Arabica coffee prices fell 6.92% to $6,526/ton, the lowest level in a week; Robusta coffee prices fell for a second session, plunging 10.63% to $4,834/ton.

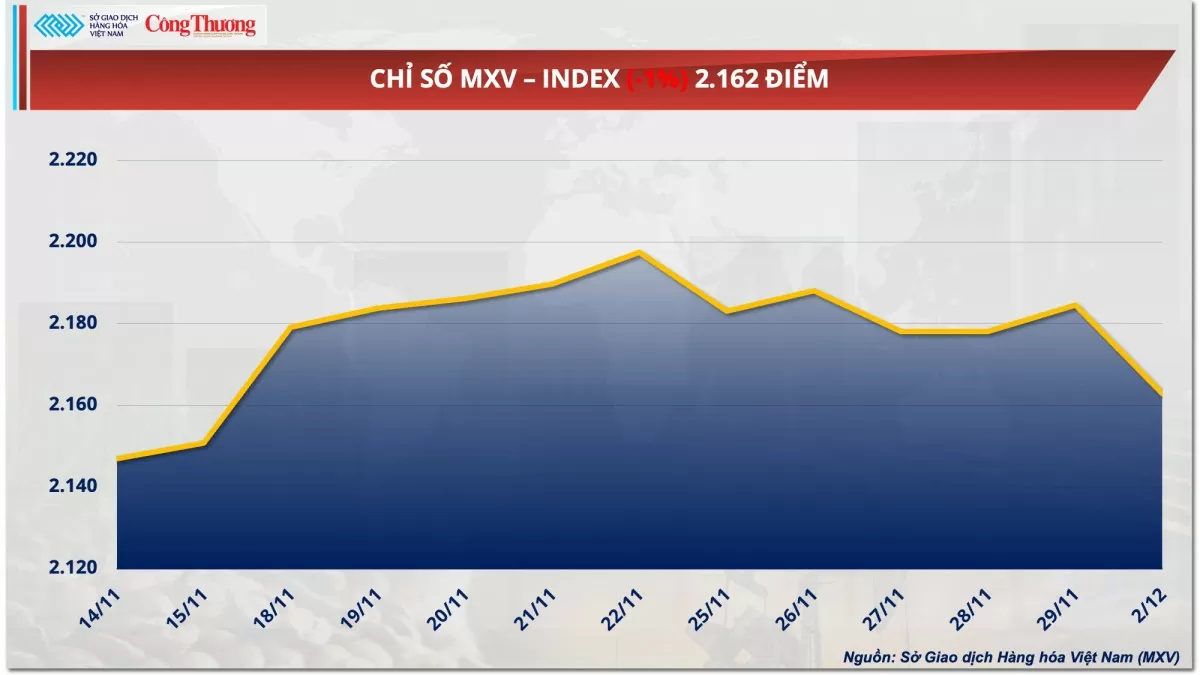

According to the Vietnam Commodity Exchange (MXV), the world raw material market was in the red in the first trading session of the week (December 2). Strong selling pressure pulled the MXV-Index down 1% to 2,162 points. Notably, the industrial raw material group had 7 out of 9 items simultaneously decreasing in price, in which the price of two coffee items dropped shockingly by 7% for Arabica and 10.6% for Robusta. In a similar trend, the prices of most agricultural products also weakened.

