Gold price today October 28, 2024: World gold price increased by 100 USD after 2 weeks, becoming the most sought-after investment asset at the moment. Domestically, the unexpected development is that gold price increases following the world, but surprisingly, gold rings continue to break the peak, chasing the price of SJC gold bars.

Update gold price today October 28, 2024

World gold prices are going up in all "weather".

The next increase in world gold prices started a week ago and now, after only 2 weeks, from 2,657.70/ounce, the price of the precious metal has increased by more than 100 USD - setting a new price record - more than 2,700 USD/ounce and is continuing to increase higher.

According to The World & Vietnam Newspaper , the international gold price traded on the Kitco electronic exchange, closed the last session of last week (October 25) with an increase, closing the week at 2,747.70 - 2,748.70 USD/ounce , up 12.4 USD/ounce compared to the previous trading session.

Gold has shown remarkable resilience over the past week – recovering quickly from a mid-week sell-off to reach record levels, as traders closely watched geopolitical developments, as well as upcoming political events, including the US election just 11 days away – emerged as a key catalyst for the market.

The market also saw a tug-of-war between short-term opportunistic traders and long-term trend followers, with each side taking advantage of the week's sharp price swings.

Notably, gold prices rose despite significant strength in the US dollar, with the USDX rising to 104.403. The greenback has shown significant momentum throughout October, rising about 4% from its low of 100.208 on September 30. Despite this challenging environment, the precious metal posted a solid monthly gain of $104.40.

The combination of political uncertainty, escalating geopolitical tensions in the Middle East and Eastern Europe, is expected to remain important in determining the direction of gold prices in the near term. As these situations continue, market participants will likely continue to adjust their positions based on emerging developments and risk assessments.

Given the current market situation, veteran expert Brien Lundin, President and CEO of Jefferson Financial, commented, "This is your last chance to get in the game." He believes that at this point, things will start moving very quickly. The US market is showing a surge in gold mining stocks, especially when their earnings reports show huge profit margins and cash flows, and this is expected to quickly spread to smaller companies. Further evidence that gold has become a "hot" investment comes when a series of mainstream analysts have officially entered the game.

Domestic gold prices continuously break the peak, gold ring price is "equal" to SJC gold bars .

The price of SJC gold bars is stable according to the adjustment of the State Bank. The flat price of 87.0 - 89.0 million VND/tael (buy - sell) continues to be maintained at Saigon Jewelry Company (SJC) and 4 banks in the Big4 group.

The price of 9999 round smooth gold rings fluctuates constantly, but seems to have been pinned at a new high. Last week, the price of gold rings continued to set an unprecedented record - 87.6 million VND/tael, getting closer and closer to the price of SJC gold bars.

At the end of last week's session (October 26), Saigon Jewelry Company (SJC) announced ring gold at 87 - 88.5 million VND/tael; Doji Group at 87.9 - 88.9 million VND/tael; PNJ Group at 87.6 - 88.9 million VND/tael; Bao Tin Minh Chau at 87.88 - 88.98 million VND/tael.

Converted according to the USD exchange rate at Vietcombank on October 26, 1 USD = 25,467 VND, the world gold price is equivalent to 84.33 million VND/tael.

|

| Gold price today October 28, 2024: Gold price is still steadily rising, last chance to jump into the investment 'game', is it time for precious metals to adjust? (Source: Kitco) |

Summary of SJC gold bar prices at major domestic trading brands at the closing times of the weekend trading session (October 26 ):

Saigon Jewelry Company: SJC gold bars 87 - 89 million VND/tael; SJC gold rings 87 - 88.5 million VND/tael.

Doji Group: SJC gold bars 87 - 89 million VND/tael; 9999 round rings (Hung Thinh Vuong) 87.9 - 88.9 million VND/tael.

PNJ system: SJC gold bars 87 - 89 million VND/tael; PNJ 999.9 plain gold rings at 87.6 - 88.9 million VND/tael.

Phu Quy Gold and Silver Group: SJC gold bars: 87.3 - 89 million VND/tael; Phu Quy 999.9 round gold rings: 87.9 - 89 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at 87 - 89 million VND/tael; plain gold rings are traded at 87.88 - 88.98 million VND/tael.

How do experts predict gold prices this week?

The latest Kitco News weekly gold survey shows a sharp drop in bullish sentiment among industry professionals and retail traders, with both groups reaching nearly identical distributions of expectations for gold’s near-term price performance.

Marc Chandler, managing director at Bannockburn Global Forex , expects consolidation in the near term and said the risk for gold is now tilted to the downside. He said a break below $2,700 would likely start to put pressure on long-term buyers. He said gold could fall to $2,600 before rising to $2,800 an ounce.

“Down,” said Adrian Day, chairman of Adrian Day Asset Management . “Is the long-awaited pullback finally imminent? Perhaps, but we doubt it will be long or deep. The fundamentals that have driven gold prices — the weaponization of the US dollar, concerns about the Chinese economy and the safety of banks, lower interest rates and persistent inflation in North America and Europe — are still there.”

