Investment Comments

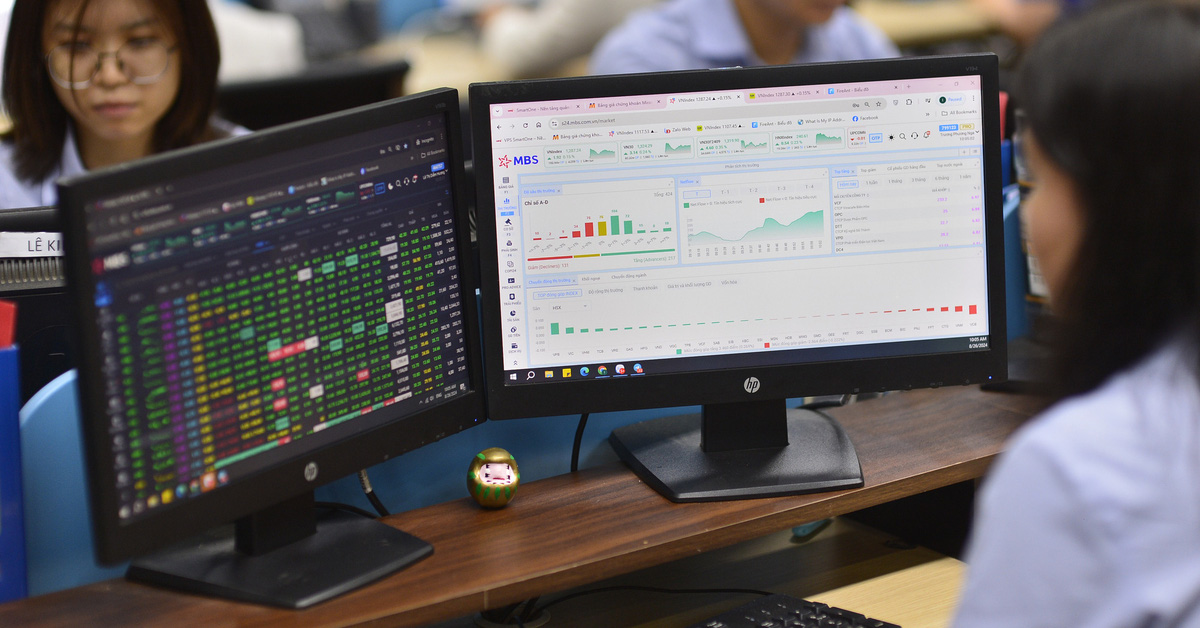

Saigon - Hanoi Securities (SHS) : From a short-term perspective, the market is in a period of unusual fluctuations, but demand is quite good and can help VN-Index form an accumulation base before the strong resistance level of 1,300.

In the session of March 20, VN-Index quickly regained the 1,250 mark according to a positive scenario and is gradually forming a new accumulation base to form a new uptrend. However, short-term investors should still be cautious because the movement of VN-Index is quite wide and unusual.

Yuanta Vietnam Securities (YSVN) : The market may continue to increase in the next session and the VN-Index may retest the 1,268 - 1,270 point zone.

At the same time, the market is still in a short-term accumulation phase, so the VN-Index may not be able to completely surpass the resistance zone of 1,268 - 1,270 points in the next 1-2 trading sessions. The positive point is that the cash flow is returning to large-cap stocks, so the market's uptrend will also be consolidated in the short term.

Vietcombank Securities (VCBS) : On the daily chart, VN-Index shows signs of recovery after intersecting with the MA20 line, along with the CMF money flow indicator pointing up, indicating that active buying money has increased again. However, the Bollinger band is still narrowing, indicating that VN-Index may experience fluctuations during the session when approaching the old peak area.

On the hourly chart, the RSI indicator is pointing up, the MACD has crossed the indicator line and is pointing up from the low zone, and the Tenkan line of the Ichimoku cloud also shows signs of crossing the Kijun line, indicating that the VN-Index will soon return to the old peak resistance area around 1,270 - 1,280 in the short term.

Stock news

- US stocks rose sharply in the trading session on Tuesday (March 19), as the Federal Reserve (Fed) kicked off a two-day monetary policy meeting amid investors' expectations that the central bank will start cutting interest rates this year.

- Why is the yen still depreciating after the BOJ ended negative interest rates? The yen and Japanese government bond yields fell after the Bank of Japan (BOJ) announced on March 19 that it would end its ultra-loose monetary policy - a historic shift away from its nearly two-decade-long fight against deflation. In a statement released after the meeting, the BOJ said that short-term interest rates would rise from -0.1% to around 0-0.1%; the yield curve control (YCC) policy would be abolished; and its risky asset purchase program would also end .

Source

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

![[Photo] Celebrating the 70th Anniversary of Nhan Dan Newspaper Printing House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a7a2e257814e4ce3b6281bd5ad2996b8)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)