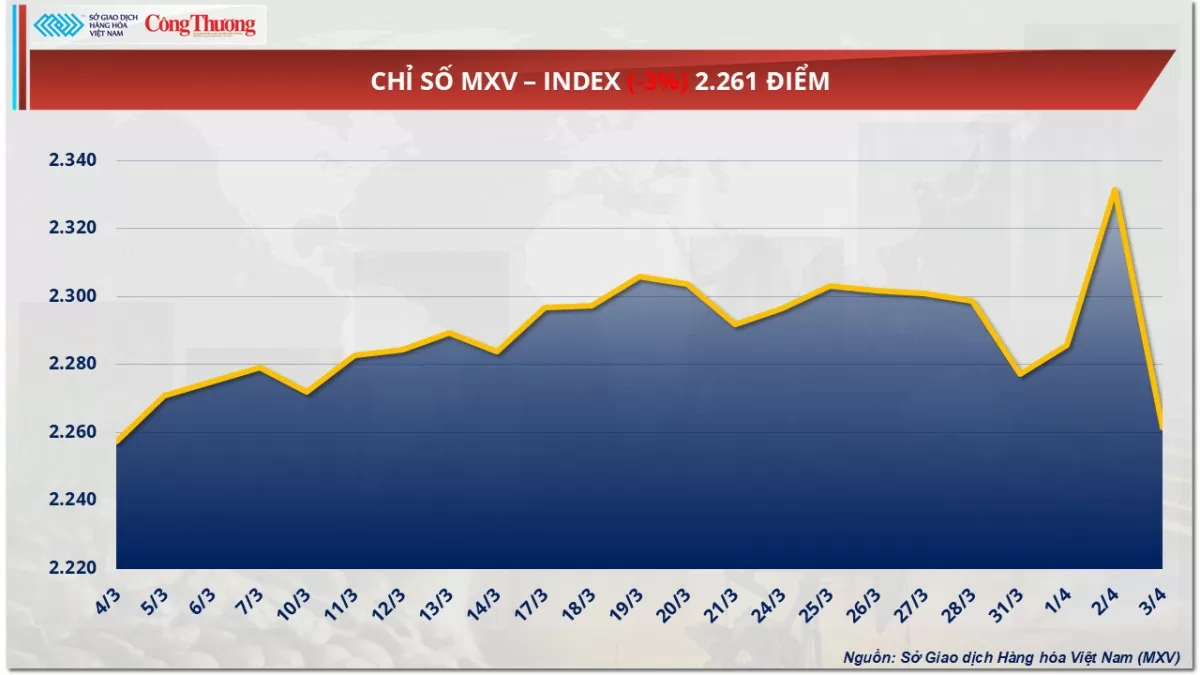

The Vietnam Commodity Exchange (MXV) said the world raw material market reacted strongly after US President Donald Trump announced the reciprocal tax policy. The price board was flooded with red, the overwhelming selling pressure pushed the MXV-Index down 3% to 2,261 points. After only one session above the 2,300 point zone, this event pushed the commodity price index to its lowest level since early March.

