Domestic gold price today April 11, 2025

At the time of survey at 11:30 on April 11, 2025, the domestic gold price increased to an all-time high of more than 106 million VND/tael. Specifically:

DOJI Group listed the price of SJC gold bars at 103.4-106.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 103.4-106.4 million VND/tael (buy - sell), an increase of 2.8 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 103-104.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 2.3 million VND/tael for buying and 1.8 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited was traded by the enterprise at 103.4-106.4 million VND/tael (buying - selling), an increase of 2.8 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 102.9-106.4 million VND/tael (buy - sell), gold price increased by 2.9 million VND/tael in buying direction - increased by 2.8 million VND/tael in selling direction compared to yesterday.

As of 11:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 101.4-105 million VND/tael (buy - sell); an increase of 1.2 million VND/tael in the buying direction - an increase of 1.8 million VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 103.5-106.4 million VND/tael (buy - sell); increased by 2.8 million VND/tael for buying - increased by 2.7 million VND/tael for selling.

The latest gold price list today, April 11, 2025 is as follows:

| Gold price today | April 11, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 103.4 | 106.4 | +2800 | +2800 |

| DOJI Group | 103.4 | 106.4 | +2800 | +2800 |

| Red Eyelashes | 103 | 104.5 | +2300 | +1800 |

| PNJ | 103.4 | 106.4 | +2800 | +2800 |

| Vietinbank Gold | 106.4 | +2800 | ||

| Bao Tin Minh Chau | 103.4 | 106.4 | +2800 | +2800 |

| Phu Quy | 102.9 | 106.4 | +2900 | +2800 |

| 1. DOJI - Updated: April 11, 2025 11:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 103,400 ▲2800K | 106,400 ▲2800K |

| AVPL/SJC HCM | 103,400 ▲2800K | 106,400 ▲2800K |

| AVPL/SJC DN | 103,400 ▲2800K | 106,400 ▲2800K |

| Raw material 9999 - HN | 101,200 ▲1200K | 104,100 ▲1800K |

| Raw material 999 - HN | 101,100 ▲1200K | 104,000 ▲1800K |

| 2. PNJ - Updated: April 11, 2025 11:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 101,900 ▲2000K | 105,100 ▲2200K |

| HCMC - SJC | 103,400 ▲2800K | 106,400 ▲2800K |

| Hanoi - PNJ | 101,900 ▲2000K | 105,100 ▲2200K |

| Hanoi - SJC | 103,400 ▲2800K | 106,400 ▲2800K |

| Da Nang - PNJ | 101,900 ▲2000K | 105,100 ▲2200K |

| Da Nang - SJC | 103,400 ▲2800K | 106,400 ▲2800K |

| Western Region - PNJ | 101,900 ▲2000K | 105,100 ▲2200K |

| Western Region - SJC | 103,400 ▲2800K | 106,400 ▲2800K |

| Jewelry gold price - PNJ | 101,900 ▲2000K | 105,100 ▲2200K |

| Jewelry gold price - SJC | 103,400 ▲2800K | 106,400 ▲2800K |

| Jewelry gold price - Southeast | PNJ | 101,900 ▲2000K |

| Jewelry gold price - SJC | 103,400 ▲2800K | 106,400 ▲2800K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 101,900 ▲2000K |

| Jewelry gold price - Kim Bao Gold 999.9 | 101,900 ▲2000K | 105,100 ▲2200K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 101,900 ▲2000K | 105,100 ▲2200K |

