Many stocks that were sold off heavily yesterday (February 10) recovered significantly in the session of February 11. Green has returned after the correction session at the beginning of the week.

Many stocks that were sold off heavily yesterday (February 10) recovered significantly in the session of February 11. Green has returned after the correction session at the beginning of the week.

After a fiery session on February 10 with trading volume increasing by 31% and equal to 135% of the average, the market tended to recover slightly in the morning session on February 11, but market sentiment remained cautious. Supply pressure has decreased, helping the general index open in green, although the increase amplitude is not too strong. Large-cap stocks play a role in keeping the market pace, although the differentiation is still quite clear. Meanwhile, mid- and small-cap stocks have not shown signs of attracting cash flow again.

After the previous sharp decline, the official announcement of the new US tariffs has somewhat eliminated the concerns and speculations, thereby helping to stabilize investor sentiment. Demand has reappeared in many sectors, helping to balance the general situation. Market liquidity this morning has decreased compared to the previous session, reflecting the hesitation of both buyers and sellers.

After the lunch break, trading on the market was still relatively positive, VN-Index maintained green throughout the afternoon trading session. There was a time when strong selling pressure appeared, causing VN-Index to retreat close to the reference level. However, the buying pressure at the end of the session increased and contributed to pushing VN-Index to close at the highest level of the session.

At the end of the trading session, VN-Index increased by 5.19 points (0.41%) to 1,268.45 points. HNX-Index increased by 0.9 points (0.39%) to 228.87 points. UPCoM-Index increased by 0.04 points (0.03%) to 96.66 points. Today's session on all three exchanges had 440 stocks increasing, while 326 stocks decreased and 799 stocks remained unchanged/no trading. The whole market recorded 31 stocks hitting the ceiling while 11 stocks hit the floor.

The banking group has continued to play a good supporting role for the market since the beginning of the trading session. In particular, codes such as SHB, TPB, SSB, CTG, VIB, TCB, MBB, BID... all increased in price. In particular, SHB increased by 1.9%, TPB increased by 1.5%, LPB increased by 1.2%.

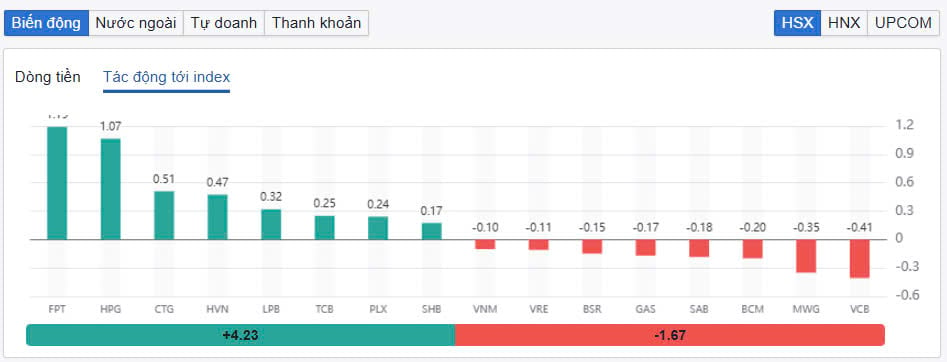

However, the market focus was on two pillar stocks that were sold heavily yesterday, FPT and HPG. After being sold heavily yesterday, both FPT and HPG recovered strongly. Of which, HPG increased by nearly 2.8%, FPT increased by 2.4%. FPT was the stock that had the most positive impact on the VN-Index when it contributed 1.19 points, HPG also contributed 1.07 points.

|

| The focus of the market is the recovery of two pillar stocks that were sold heavily on February 10. |

However, the differentiation in the VN30 group is still relatively strong when names such as MWG, VRE, SAB, BCM... are still in red. MWG continued to decrease by 1.7% and closed at the lowest level of the session at VND56,400/share. MWG is the code with the second largest negative impact on the VN-Index when taking away 0.35 points. Meanwhile, VCB is the code with the most negative impact with 0.41 points. At the end of the trading session, VCB decreased by 0.33%.

