease of 39.7% compared to VND 70,110 billion at the beginning of the year. Of which, investments held to maturity were VND 35,005 billion, a decrease of 44%; According to the financial statement notes, these are EVN's term bank deposits.

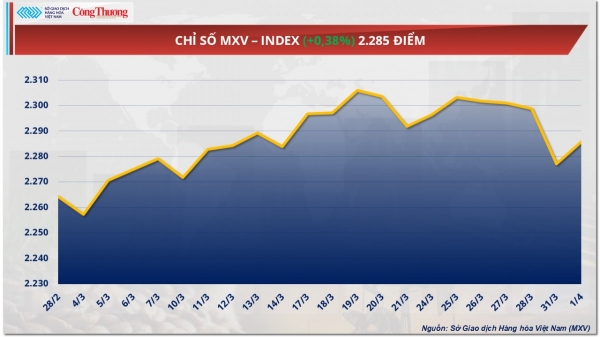

Thus, EVN holds a total of cash and cash equivalents and deposits at VND 76,585 billion, down 25% compared to the beginning of the year.

Meanwhile, capital investments in joint ventures, associates and other entities reached VND7,225 billion, a slight increase of 1% compared to the beginning of the year.

Short-term receivables increased by 15.6% to VND39,376 billion. Of which, short-term receivables from customers reached VND16,937 billion, up 23%; prepayments to sellers were VND9,603 billion, up 22.6%; other short-term receivables were VND13,232 billion, up slightly by 2.8%. EVN made a provision of VND398 billion for short-term receivables that were difficult to collect.

Inventory at the end of the second quarter of 2023 was VND25,305 billion, up 18%. Most of this was raw materials at VND22,368 billion; goods in transit at VND1,025 billion; tools and equipment at VND1,094 billion; and unfinished production and business costs at VND786 billion.

Long-term unfinished assets decreased slightly to VND39,654 billion, the entire figure being unfinished basic construction items.

Interest expenses increased sharply

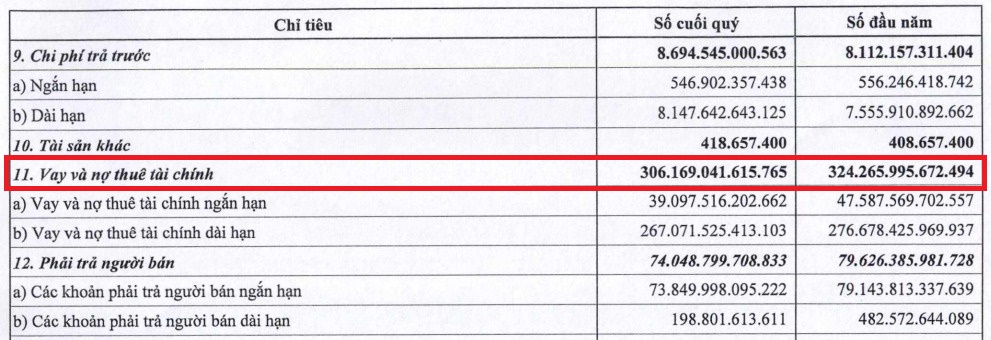

As of June 30, 2023, EVN's liabilities were VND 437,962 billion, down slightly by 0.6% compared to the beginning of the year. Loans accounted for nearly 70% of the liabilities structure, at VND 306,169 billion, down 5.5% compared to the beginning of the year. Of which, long-term loans were VND 267,071 billion; short-term loans were VND 39,097 billion.

High debt levels forced the Group to pay a large amount of interest expenses, up to VND8,744 billion, an increase of 34% over the same period last year.

In addition, short-term payables to suppliers were at VND73,850 billion; short-term payable expenses were VND35,670 billion; other payables were VND9,325 billion.

As of the end of June 2023, EVN's equity was VND 194,456 billion, down 13.7% compared to the beginning of the year. Thus, EVN's debt of VND 437,962 billion is 2.2 times higher than its equity.

Regarding corporate structure, EVN Group invests in 17 subsidiaries and 29 affiliated companies. Including power transmission, power generation, thermal power, hydropower, electromechanical, electrical construction companies, etc.

In particular, Power Generation Corporation 3 (EVN GECNCO 3 - Stock code: PGV) and Power Generation Corporation 2 (EVNGENCO 2 - Stock code: GE2) - two subsidiaries of EVN have both operated under the joint stock company model. Accordingly, the ownership ratio and voting ratio of EVN Group in these two companies have decreased to 99.19% (from September 27, 2018) and 99.87% (from July 1, 2021), respectively.

Source: https://laodong.vn/kinh-doanh/khoan-no-vay-hon-306-nghin-ti-dong-cua-evn-1338747.ldo

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)