However, experts say that if current economic conditions do not change, with rising uncertainty due to the wave of US tariffs, gold prices will continue to rise in the coming months. In this situation, if gold prices fall sharply in the short term, it will be an opportunity for investors to buy.

|

| Experts say gold is still a safe haven for many investors amid economic uncertainty due to the wave of US tariffs. Photo: Reuters |

Gold prices plunged in trading on April 4, erasing gains from earlier in the week, as investors sold off to offset losses in collapsing global stock markets due to the escalating trade war.

Spot gold fell 2.9% to $3,024.20 an ounce, after hitting a session low of $3,015.29 an ounce. Meanwhile, gold futures in New York fell 2.8% to $3,035.40 an ounce.

Gold is a highly liquid asset, often used to meet margin calls on other assets, explained Suki Cooper, an analyst at Standard Chartered Bank.

“So given the role gold plays in a portfolio, it is not unusual for gold to sell off during a risk event,” she said.

Global stocks fell for a second straight day, with the S&P 500 and Nasdaq Composite on Wall Street both down about 5% after China announced a 34% tariff on all US goods, effective April 10, in response to President Donald Trump's reciprocal tariffs.

On the same day, Fed Chairman Jerome Powell said that Mr. Trump's new tariffs were larger than expected, which could lead to consequences for the US economy, including higher inflation and slower growth.

“We will wait for further clarity before considering any adjustments to the policy stance. It is too early to say which path monetary policy will take,” he said.

Data from the US Department of Labor on April 4 also showed that the number of non-agricultural jobs in the US in March increased by 228,000, higher than the forecast of 140,000.

The latest jobs data will keep the Fed on hold for another rate cut, according to Alex Ebkarian, CEO of Allegiance Gold. Gold tends to rally in a low-interest-rate environment. Higher interest rates increase the opportunity cost of holding gold.

Still, gold prices are up about 15.3% this year, helped by strong central bank buying and the metal's appeal as a safe haven against economic and geopolitical uncertainty.

“Despite the volatility, gold remains a safe haven for many investors,” said Matt Simpson, senior analyst at City Index.

CBS News financial commentator Matt Richardson said that if the recent trend in gold prices is a reliable indicator and current economic conditions do not change, gold prices are unlikely to decline in the coming months.

Gold prices experienced a slight correction in November after breaking a record high of $2,700 an ounce in October. However, they recovered fairly quickly and hit new highs this year. According to Richardson, gold prices can fall in relatively small bursts during a bull cycle, so waiting for a sharp drop before buying is not a good idea.

Gold prices tend to rise in high inflation environments. If US inflation picks up again due to the impact of tariffs, gold could easily enter a new bull market.

In addition, investors' need to diversify their assets will increase amid stock market volatility and concerns about economic recession. Gold and precious metals are often chosen for this need because of their stable value, even when assets such as stocks and bonds fluctuate.

Some analysts warn that gold prices could retest support at $2,800 an ounce. But a sharp fall in gold prices could attract new investors.

HSBC Bank predicts that if gold prices correct sharply, falling near or below $2,700/dollar, central banks will increase purchases.

Goldman Sachs also sees the recent decline in gold prices and potential future price moves as buying opportunities, saying the decline is due to short-term technical factors, including liquidation of positions to offset losses in the stock market.

The sell-off came after the US announced reciprocal tariffs on all trading partners, which Goldman Sachs believes will hit global growth and bolster demand for defensive assets like gold.

“We maintain our year-end gold price forecast of $3,300/oz. We continue to see more upside potential for gold than we currently expect,” the analysts wrote in a report.

( According to thesaigontimes.vn )

Source: https://baoapbac.vn/kinh-te/202504/gia-vang-giam-manh-co-hoi-de-mua-vao-1038961/

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

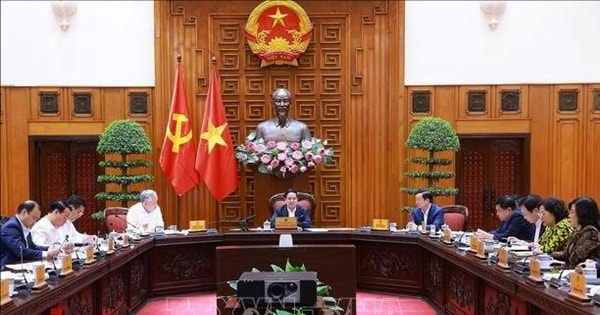

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)