MXV-Index |

World crude oil prices fall nearly 7%

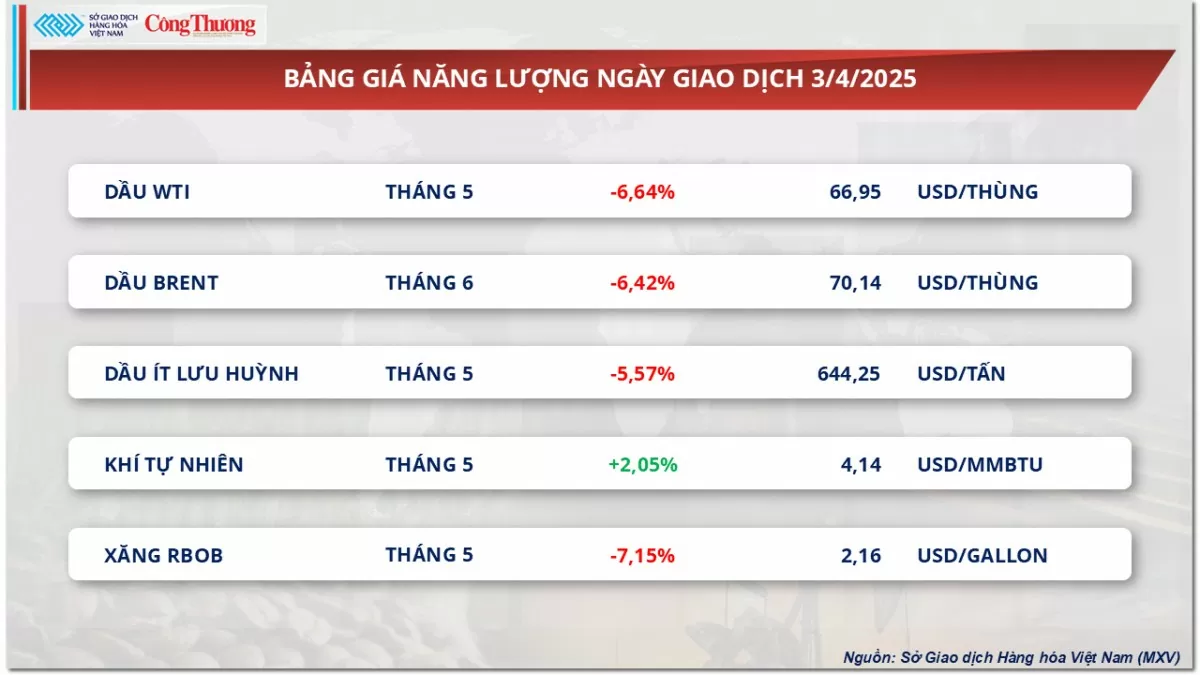

According to MXV, pressure was heavy on the energy market yesterday when 4 out of 5 commodities fell sharply. In particular, oil prices plummeted after Mr. Trump announced the imposition of reciprocal tariffs on more than 180 countries and territories. In addition, OPEC+'s May oil production plan continued to "add fuel to the fire", causing the crude oil market to slide in yesterday's trading session.

At the end of the session, Brent and WTI oil prices lost 6.42% and 6.64% to $70.14/barrel and $66.95/barrel, respectively. This is the deepest decline for Brent oil prices since August 1, 2022, and for WTI oil prices since July 11, 2022.

Energy price list |

World oil prices have really reacted strongly when the US launched reciprocal tariffs. The massive plan with a list of 185 economies is said to be worse than previous predictions in the market.

Escalating trade tensions have raised market concerns about the prospect of a serious decline in global oil demand in the coming time.

In addition, in the latest developments, OPEC+ unexpectedly increased oil production in May. The initial plan put the increase at 135,000 barrels/day. However, after an online meeting between representatives of eight countries yesterday, OPEC+ gave a new figure of up to 411,000 barrels/day.

According to OPEC, the sharp increase in production is due to “a solid foundation and positive market outlook” and “the increase in production could be paused or reversed depending on changing market conditions.”

OPEC+’s plans to sharply increase production in May, along with the planned increase in April, have somewhat eased concerns about oil supply shortages due to US sanctions targeting crude exports from Iran and Venezuela. However, according to MXV, global trade tensions remain a major risk factor weighing on the energy market in the coming time.