| Jewelry gold price - Jewelry gold 999.9 | 101,900 ▲2000K | 104,400 ▲2000K |

| Jewelry gold price - Jewelry gold 999 | 101,800 ▲2000K | 104,300 ▲2000K |

| Jewelry gold price - Jewelry gold 9920 | 101,170 ▲1990K | 103,670 ▲1990K |

| Jewelry gold price - Jewelry gold 99 | 100,960 ▲1980K | 103,460 ▲1980K |

| Jewelry gold price - 750 gold (18K) | 75,950 ▲1500K | 78,450 ▲1500K |

| Jewelry gold price - 585 gold (14K) | 58,720 ▲1170K | 61,220 ▲1170K |

| Jewelry gold price - 416 gold (10K) | 41,080 ▲830K | 43,580 ▲830K |

| Jewelry gold price - 916 gold (22K) | 93,230 ▲1830K | 95,730 ▲1830K |

| Jewelry gold price - 610 gold (14.6K) | 61,330 ▲1220K | 63,830 ▲1220K |

| Jewelry gold price - 650 gold (15.6K) | 65,510 ▲1300K | 68,010 ▲1300K |

| Jewelry gold price - 680 gold (16.3K) | 68,640 ▲1360K | 71,140 ▲1360K |

| Jewelry gold price - 375 gold (9K) | 36,800 ▲750K | 39,300 ▲750K |

| Jewelry gold price - 333 gold (8K) | 32,100 ▲660K | 34,600 ▲660K |

| 3. SJC - Updated: 11/4/2025 11:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 103,400 ▲2800K | 106,400 ▲2800K |

| SJC gold 5 chi | 103,400 ▲2800K | 106,420 ▲2800K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 103,400 ▲2800K | 106,430 ▲2800K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 102,400 ▲2600K | 105,400 ▲2600K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 102,400 ▲2600K | 105,500 ▲2600K |

