Get out of the hole through financial activities

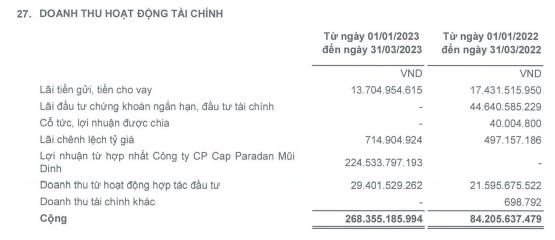

FIT Group Corporation (stock code: FIT) has announced its financial report for the first quarter of 2023 with revenue reaching VND 335.5 billion, down nearly 6% over the same period. Cost of goods sold continued to increase, causing gross profit to drop sharply by nearly 36% to VND 58.5 billion.

The actual gross profit was not enough to cover the expenses incurred during the period. If financial revenue had not increased more than threefold to VND268.4 billion, FIT could have suffered heavy losses in the first quarter. As a result, FIT's first quarter after-tax profit reached VND206.5 billion, many times higher than the same period last year and far exceeding the annual plan.

Not only the parent corporation, but also most of the member companies in FIT's ecosystem are experiencing business decline.

According to the explanation, the reason for the sharp increase in financial revenue comes from the profit from the merger of Cap Padaran Mui Dinh Joint Stock Company (VND 224 billion). Cap Padaran Mui Dinh, which started construction in February 2022, is a resort project built on an area of nearly 800 hectares, divided into many sub-areas including: hotel functions, resorts, beach villas, hotel apartment complexes, entertainment, recreation and sports tourism.

The total investment of the entire project is estimated at more than 1 billion USD. On November 14, 2022, FIT officially signed a cooperation contract with Banyan Tree. After signing, the Cap Padaran Mui Dinh project will be consulted on technical consulting strategy, design and professional operation management, befitting the scale of a large project.

Financial report Q1/2023

Capital misappropriation is getting worse

In addition to the decline in core operating profits, FIT also faced a rapid increase in short-term receivables.

Although short-term receivables decreased by 2.25% compared to the beginning of the year to VND 3,436 billion, their proportion to total assets was still very high, at 47.1% at the end of the first quarter. As of March 31, 2023, FIT's provision for doubtful receivables was VND 110 billion, a slight decrease of 1.62% compared to the beginning of the year.

Over the years, we can see the rapid growth rate of short-term receivables. In 2020, the total short-term receivables were 464 billion VND, but in 2022, after only 2 years, this number increased 7.6 times, to 3,516 billion VND.

The rapid increase in short-term receivables means that the business is increasingly being deprived of capital by its partners, and at the same time, this is also a sign that the business is having difficulty in effectively managing receivables.

The business ecosystem is in decline.

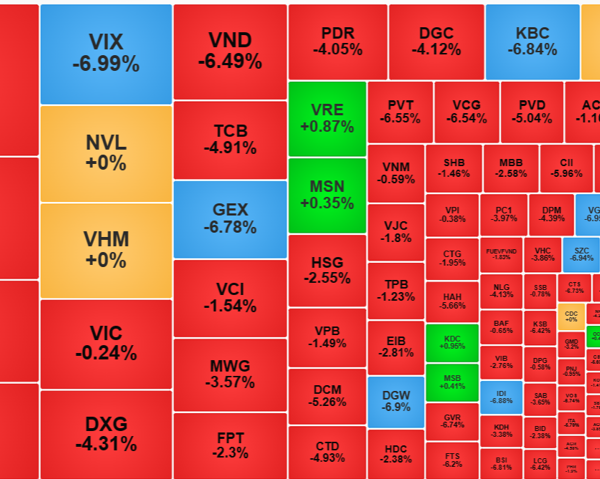

In 2022, due to the lack of any extraordinary revenue, FIT's business results were much worse. The whole year's after-tax profit was only 71.6 billion VND, down 69% compared to the same period. Net cash flow from business activities was heavily negative at 1,676 billion VND.