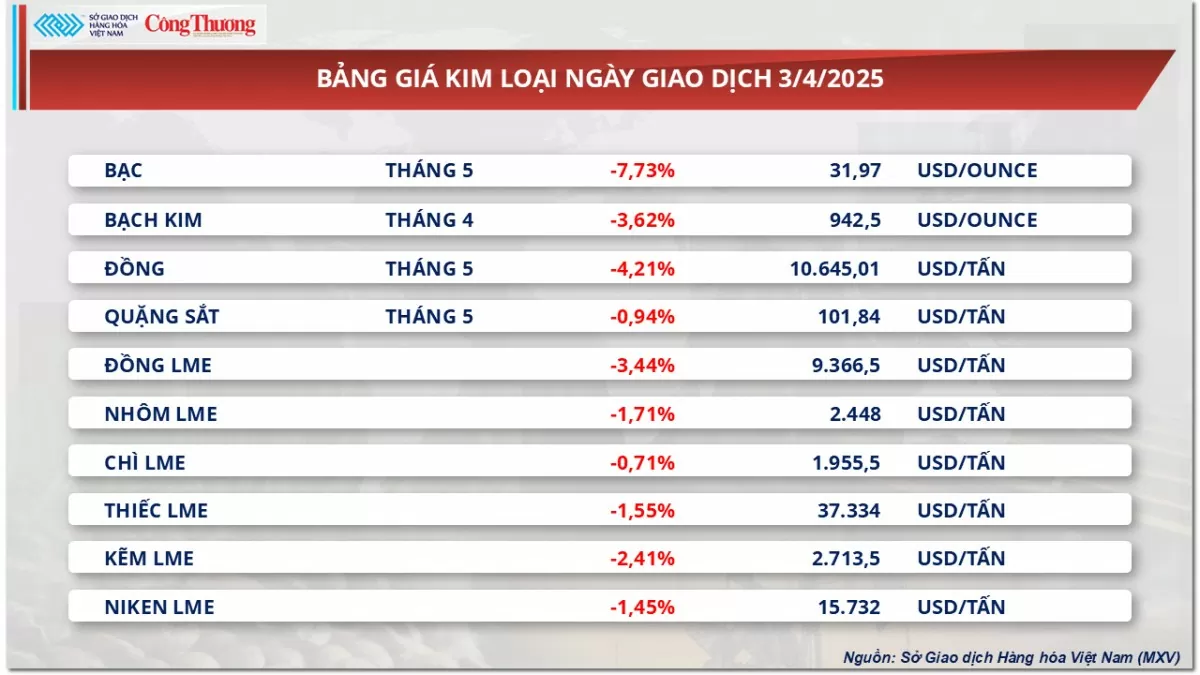

Metal market in red

The entire metal market was in the red in yesterday's trading session with concerns about global economic growth and weakening metal consumption prospects.

In the precious metals market, silver prices plunged 7.73% to $31.97/ounce. Meanwhile, platinum also fell sharply by 3.62% to $942.5/ounce.

Metal price list |

The decision to impose global reciprocal tariffs has sent precious metals markets reeling as investors worry that escalating trade tensions could lead to supply chain disruptions and higher production costs, reducing demand.

Meanwhile, the majority of demand for silver and platinum comes from the industrial manufacturing sector. Specifically, about 60% of silver demand is used in industries such as electrical and electronic equipment and solder alloys; while nearly 70% of platinum demand comes from the automotive and high-tech industries. If the global economy weakens, the consumption outlook for these two metals will be negatively affected, putting further pressure on prices.

The base metals group was also not out of the deep downward trend. COMEX copper prices fell sharply by 4.21% to $10,645/ton, while iron ore extended its decline by another 0.94% to close at $101.84/ton.

Higher-than-expected reciprocal tariffs have eroded global growth expectations, putting significant pressure on copper consumption prospects. According to Citigroup, copper prices could fall another 8-10% in the coming weeks. Notably, although copper is not currently subject to reciprocal tariffs, Washington is investigating the possibility of imposing its own tariffs on the commodity.

In another development, the Indian government has just issued a policy to prioritize the use of domestic steel in public procurements to protect the steel industry from a wave of cheap imports. As the world's second-largest consumer of iron ore, this move by India could increase the global steel supply. In the context of cheap steel from China flooding the market, India's policy is likely to exacerbate the oversupply situation and put downward pressure on input prices such as iron ore.

