October 12 was a memorable trading session for the financial market. The conflict in the Gaza Strip pushed gold prices to continuously soar in the world and domestic markets. While the world gold price broke out but still could not conquer the 1,900 USD/ounce mark, the SJC gold price regained the threshold of 70 million VND/tael.

While precious metals soared, the USD sank. In the Asian market, the greenback fell to a two-week low, while domestically, the USD/VND exchange rate fell by as much as 38 VND/USD in some places.

USD/VND exchange rate decreased by 38 VND/USD

The Joint Stock Commercial Bank for Industry and Trade (VietinBank) is the unit with the highest adjustment range. At the beginning of the session on October 12, the USD price at VietinBank decreased by 50 VND/USD. However, by noon, the downward trend was more limited. The USD/VND exchange rate "only" decreased by 38 VND/USD to 24,195 VND/USD - 24,615 VND/USD.

Orient Commercial Joint Stock Bank (OCB) is still the unit with the highest USD selling price at 24,743 VND/USD. The USD/VND exchange rate at OCB is traded at: 24,273 - 24,743, down 10 VND/USD compared to the end of yesterday.

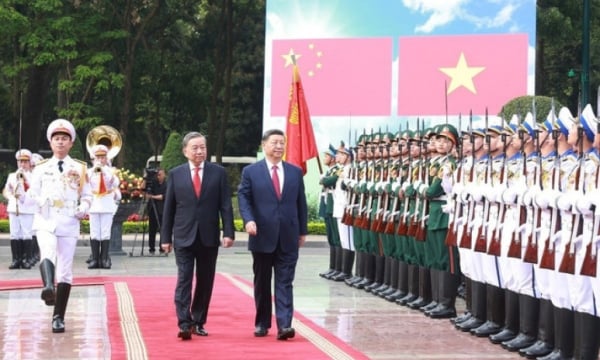

While the gold price increased sharply, reaching a peak of 70 million VND/tael, the USD/VND exchange rate dropped shockingly, in some places losing up to 38 VND/USD. Illustrative photo

At the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), the exchange rate is listed at: 24,295 VND/USD - 24,595 VND/USD, down 5 VND/USD. Vietnam Technological and Commercial Joint Stock Bank (Techcombank) listed the exchange rate at: 24,268 VND/USD - 24,605 VND/USD,

Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) is one of the units that went against the market. The USD/VND exchange rate at Vietcombank was adjusted up 5 VND/USD to 24,240 VND/USD - 24,610 VND/USD, down 5 VND/USD.

In the free market, the greenback is more stable. At Hang Bac and Ha Trung – the “foreign currency streets” of Hanoi, the USD/VND exchange rate is traded at: 24,550 VND/USD – 24,620 VND/USD, not much different from yesterday. At other shops, the difference is about 10 VND/USD.

It can be seen that the gap between the USD price in the banking market and the free market is getting shorter and shorter. Previously, the USD price in the “black market” was often lower than in the bank. However, currently, the two markets are equivalent.

USD hits 2-week low in Asian markets

The dollar hit a two-week low on Thursday after minutes from the Federal Reserve's last meeting showed policymakers were taking a cautious stance and as investors awaited key inflation data.

The dollar index, which measures the U.S. currency against six rivals, traded at 105.67, not far from 105.55, its lowest since Sept. 25, touched on Wednesday. The index fell 0.4% for the week.

In recent comments, Fed officials have cited rising bond yields as a factor that could allow them to end their rate-hike cycle.

Also adding to the cautious mood was a mixed report on US producer prices, which rose more than expected in September amid rising energy and food costs. But underlying inflation pressures at the factory gate continued to ease.

“This PPI data is a reminder that the last leg of the fight against inflation will be a difficult one,” said Ryan Brandham, head of global capital markets, North America at Validus Risk Management.

The report comes ahead of the release of September consumer price index data, which is expected to show inflation moderated last month.

The surprise impact on inflation could support the case that the Fed ends its tightening cycle, which could push down US bond yields and the dollar, said Carol Kong, a currency strategist at Commonwealth Bank of Australia.

“On the other hand, a bullish surprise would likely encourage the market to reprice higher, potentially prompting the Federal Open Market Committee to deliver on its expected 25 basis point hike.”

According to the CME FedWatch tool, futures markets are pricing in a 26% chance of a 25 basis point hike at the December meeting and a 9% chance of a 25 basis point hike at the November meeting.

The recent weakness in the dollar has been due to Treasury yields falling as bond prices have risen on the Fed's more dovish stance on future rate hikes. Bond yields move inversely to their prices.

The yield on the 10-year Treasury note fell 3.5 basis points to 4.562%.

The euro was up 0.03% at $1.062, after hitting a more than two-week high on Wednesday.

Two influential European Central Bank policymakers said on Wednesday that the central bank has made progress in bringing inflation back to target, but new shocks could still force the bank to resume its currently paused tightening cycle.

The Japanese yen rose 0.03% to 149.11 per dollar, while sterling last traded at $1.2311, unchanged on the day.

The Australian dollar rose 0.05% to $0.642, while the kiwi fell 0.03% to $0.602.

Source

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

Comment (0)