|

| MXV-Index |

Robusta coffee prices drop to record low

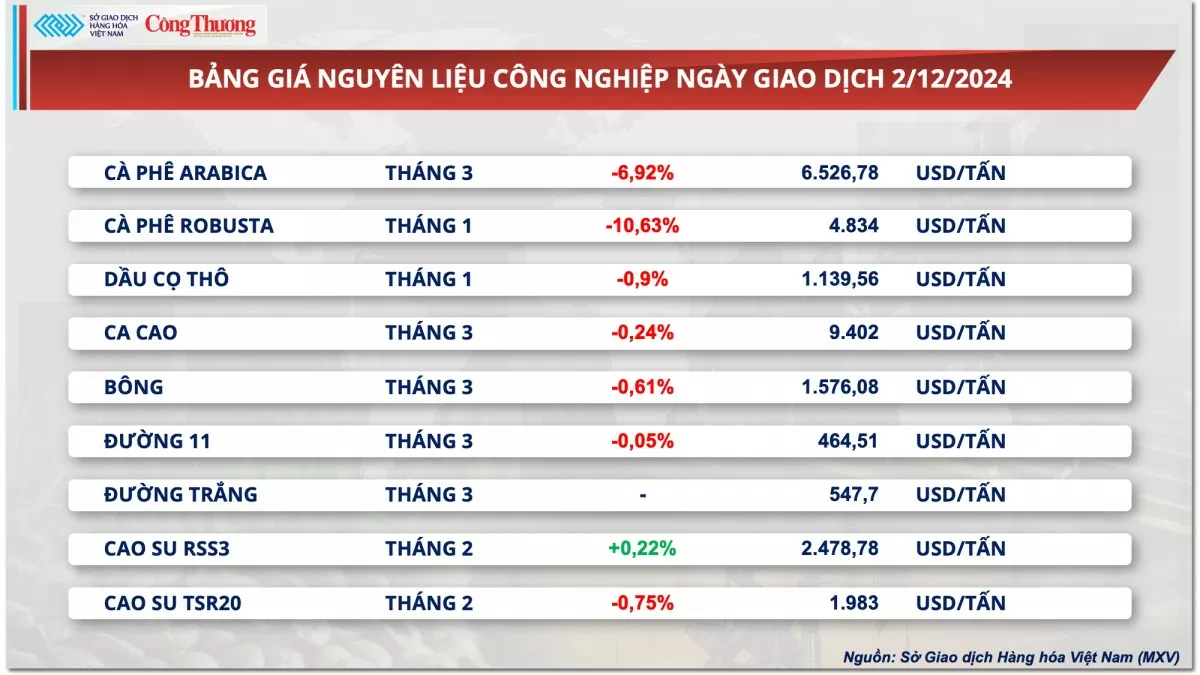

Closing the first trading session of the week, red dominated the price list of industrial raw materials. In particular, two coffee products shocked the market when their prices simultaneously plummeted.

|

| Industrial raw material price list |

Specifically, Arabica coffee prices fell 6.92% to $6,526/ton, the lowest level in a week; Robusta coffee prices fell for the second consecutive session, plunging 10.63% from the reference to $4,834/ton.

The Dollar Index jumped nearly 1% yesterday after Trump tweeted that he would impose a 100% tariff on BRICS countries if they tried to create new currencies to replace the USD. Meanwhile, the Brazilian Real weakened, causing the USD/BRL exchange rate to surge 1.42% to a historic high. The widening gap has fueled concerns that Brazilian farmers will sell their coffee to take advantage. This has pulled money out of the coffee market, causing prices to fall sharply.

Moreover, profit-taking pressure after the correction session at the end of last week increased the pressure, pushing coffee prices to an unprecedented low in a single session. In addition, technical adjustments after the surge also contributed to increasing pressure on prices.

On the fundamental front, the market remains concerned about coffee supplies in major producing countries. The main highlight is the persistently below-average rainfall in Brazil’s main coffee growing region, which has turned the outlook for new crop supply negative. Somar Meteorologia reported that Minas Gerais, Brazil’s largest Arabica coffee growing state, received 17.8 mm of rainfall last week, or 31% of the historical average.

Also concerned about the weather, Hedgepoint Consulting in its global market report forecasts Brazil's coffee output for the 2025-2026 crop year at around 65.2 million bags. Of which, Arabica coffee output is expected to be at 42.6 million 60kg bags, down 1.4% from the previous crop. The company also said its output forecast could change based on the weather conditions in the coming time.

In the domestic market, coffee prices in the Central Highlands and Southeast this morning (December 3) were recorded at 125,800 - 126,500 VND/kg, down 4,000 - 4,300 VND/kg compared to December 2. However, compared to the same period last year, coffee prices have now doubled.