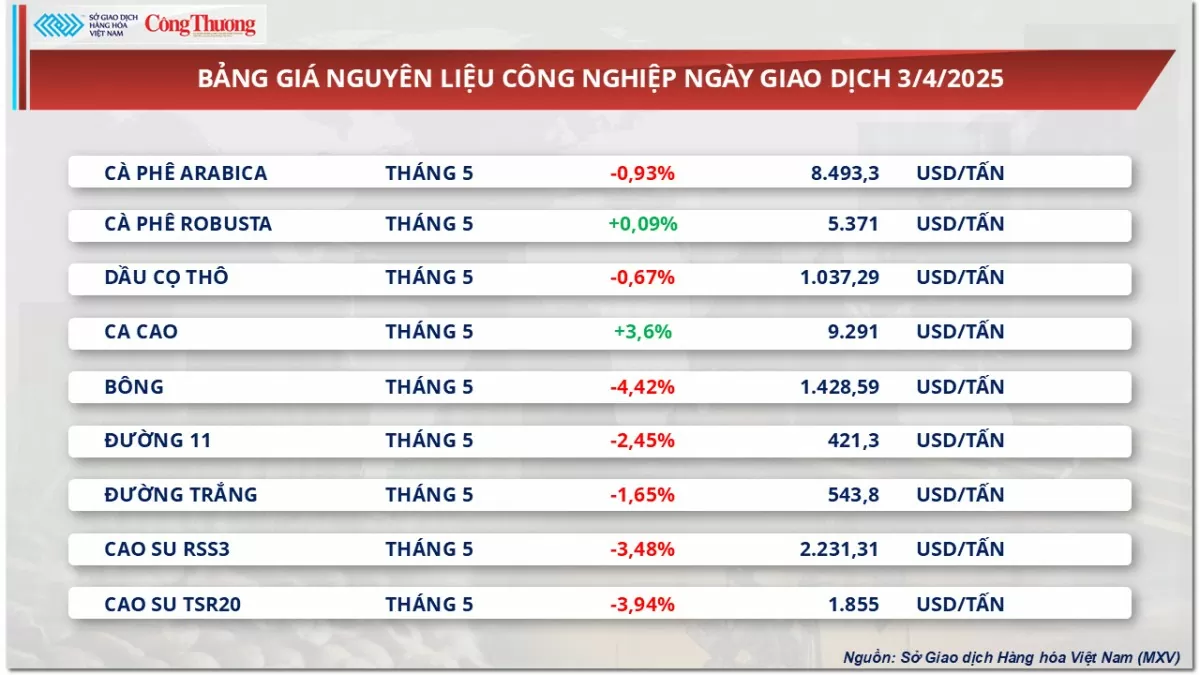

Prices of some other goods

Industrial raw material price list |

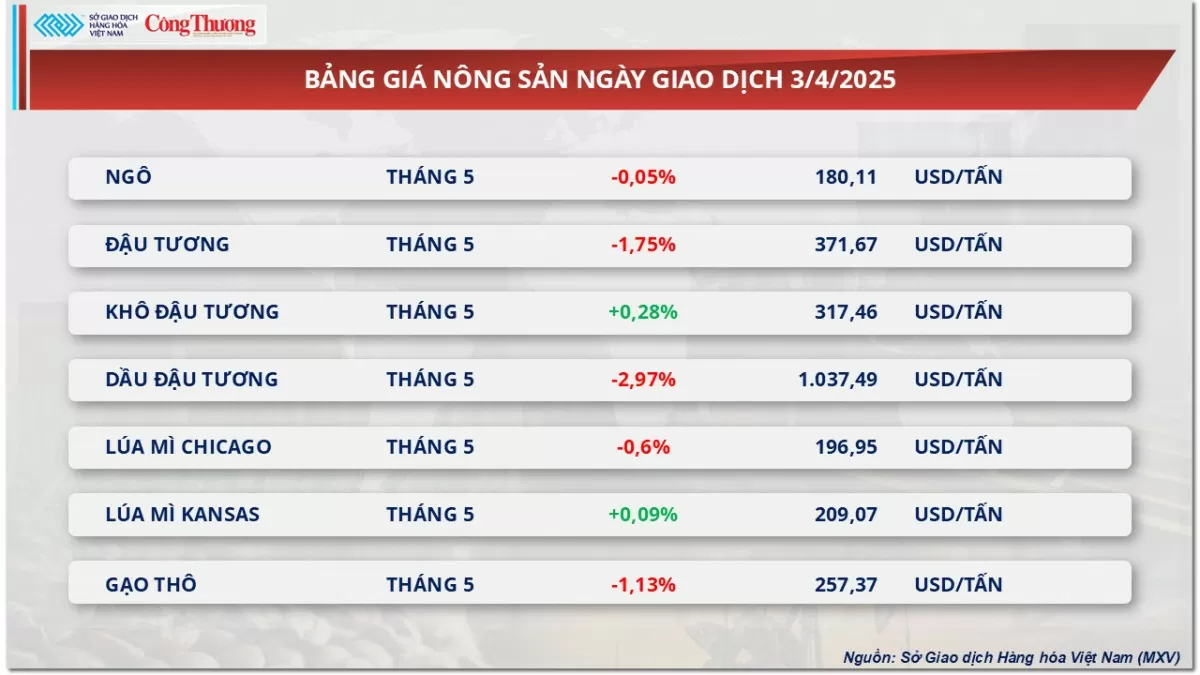

Agricultural product price list |

Ngoc Ngan

Source: https://congthuong.vn/gia-dau-tho-the-gioi-giam-sau-nhat-ke-tu-nam-2022-381445.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)