USD exchange rate today 02/07/2025: The USD has increased by 7% since its low in September, approaching a two-year high.

USD exchange rate today 02/07/2025

At the time of survey at 5:00 a.m. on February 7, the central exchange rate at the State Bank was currently 24,425 VND/USD, an increase of 30 VND compared to yesterday's trading session.

Specifically, at Vietcombank, the USD exchange rate is 25,060 - 25,450 VND/USD, an increase of 110 VND for buying and 200 VND for selling compared to yesterday's trading session.

TPB Bank is buying USD cash at the lowest price: 1 USD = 24,390 VND

TPB Bank is buying USD transfers at the lowest price: 1 USD = 24,430 VND

VietinBank is buying USD cash at the highest price: 1 USD = 25,190 VND

VietinBank is buying USD transfers at the highest price: 1 USD = 25,549 VND

TPB Bank is selling USD cash at the lowest price: 1 USD = 24,870 VND

HSBC Bank is selling USD transfers at the lowest price: 1 USD = 25,283 VND

Saigonbank is selling USD cash at the highest price: 1 USD = 25,646 VND

MB Bank is selling USD transfers at the highest price: 1 USD = 25,575 VND

|

| USD exchange rate at some banks today. Source Webgia.com |

| 1. Agribank - Updated: February 7, 2025 05:30 - Time of website source supply | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,050 | 25,070 | 25,410 |

| EUR | EUR | 25,709 | 25,812 | 26,899 |

| GBP | GBP | 30,926 | 31,050 | 32,031 |

| HKD | HKD | 3,176 | 3,189 | 3,295 |

| CHF | CHF | 27,429 | 27,539 | 28,418 |

| JPY | JPY | 161.85 | 162.50 | 169.76 |

| AUD | AUD | 15,515 | 15,577 | 16,093 |

| SGD | SGD | 18,358 | 18,432 | 18,961 |

| THB | THB | 731 | 734 | 766 |

| CAD | CAD | 17,293 | 17,362 | 17,870 |

| NZD | NZD | 14,078 | 14,574 | |

| KRW | KRW | 16.67 | 18.40 | |

| 2. Sacombank - Updated: 05/19/2000 07:16 - Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25060 | 25060 | 25460 |

| AUD | AUD | 15468 | 15568 | 16136 |

| CAD | CAD | 17242 | 17342 | 17898 |

| CHF | CHF | 27492 | 27522 | 28411 |

| CNY | CNY | 0 | 3429.6 | 0 |

| CZK | CZK | 0 | 985 | 0 |

| DKK | DKK | 0 | 3485 | 0 |

| EUR | EUR | 25717 | 25817 | 26692 |

| GBP | GBP | 30877 | 30927 | 32042 |

| HKD | HKD | 0 | 3241 | 0 |

| JPY | JPY | 162.54 | 163.04 | 169.55 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 17 | 0 |

