| Gold prices plummeted, 999.9 gold rings dropped to 76.58 million VND/tael, yesterday's buyers lost 2 million. Gold prices fluctuated, SJC gold increased slightly, 999.9 gold rings dropped to 76.50 million VND/tael. |

Gold price domestic

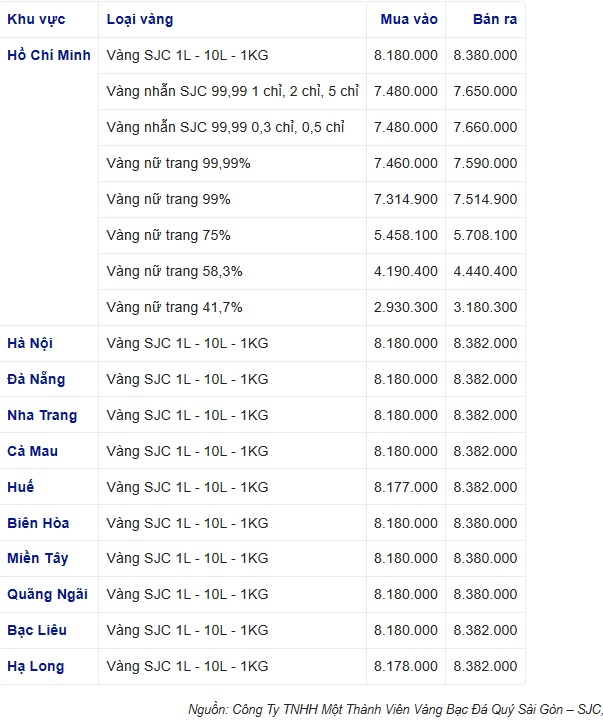

At noon on April 15, the price of SJC gold turned around and increased sharply after two sessions of decline. Currently, the price of SJC gold at Saigon Jewelry Company in Ho Chi Minh City is trading around 81.80 - 83.80 million VND/tael, an increase of 100 thousand VND/tael for buying and 100 thousand VND/tael for selling compared to yesterday. The difference between buying and selling is 2 million VND/tael.

|

The price at Saigon Jewelry Company in Hanoi is around 81.80 - 83.82 million VND/tael, an increase of 100 thousand VND/tael for buying and 100 thousand VND/tael for selling compared to yesterday. The difference between buying and selling is 2 million VND/tael.

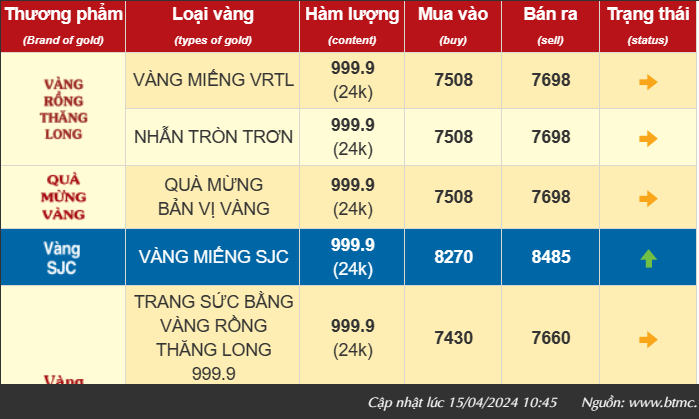

The price of SJC gold bars at Bao Tin Minh Chau Company is trading around 82.70 - 84.85 million VND/tael, an increase of 1.4 million VND/tael for buying and a sharp increase of 1.7 million VND/tael for selling compared to yesterday.

At Phu Quy Group, the price of SJC gold bars is currently trading around 82.80 - 85.30 million VND/tael for buying and selling, an increase of 1.9 million VND/tael for buying and an increase of 1.9 million VND/tael for selling compared to yesterday.

The price of SJC gold bars at Bao Tin Manh Hai Company is trading around 82.70 - 84.85 million VND/tael, an increase of 1.7 million VND/tael for buying and 2 million VND/tael for selling compared to the previous session.

|

Along with the price of SJC gold, the price of 999.9 gold rings today also increased sharply. Specifically, the price of 999.9 gold rings (24k), the price of Thang Long gold dragon gold bars, and plain round rings at Bao Tin Minh Chau Company is trading at 75.08 - 76.98 million VND/tael for buying - selling, an increase of 900 thousand VND/tael for buying and an increase of 900 thousand VND/tael for selling compared to yesterday. Thang Long 999.9 gold dragon jewelry (24k) is trading around 74.30 - 76.60 million VND/tael, an increase of 900 thousand VND/tael for buying and an increase of 900 thousand VND/tael for selling compared to yesterday.

Similarly, Thang Long Gold Dragon blister rings and Kim Gia Bao blister rings of Bao Tin Manh Hai Company are trading around 75.08 - 76.98 million VND/tael for buying and selling, an increase of 900 thousand VND/tael for buying and an increase of 900 thousand VND/tael for selling compared to yesterday.

|

| Gold price traded at Bao Tin Manh Hai |

The price of 999.9 gold is around 74.40 - 76.60 million VND/tael, an increase of 900 thousand VND/tael for buying and 900 thousand VND/tael for selling compared to yesterday's session. The price of 99.9 gold is currently around 74.30 - 76.50 million VND/tael, an increase of 900 thousand VND/tael for buying and 900 thousand VND/tael for selling compared to yesterday's session.

At Phu Quy Group, Phu Quy 999.9 round rings and Phu Quy 999.9 God of Wealth rings are trading around 75.50 - 77.30 million VND/tael, an increase of 800 thousand VND/tael for buying and an increase of 800 thousand VND/tael for selling compared to yesterday.

|

| Gold price traded at Phu Quy Group |

24K 999.9 gold is trading around 74.40 - 76.40 million VND/tael, up 500 thousand VND/tael for buying and 500 thousand VND/tael for selling compared to yesterday.

World gold price

At noon on April 15, the world gold price on Kitco was trading around 2,358 USD/ounce. Compared to the converted world gold price, the retail price of SJC gold bars is 12.2 million VND/tael higher, while the price of gold rings is 5.2 million VND/tael higher.

|

| World gold price chart this afternoon |

Gold's rally is being somewhat hampered by the prospect of the US Federal Reserve keeping interest rates higher for longer as US inflation is hotter than expected, as well as the rising trend of the US dollar and US Treasury yields.

Along with gold, investors are buying the US dollar to hedge against geopolitical risks. Last week, the Dollar Index rose 1.7%, its strongest weekly gain since September 2022.

Although gold failed to hold above $2,400 an ounce, analysts noted that gold remained relatively strong. Specifically, the market began to price in the possibility of a rate cut in June after March inflation was higher than expected. According to CME, the market sees only a 27% chance of the Fed cutting rates in June, down from 50% last week and 68% a month ago.

However, analysts note that while the Fed may delay the start of its easing cycle, it is unlikely to raise interest rates again, which means real interest rates could still fall – a positive environment for gold.

Some of the data that will impact gold prices this week include regional manufacturing data, March retail sales and housing. Fed Chairman Jerome Powell will also speak next week in a discussion with Bank of Canada Governor Tiff Macklem. Other data on the market include weekly jobless claims and the New York Fed’s Empire State survey.

Source

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

Comment (0)