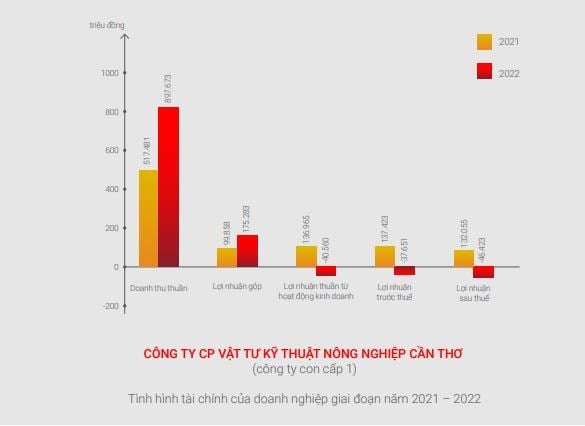

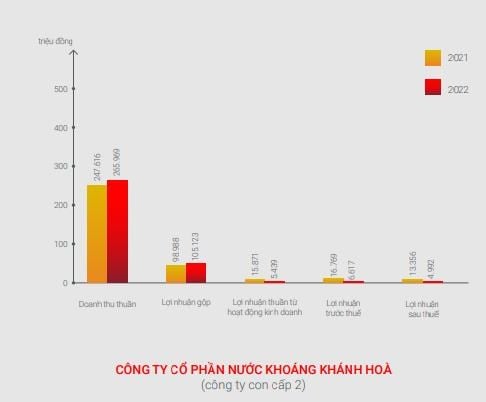

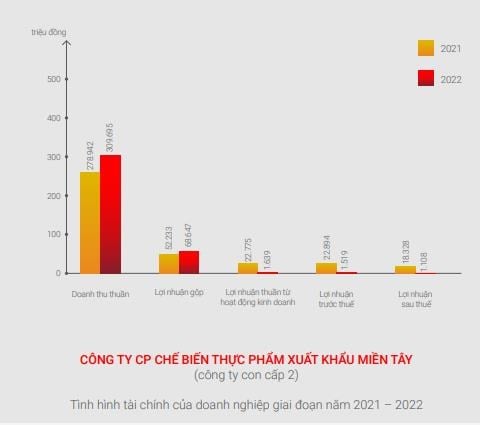

Not only the parent corporation, but also most of the member companies in FIT's ecosystem are experiencing business decline.

In particular, Can Tho Agricultural Technical Materials Joint Stock Company (level 1 subsidiary) unexpectedly recorded a loss after tax of up to 46 billion VND, while in the same period in 2021, it recorded a profit of 132 billion VND.

Khanh Hoa Mineral Water Joint Stock Company (level 1 subsidiary) recorded a 63% decrease in after-tax profit in 2022 compared to 2021, down to VND 4.9 billion, while in the same period last year it recorded VND 13.3 billion.

Western Food Processing Export Joint Stock Company (level 2 subsidiary) also recorded a serious decline in profits in 2022, when after-tax profit decreased by 94% compared to the same period in 2021, down to VND 1.1 billion.

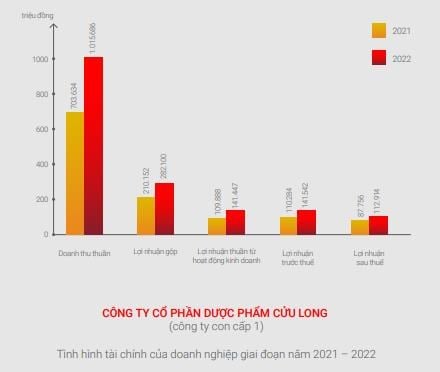

The most optimistic is Cuu Long Pharmaceutical Joint Stock Company (a level 2 subsidiary) when it recorded a 28% increase in after-tax profit in 2022 compared to 2021, reaching VND 113 billion. However, the after-tax profit margin/total net revenue decreased from 12.4% in 2021 to 11.1% in 2022.

Source

![[Infographic] Maintaining stable momentum, import and export reached 35.44 billion USD](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/d008bc6a1c4f4758ac6d42f25104a280)

Comment (0)