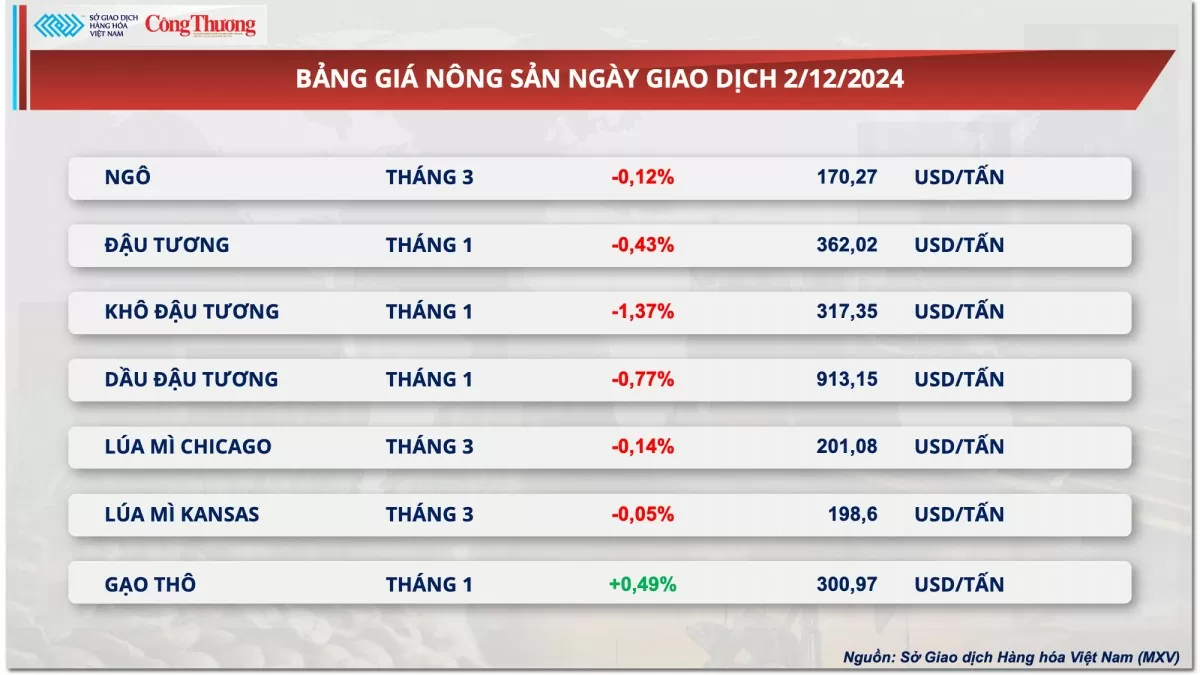

Soybean prices weaken for third consecutive session

Soybean prices fell slightly by 0.43%, marking the third consecutive session of weak close, according to MXV. The market is under pressure due to positive supply prospects from leading South American producers such as Brazil and Argentina.

|

| Agricultural product price list |

Brazil's 2024-25 soybean planting progress reached 91% of the planned area as of November 28, the highest level for that period since 2018, according to a report from consultancy AgRural. Although planting has slowed in the eastern region of Mato Grosso and Triangulo Mineiro due to excessive humidity, AgRural stressed that overall, many soybean areas across the country show very good yield potential. Another consultancy, Céleres, said favorable climatic conditions in Brazil's soybean fields in the 2024-25 season have reinforced expectations of a "bumper crop," with an estimated production of 170.8 million tons. The bumper crop is expected to result in exports of up to 107 million tons, the report said. Such a large volume of transportation will create a higher demand for transportation services, thus, transportation costs are likely to increase during harvest time.

In addition, in the Export Inspections report, the US Department of Agriculture (USDA) said that soybean deliveries in the reporting week reached 2.09 million tons, down from 2.12 million tons in the previous week. Although there was not much change, this still raised concerns that demand for US soybeans has begun to slow down. This is a factor that contributed to the pressure on the market yesterday.

Soybean meal prices fell nearly 1.4%, the biggest decliner among agricultural commodities, also due to the positive supply outlook. The Buenos Aires Grains Exchange said Argentina’s crops were in good condition after recent rainfall added moisture, which also weighed on prices.

In the domestic market, on December 2, the offer price of South American soybean meal to Vietnamese ports increased slightly. At Vung Tau port, the offer price of soybean meal for delivery in January 2025 - February 2025 was VND 10,650/kg. At Cai Lan port, the offer price was about VND 100/kg higher than at Vung Tau port.