| LAK | LAK | 0 | 1,133 | 0 |

| MYR | MYR | 0 | 5827 | 0 |

| NOK | NOK | 0 | 2219 | 0 |

| NZD | NZD | 0 | 14085 | 0 |

| PHP | PHP | 0 | 402 | 0 |

| SEK | SEK | 0 | 2272 | 0 |

| SGD | SGD | 18275 | 18405 | 19135 |

| THB | THB | 0 | 691.6 | 0 |

| TWD | TWD | 0 | 760 | 0 |

| XAU | XAU | 8650000 | 8650000 | 8900000 |

| XBJ | XBJ | 7900000 | 7900000 | 8900000 |

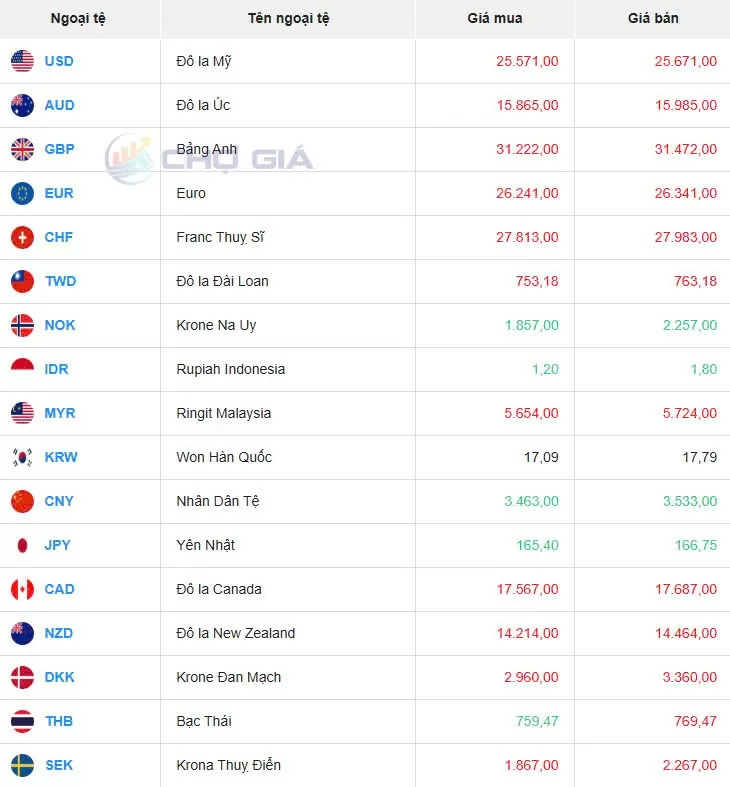

In the "black market", the black market USD exchange rate as of 5:00 a.m. on February 7, 2025 decreased by 26 VND in both buying and selling compared to yesterday's trading session, trading around 25,571 - 25,671 VND/USD.

|

| Black market on February 7, 2025. Photo: Chogia.vn |

USD exchange rate today February 7, 2025 on the world market

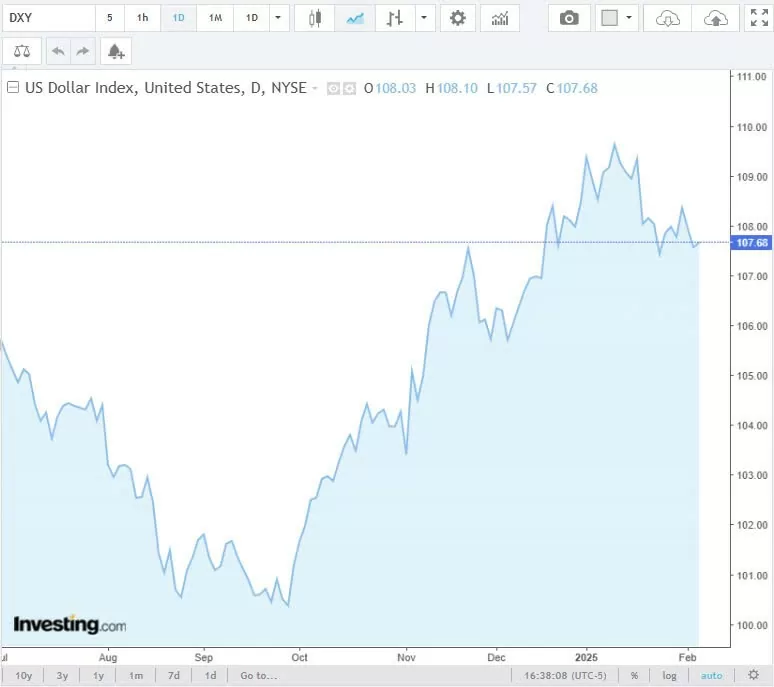

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 107.68 - up 0.06 VND compared to February 6, 2025.

|

| DXY index developments in recent times. Source: Investing |

Corporate fund managers are stepping up efforts to protect their profits from the strength of the dollar, a move some analysts say shows growing confidence that President Donald Trump’s tariff plans will help keep the U.S. currency strong for longer.

The dollar index (.DXY), open new tab, has risen about 7% from its September low, hovering near a two-year high hit in January as investors bought into bets the dollar would benefit from solid U.S. economic growth and Trump’s protectionist trade policies. Speculators have piled into bullish bets on the currency, pushing the net long dollar position to $35 billion, the largest in nearly nine years.

