GREAT POTENTIAL

In the report Vietnam Data Center Market - Investment Analysis and Growth Opportunities 2025-2030 by Research and Markets, the Vietnam data center market was valued at USD 654 million in 2024 and is expected to reach USD 1.75 trillion by 2030, growing at a CAGR (compound annual growth rate) of 17.93%.

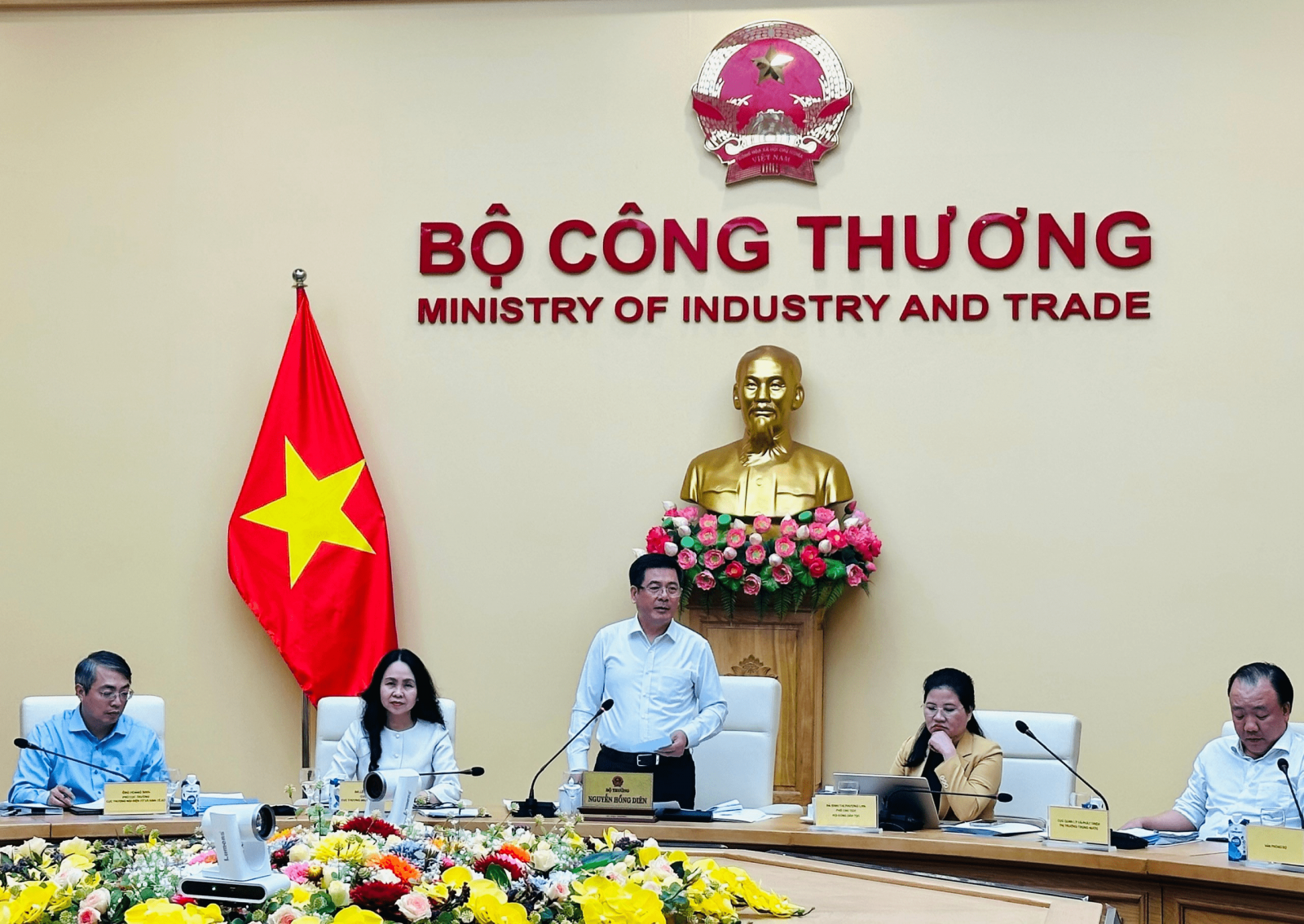

The Vietnamese data center market is showing signs of improvement as in 2024, large telecommunications enterprises will launch "Make in Vietnam" data centers.