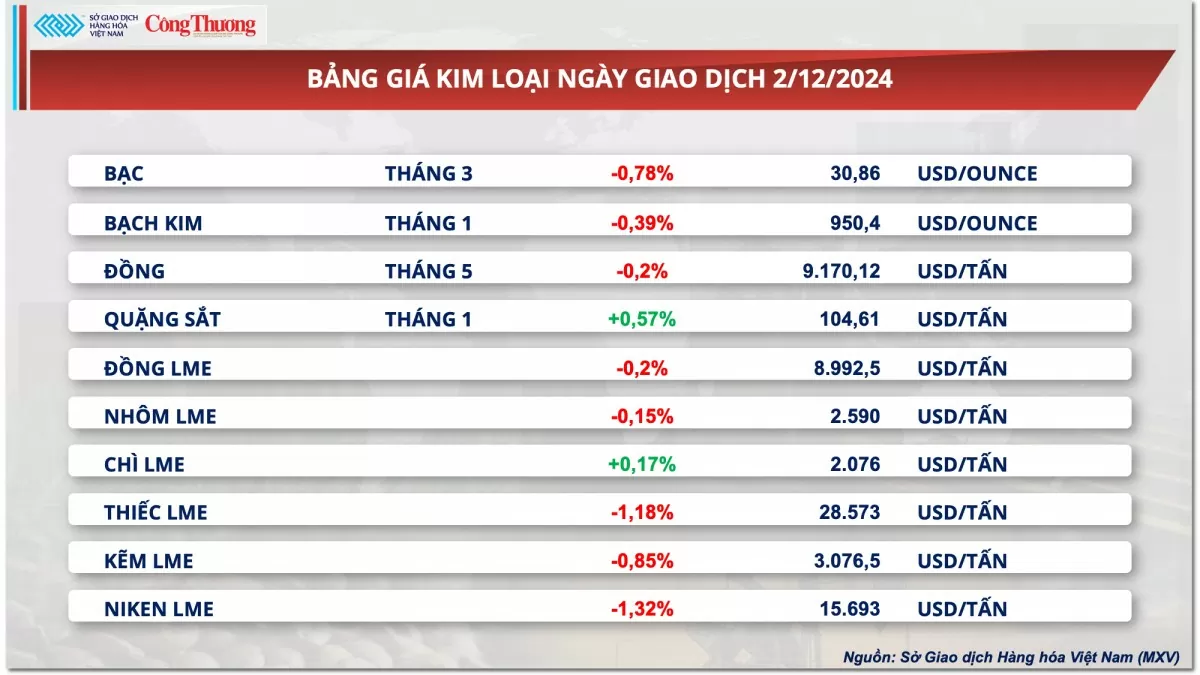

Prices of some other goods

|

| Metal price list |

|

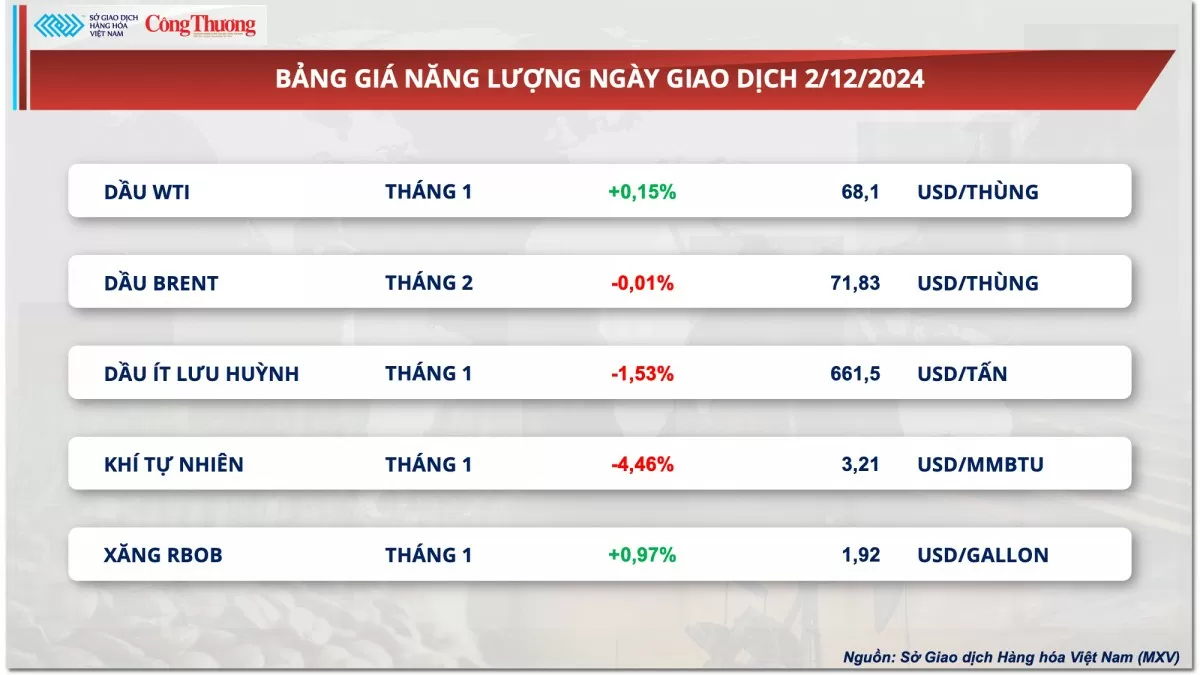

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-312-gia-ca-phe-robusta-giam-sau-ky-luc-362148.html

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Infographic] Diverse activities of the 4th Dong Thap Province Book and Reading Culture Day in 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/a5f00b7d966a475d891f3c3e528c9a66)

Comment (0)