Recently, the Ho Chi Minh City Stock Exchange (HoSE) has just issued a notice reminding companies to delay submitting their audited semi-annual financial statements for 2023.

Specifically, based on the provisions of Point c, Clause 2, Article 14 of Circular 96 dated November 16, 2020 of the Ministry of Finance guiding the disclosure of information on the stock market, the deadline for publishing semi-annual financial statements is 5 days from the date the auditing organization reports the review, but must not exceed 45 days from the end of the first 6 months of the fiscal year.

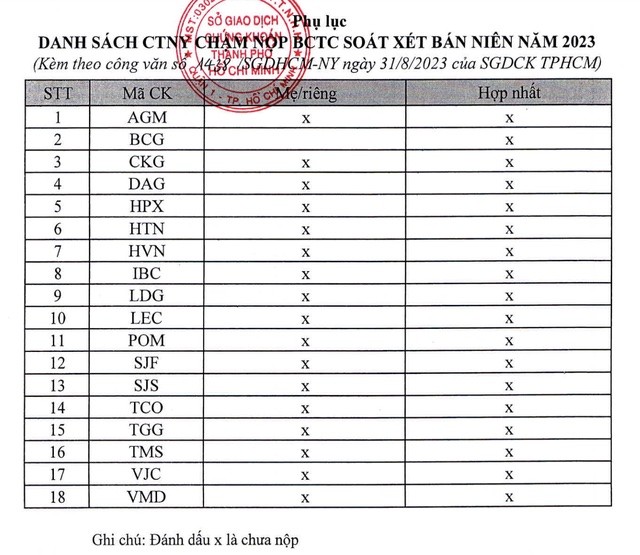

However, by the deadline for submitting reports, HoSE has not yet received the 2023 semi-annual financial reports of 18 companies as prescribed.

HoSE announced the list of companies that are late in submitting financial reports.

Among the above companies, Dong A Plastics Group Corporation (HoSE: DAG) was previously reminded twice about the delay in submitting the first quarter financial report of 2023 and the delay in disclosing the 2022 Annual Report.

In addition, the company's DAG shares were also put on warning since August 9 due to violating information disclosure regulations 4 times or more within 1 year.

Regarding IBC shares of Apax Holdings Investment JSC, HoSE has put this stock on warning status since July 11, 2023, because the listed organization has not held an annual general meeting of shareholders for more than 6 months since the end of the fiscal year.

Similarly, HPX stock of Hai Phat Investment has been under warning since July 11 because the company has not yet held its annual general meeting of shareholders (AGM), while the deadline for holding it is within 6 months from the end of the fiscal year.

With AGM shares of An Giang Import-Export Joint Stock Company (Angimex), the shares were put on warning status from September 7, 2023 due to undistributed loss after tax as of December 31, 2022 on the audited consolidated financial statements for 2022 of VND 70.73 billion.

Recently, Angimex was also administratively sanctioned by the An Giang Provincial Tax Department for declaring input value-added tax deductions that were not in accordance with regulations, and declaring export sales revenue that was not on the date of confirmation of completion of customs procedures, which was an act of false declaration but did not lead to a shortage of value-added tax payable and no tax refund.

Regarding LDG, recently, the State Securities Commission also decided to fine 520.26 million VND and suspend securities trading activities for 4 months for Mr. Nguyen Khanh Hung, Chairman of the Board of Directors of LDG Investment Company, for selling more than 2 million LDG shares without reporting the expected transaction .

Thu Huong

Source

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)