The export sectors that were strongly affected in yesterday's session, including steel, textiles, fertilizers, chemicals, etc., also had a certain recovery. In the steel group, besides HPG, NKG, VGS, etc. were also pulled up above the reference level. Chemical fertilizer stocks such as DDV, DCM, DPM, DGC, CSV, etc. all increased well again.

In the mineral group, some stocks that have increased "hotly" in the past few sessions have had very strong adjustments. MGC decreased by nearly 9.1%, MSR decreased by 6.3%, AMC decreased by 6.4%, BMC decreased by 5.3%...

|

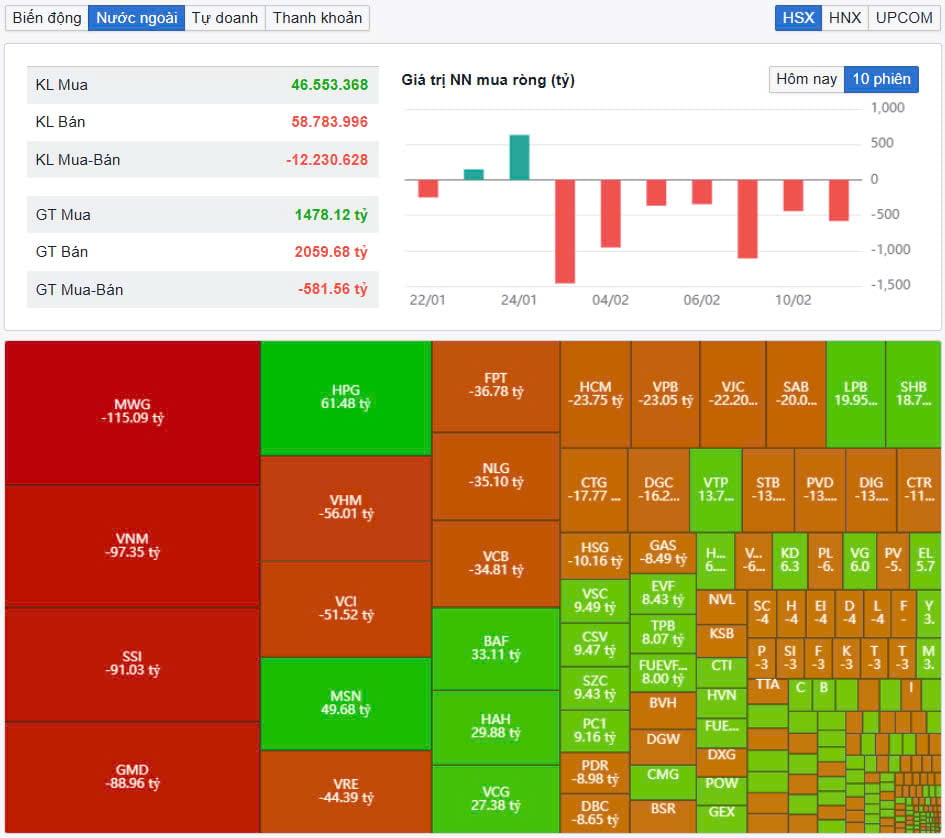

| Foreign investors continued to net sell for the 7th consecutive session. |

The total trading volume on HoSE reached 629 million shares, equivalent to a trading value of VND14,210 billion, down 21% compared to the previous session, of which negotiated transactions contributed VND1,478 billion. The trading value on HNX and UPCoM reached VND761 billion and VND648 billion, respectively.

FPT ranked first in terms of total market transaction value with 764 billion VND. HPG and TPB traded 747 billion VND and 723 billion VND respectively.

Foreign investors had the 7th consecutive net selling session with a value of over 625 billion VND. Of which, foreign investors net sold the most MWG code with 115 billion VND. VNM and SSI were net sold 97 billion VND and 91 billion VND respectively. On the opposite side, HPG topped the net buying list with 61 billion VND. MSN and BAF were net bought 50 billion VND and 33 billion VND respectively.

Source: https://baodautu.vn/fpt-va-hpg-hoi-phuc-vn-index-tang-diem-tro-lai-trong-phien-112-d245512.html

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)