Vietnam's steel production is expected to increase by about 10% in 2024 and 8% in 2025 as steel demand from domestic economic sectors recovers.

However, it is forecasted that the steel industry will find it difficult to achieve high growth as expected this year due to large inventories and increasing trade protectionism...

Increase pressure

According to the Vietnam Steel Association (VSA), Vietnam currently ranks 12th in the world and first in the ASEAN region in steel production. VSA forecasts that our country's finished steel production in 2024 could reach 30 million tons, up 7% compared to 2023.

Steel consumption is expected to increase by 6.4% compared to 2023, reaching 21.6 million tons, however, this recovery is uncertain as steel industry enterprises are currently facing many difficulties due to the decline of the real estate market and rising raw material prices. This year's inventory is estimated at about 8.4 million tons.

Since the first price increase in early 2024 (increased by 200-400 thousand VND/ton, reaching 15 million VND/ton) after 21 price decreases in 2023, steel prices have continuously decreased and remained at 13.4-13.6 million VND/ton for CB300 ribbed steel.

The reason for this situation is that the global steel market has a clear downward trend. In addition, domestic steel prices have decreased because steel enterprises have to compete with cheap steel from China as this country continuously lowers its steel export prices.

According to VSA's report, in the first 7 months of 2024 alone, crude steel production reached more than 12.8 million tons, an increase of 21% over the same period in 2023; internal crude steel consumption and sales reached 12.4 million tons, an increase of 17% over the same period in 2023; of which exports reached 1.6 million tons, an increase of 45% over the same period in 2023.

However, Vietnam also imported about 8.2 million tons of finished steel products of all kinds with a value of nearly 6 billion USD, an increase of 47.88% in volume and 25.15% in value compared to the same period in 2023, mainly imported from the Chinese market. Currently, China is the world's leading country in steel production and export with about 500 steel factories of all kinds, with a total capacity of about 1.2 billion tons of steel/year.

Not only the domestic market, our country's steel export activities are also facing difficulties because businesses are facing trade defense lawsuits, with technical "barriers" against dumping, anti-subsidy, and self-defense that import markets have erected. By the end of May 2024, of the total 252 foreign trade defense investigations with Vietnam, about 30% of the cases were related to steel products. The investigated steel products are quite diverse, including galvanized steel, cold-rolled stainless steel, color-coated steel, steel pipes, steel hangers, steel nails, etc.

It is worth noting that these lawsuits mostly occurred in Vietnam's major steel export markets such as the United States, the EU, Australia, India, etc., of which the United States is the country that conducts the most investigations against Vietnam. And most recently, India announced that it will impose a tax of 12-30% on some steel products imported from Vietnam; the EU also initiated an anti-dumping investigation on hot-rolled steel from Vietnam from April 1, 2023 to March 31, 2024, etc.

Find a solution

According to Dr. Nguyen Thi Thu Trang, Director of the WTO and Integration Center (under VCCI), trade defense measures, especially anti-dumping, are legal tools to protect the legitimate rights of domestic production activities, directly the steel production industry, against unfair competition such as dumping or selling products subsidized by the Government of the exporting country to Vietnam.

However, in the long term, the State needs to design a legal framework and organize a mechanism to implement trade defense tools in a reasonable, strict, transparent manner, in accordance with the World Trade Organization (WTO) so that domestic manufacturing enterprises can use them conveniently and effectively, to protect their legitimate rights and interests according to regulations.

VSA Chairman Nghiem Xuan Da said that the oversupply of many domestic steel products and the increase in imported steel from abroad are making the price competition of domestic finished steel products more fierce than ever.

Notably, from January 2026, the European Union (EU) will apply the Carbon Border Adjustment Mechanism (CBAM) to impose carbon taxes on products exported to this market, creating a significant obstacle to the growth of the steel industry.

Therefore, we hope that the Government will soon direct relevant agencies to take measures to prevent unfair competition to protect the interests of Vietnamese steel enterprises in domestic and foreign markets. At the same time, we will accelerate the synchronization of stimulus channels for steel products such as the real estate market, the construction market, the program to build 1 million social housing, and promote public investment, etc. to help the steel industry recover in the coming time.

In addition to the temporal issues, according to experts, it must also be frankly acknowledged that due to being behind, the Vietnamese steel industry still has limitations and long-term bottlenecks compared to other countries. In particular, production capacity is still limited, steel imports are still large, crude steel production is only basically meeting domestic demand, and there is a shortage of high-quality steel products and technical steel.

In addition, outdated technology leads to fuel consumption and high costs, making it difficult for domestic steel products to compete with cheap imported products. Steel industry enterprises hope that the Government will respond promptly, positively and harmonize interests to protect the sustainable and healthy development of steel production.

In addition to the support of the State, domestic steel manufacturing enterprises need to quickly improve product quality by optimizing production scale with a closed process, proactively restructuring, increasing investment in advanced technology, in order to reduce product costs to create the best competitiveness with imported steel.

At the same time, it is necessary to proactively source raw materials, diversify markets and product structures, especially products with good export potential and high profit margins, and quickly convert to green production and consumption according to the Government's commitment at COP26.

Source

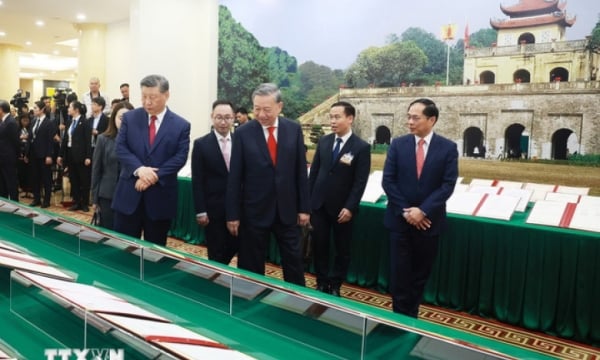

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

Comment (0)