Wall Street analysts fear the gold sell-off may not be over yet, after the precious metal posted its biggest weekly decline in three months.

Gold just had its worst week since early February. Gold futures for June delivery fell from above $2,013 at the start of the week to $1,964 late last week, their highest in more than three months.

One reason is the rising USD. The greenback has been strong thanks to stable US macro data, which has forced the market to re-evaluate expectations of interest rate hikes from the US Federal Reserve (Fed). The CME FedWatch tool shows a 44% chance that the Fed will raise interest rates by another 25 basis points at its June meeting. Previously, almost the entire market predicted that the agency would pause interest rate hikes.

Some Fed leaders have also resisted the idea of pausing rate hikes next month, and markets have begun to reverse bets that the central bank will cut rates by year-end.

“Rising interest rates and a stronger US dollar have dragged gold lower,” said Marc Chandler, managing director at Bannockburn Global Forex. “The greenback’s stability, after key resistance levels held, has helped gold stabilize at the end of the week.”

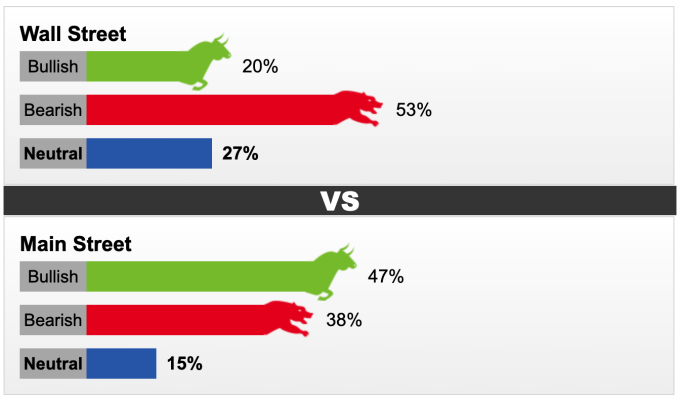

With this development, analysts are leaning towards a bearish trend for gold next week. Of the 15 Wall Street analysts participating in the Kitco survey, 53% predict gold will have another week of declines. Only 20% of the experts surveyed are optimistic, while 27% are neutral.

For individual investors, bullish expectations for gold remain dominant but not as dominant as in previous weeks. Of the more than 900 investors surveyed, 47% expect gold to close next week in the green, 38% expect the precious metal to fall and 15% expect the market to remain flat.

Kitco's gold price forecast for the week of May 22-26. Photo: Kitco News

According to Chandler, resistance on the gold price chart is first at $1,979 and then at $1,987 per ounce. However, momentum indicators — technical analysis indicators that reflect trends and price changes — are showing that the market is likely to face another decline, in which case gold could fall back to the $1,936 per ounce area.

Michael Moor, founder of Moor Analytics, also said gold could come under further pressure next week, after the precious metal has fallen more than $100 since its peak of $2,060 two weeks ago.

Adrian Day, CEO and chairman of Adrian Day Asset Management, sees progress in resolving the U.S. debt ceiling debate as another short-term headwind for gold. However, he notes that the long-term trend for the precious metal remains bullish.

“Central banks will find that they cannot achieve their inflation targets by raising interest rates without causing serious damage to the economy and the financial system,” Adrian Day commented.

Minh Son ( according to Kitco )

Source link

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

Comment (0)