| Jewelry 99.99% | 102,400 ▲2600K | 105,100 ▲2600K |

| Jewelry 99% | 100,559 ▲2074K | 104,059 ▲2574K |

| Jewelry 68% | 68,125 ▲1268K | 71,625 ▲1768K |

| Jewelry 41.7% | 40,481 ▲584K | 43,981 ▲1084K |

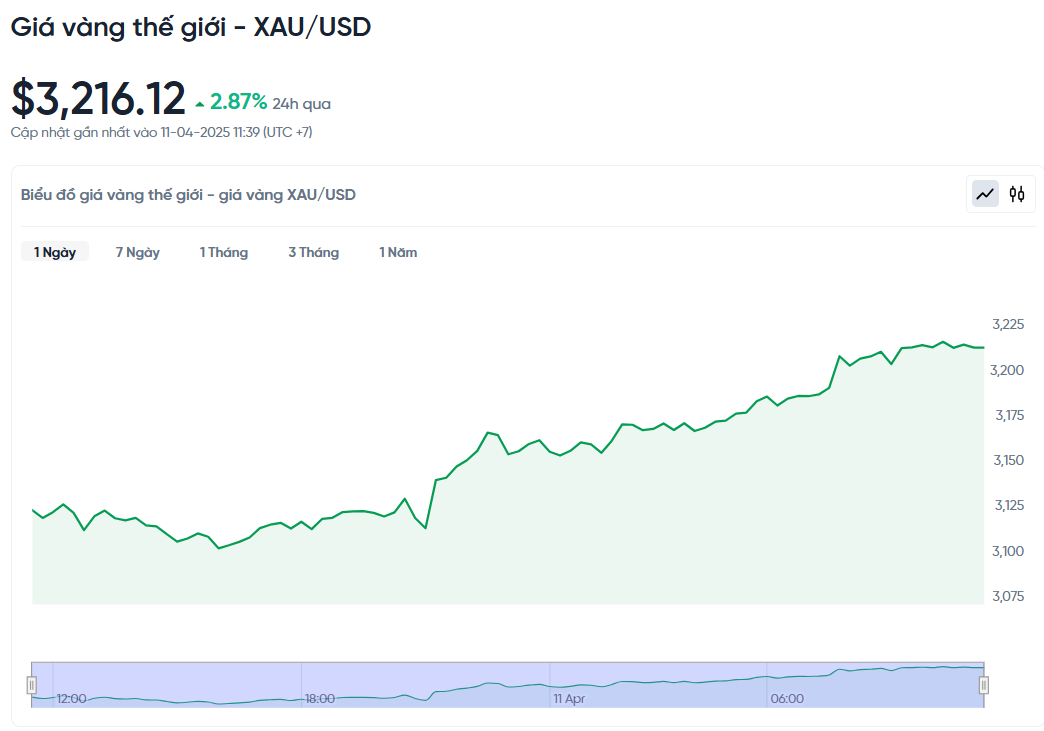

World gold price today April 11, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,216.12 USD/ounce. Today's gold price increased by 89.66 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (25,880 VND/USD), the world gold price is about 101.4 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 5 million VND/tael higher than the international gold price.

The world gold price has surpassed the important threshold of 3,200 USD/ounce for the first time, thanks to the weakening USD and escalating trade tensions causing investors to rush to safe assets. The world gold price increased by nearly 6% this week. Meanwhile, the price of gold futures in the US also increased by 1.9%, to 3,237.5 USD.

The main reason for the sharp rise in gold prices is the rapid depreciation of the US dollar, reflecting the fact that many investors are withdrawing from US dollar-denominated assets, including stocks and bonds, due to concerns about unclear tariff policies, according to Ilya Spivak, an analyst at Tastylive.

The dollar fell nearly 1% against major currencies, making gold cheaper for foreign investors. Major stock indexes also fell after US President Donald Trump raised tariffs on Chinese imports to 145% but delayed tariffs on a range of other countries for 90 days.

China has also responded by raising tariffs on US imports, raising concerns that Beijing could push the tariffs beyond the current 84%.

Capital.com's Kyle Rodda said that $3,500 an ounce could be the market's next target, but reaching that level won't be easy and there could be plenty of volatility along the way.

In addition to tariffs, gold prices are also supported by strong buying demand from central banks, expectations that the US Federal Reserve (Fed) will cut interest rates, geopolitical instability in the Middle East and Europe, and money flowing into gold ETFs.

The latest data showed that US consumer prices unexpectedly fell in March, but inflation risks remain elevated. Investors now expect the Fed to start cutting rates in June and could cut them by a total of 1 percentage point by the end of 2025.

Besides gold, silver prices rose slightly by 0.3% to $31.29 an ounce, while platinum fell by 0.1% to $936.85. Palladium also rose by 0.8% to $916.18.

Gold Price Forecast

More and more traders believe the US Federal Reserve will cut interest rates in May, with the probability reaching 55%, according to the FedWatch tracker.

If this happens, it would create favorable conditions for gold prices to rise further, as low interest rates typically make the precious metal more attractive relative to other yielding assets.

Gold is being viewed as a hedge against uncertainty, especially as tariff tensions could add to inflationary pressures and push bond yields higher, said TD Securities expert Bart Melek.

He also warned that if the trade war drags on, the US dollar could gradually lose its central role in the global trading system, which would further strengthen gold's position.

Nikos Tzabouras, senior market analyst at Tradu.com, said that gold is regaining its image as a safe haven amid volatile markets. He said that the upward trend is still strong and does not rule out the possibility that gold will set new price peaks in the near future.

However, Tzabouras also noted that if the US reaches trade agreements with its partners, the appeal of gold could decline. Additionally, if the Fed cuts interest rates but the US dollar recovers strongly, this could put pressure on gold prices again.

WisdomTree commodity strategist Nitesh Shah stressed that the world is entering a period of uncertainty with unpredictable developments in the trade war.

He predicts that gold prices could continue to rise and reach $3,600 an ounce within the next year. In a worse case scenario, if risks continue to increase, gold prices could reach $4,000 an ounce.

Source: https://baonghean.vn/cap-nhat-gia-vang-hom-nay-11-4-2025-gia-vang-trong-nuoc-va-the-gioi-co-dinh-ky-luc-moi-10294890.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)