In the report Vietnam Data Center Market - Investment Analysis and Growth Opportunities 2025-2030 by Research and Markets, the Vietnam data center market was valued at USD 654 million in 2024 and is expected to reach USD 1.75 trillion by 2030, growing at a CAGR (compound annual growth rate) of 17.93%.

Viettel Hoa Lac Data Center is one of the largest data centers in the country, established in April 2024 with an electric capacity of about 30MW. The center's operating systems are all automated, applying artificial intelligence to the maximum.

According to Mr. Le Hoai Nam, Deputy Director of IDC Viettel Center, the data center market in Vietnam is growing strongly thanks to some key drivers such as digital transformation and digital economy, which have created the need for storing and processing large data, encouraging businesses to invest in data center infrastructure. Vietnam has the advantage of lower construction and operating costs compared to other countries in the region. That is one of the potentials for Vietnam to attract the attention of investors.

|

In 2024, large telecommunications enterprises will launch "Make in Vietnam" data centers. |

Previously, in October 2023, VNPT Group also put into operation its 8th data center at Hoa Lac High-Tech Park with an area of up to 23,000m2 of floor space and a scale of about 2,000 network cabinets.

This center has achieved Uptime Tier III certification, an international assessment standard for criteria such as design, operation, construction, management and stability of a data center for the design and construction category.

By the end of the first quarter of 2024, Vietnam will have 33 data centers and a total of 49 service providers, mainly concentrated in major cities such as Hanoi and Ho Chi Minh City.

Mr. Vu The Binh, General Secretary of the Vietnam Internet Association, commented that the operation of a number of large-scale data centers will promote the transformation process of Vietnamese agencies, organizations and enterprises, especially promoting digital transformation. Data centers also anticipate the needs from abroad to Vietnam following the wave of foreign investment and the trend of shifting content closer to Vietnamese internet users by global content service providers.

COMPETE TO DEVELOP

Despite rapid growth and being assessed as having billion-dollar potential, the Vietnamese data center market has not yet developed commensurately.

Mr. Vu The Binh said that because Vietnam's starting point is lower than some ASEAN countries, the scale of data centers is still modest, and the international internet bandwidth is larger than the domestic internet bandwidth, a large proportion of internet content accessed by Vietnamese users is located abroad.

Building a data center requires a large investment cost (hundreds of millions to billions of USD). In addition, domestic investors face many challenges when the quality of power sources is unstable and international connection infrastructure is limited. The number of submarine cable lines in Vietnam is too small - 5 existing lines and 2 lines under construction (serving 72 million internet users), only 20-30% compared to other countries in the region.

Currently, the data center market in Vietnam is still led by domestic providers. However, the Law on Telecommunications (amended) 2023, effective from July 1, 2024, allows 100% foreign investment in data center services, opening up opportunities to attract capital and technology investment, but at the same time, it also poses many challenges for domestic enterprises.

International investors with advantages in finance, technology and operational experience will create strong competitive pressure on domestic suppliers, but at the same time, Vietnamese data center service providers can also take advantage of their understanding of the market, government policies and customer needs to provide suitable services.

In addition, “handshakes” with foreign suppliers to take advantage of investment capital will be the driving force for economic growth. With the right strategy, domestic suppliers can still exploit and develop sustainably in this fiercely competitive context.

Source: https://nhandan.vn/khai-pha-thi-truong-trung-tam-du-lieu-post870413.html

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Video] Effective management mechanism is needed for tutoring centers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/673ef39486294f128badc33688ed8a0e)

![[Photo] Reliving the heroic memories of the nation in the program "Hanoi - Will and belief in victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19ce7bfadf0a4a9d8e892f36f288e221)

Comment (0)