Corporate treasurers, who often use forward contracts, currency options and swaps to mitigate potential losses from currency fluctuations, have traditionally been slower to act. But they are increasingly taking the view that the dollar could rise higher or stay at this high level for some time. “The corporate community is moving more slowly and cautiously,” said Paula Comings, head of foreign exchange trading at U.S. Bank.

“(But) we have seen people with significant overseas income sources needing to repatriate, adding to these planned cash flow prevention programs,” she said.

“What we’re hearing from clients is that they’re planning to maintain the value of the dollar,” Comings said. Multinational companies such as Apple (AAPL.O), open new tab, and Microsoft (MSFT.O), open new tab, have warned that the strong dollar will pressure financial results in the coming months.

While there is little information on the overall level of corporate hedging activity, interviews with market participants suggest that the drive to protect against the strength of the US dollar has increased sharply ahead of the US election in November and in anticipation of a potential Trump victory.

“In the run-up to the election, our research shows that North American companies with a market capitalization of less than $100 million are acutely aware of the potential and risks of a strong US dollar after the country goes to the polls. Half of these smaller companies say they are concerned about the impact of policy changes on currency values,” said Eric Huttman, CEO of MillTechFX.

The forex market’s vulnerability to volatility was highlighted this week as US tariff threats against Mexico, Canada and China boosted the dollar and caused a spike in volatility.

While a stronger dollar reflects the relative strength of the US economy, it can cause problems for some companies. A strong US dollar makes it more expensive for multinationals to convert foreign profits into dollars, and it also reduces the competitiveness of their exports.

“We have seen a sharp increase in hedging activity across a wide range of industries as companies look to protect themselves against the higher volatility and increased uncertainty since Trump was elected and the strong dollar,” said Kyle Chapman, foreign exchange analyst at Ballinger Group in London.

“FX is being driven by headlines that are coming out of the market, and that is drawing fund managers’ attention to market volatility,” he said. The driving force behind this hedging is a growing belief that the dollar’s strength will persist for some time as Trump’s tariffs take effect.

“There is a general sense that we have entered a stronger dollar environment since Trump’s re-election… the scale and speed of the rally since September has woken people up to the impact of exchange rate volatility on net returns,” Chapman said.

In recent weeks, a number of companies have reported and forecast significant negative impacts from adverse currency market movements. In late January, Apple warned that it expected the stronger dollar to reduce its current quarter revenue by 2.5 percentage points, compared to the same period last year.

Johnson & Johnson (JNJ.N), open new tab, also said adverse foreign currency moves reduced its 2024 sales by $1.7 billion, or 2%, while Microsoft warned that its third-quarter revenue growth would be hit by 2 percentage points due to the stronger dollar.

Smaller and less FX-savvy companies, often constrained by tight hedging budgets, limited capital they can invest in hedging activities and generally lacking access to more advanced hedging programs at the best rates, face a greater challenge from the rising dollar.

“A stronger US dollar requires treasury teams at smaller firms to manage FX risk more carefully and deploy sound hedging strategies to help adapt to this new normal,” said Huttman of MillTechFX.

Larger companies made more of an effort than expected in 2024 to review and update their hedging programs due to concerns about the strength of the dollar, and it is not surprising to see smaller companies making similar moves now, said Amol Dhargalkar, managing partner at risk management firm Chatham Financial.

While tariff-related headlines may spur increased hedging activity, a broader escalation in trade tensions could undermine those efforts as a full-blown trade war could jeopardize companies' ability to forecast business performance and implement effective hedging measures, analysts warned.

“For many businesses, their underlying cash flow is at risk here… some may have to reorganize their supply chains while some may face lower revenue from customers in international locations,” said Karl Schamotta, chief market strategist at Toronto-based payments company Corpay. “There are a lot of cross-currents rather than just a linear increase in hedging volume.”

|

| USD exchange rate today February 7, 2025. Illustration photo |

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop - No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts - No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Gold and Silver Store - No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company - No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store - No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones - No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store - No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store - No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store - No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange - 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop - 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop - 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center - 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store - Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop - No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop - No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop - No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

Source: https://congthuong.vn/ty-gia-usd-ngay-07022025-gan-dat-moc-cao-nhat-2-nam-372618.html

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

Comment (0)