Darin Newsom, senior market analyst at Barchart.com, is also “bearish on gold for the week,” saying he expects the yellow metal to see a pullback this week.

Cieszynski said he is mostly neutral for the coming week, because in the long term, “the fundamentals driving the current bull market remain unchanged, such as paper currency depreciation and political risk, especially with the US election.” “My bearish stance is only for one week, based on the possibility of a trade correction,” he said.

James Stanley, senior market strategist at Forex.com, however, remains bullish on gold. He said that buyers have struggled to gain acceptance above $2,750 an ounce so far, but he sees no evidence that the rally is over. “Buyers have responded strongly to support over the past week, so I think the primary trend remains bullish until there is evidence to the contrary.”

Source: https://baoquocte.vn/gia-vang-hom-nay-28102024-gia-vang-van-miet-mai-di-len-co-hoi-cuoi-cung-nhay-vao-cuoc-choi-dau-tu-kim-loai-quy-da-den-luc-dieu-chinh-291526.html

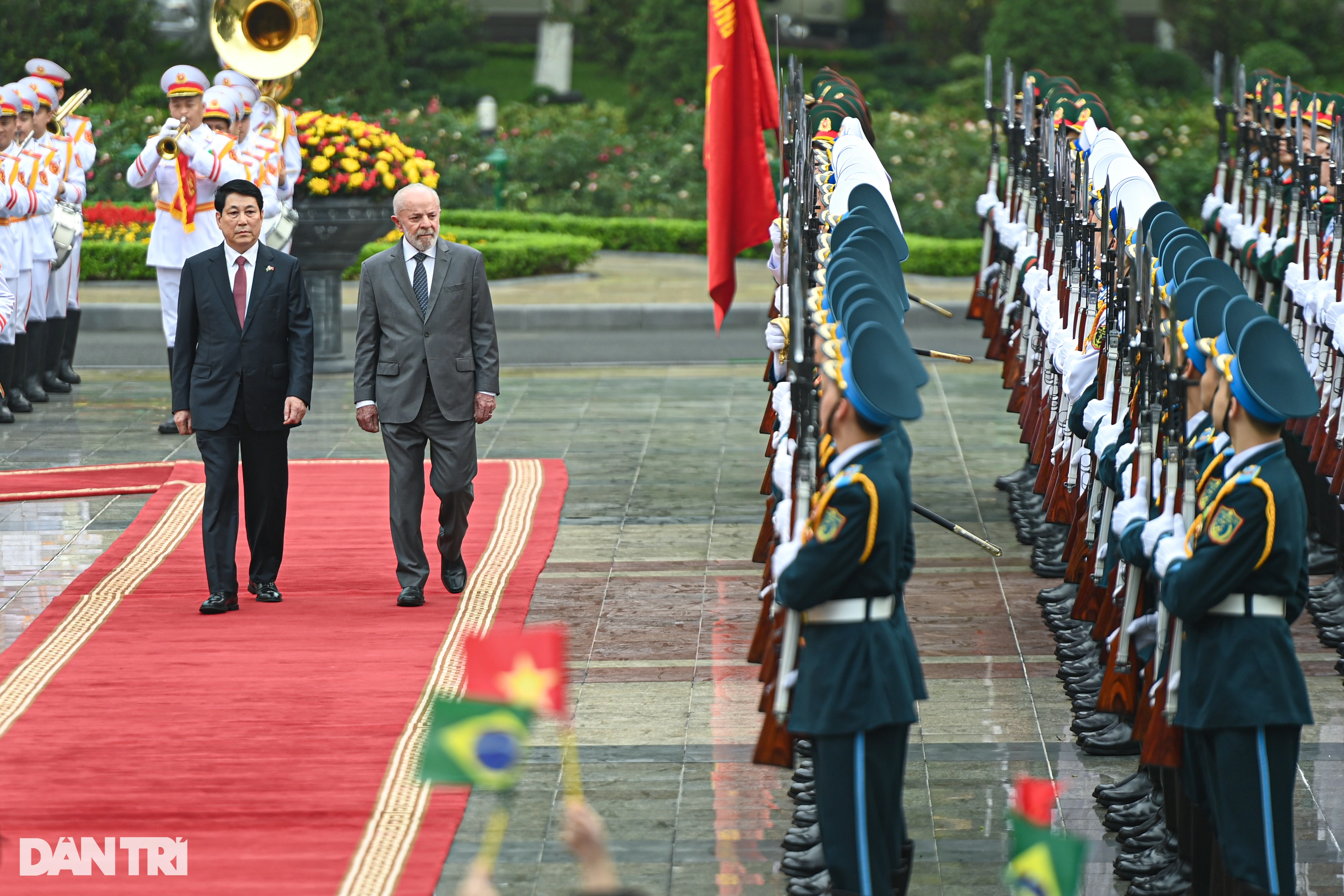

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

Comment (0)