Continuously expanding FPT Long Chau pharmacy chain

Recently, FPT Long Chau announced that it has officially reached the milestone of 1,600 pharmacies in December 2023, becoming the pharmaceutical retail chain with the largest number of pharmacies in Vietnam. Long Chau Pharmaceutical Joint Stock Company is the owner of the FPT Long Chau pharmacy chain, a subsidiary of FPT Digital Retail Joint Stock Company (stock code: FRT).

This is quite an impressive number, realizing the plan to develop the FPT Long Chau pharmacy chain that was affirmed by FPT Retail Chairman of the Board of Directors - Nguyen Bach Diep in early 2023. That is, in 2023, the enterprise will focus on the FPT Long Chau pharmacy chain, with the goal of opening 400 new stores, increasing the number of stores in the entire chain to 1,400 to 1,500.

FPT Retail's 2023 Annual General Meeting of Shareholders.

Accordingly, a rather bright "prospect" was reported when according to the 2023 plan, FPT Retail expected the FPT Long Chau pharmacy chain to bring in 14,000 billion VND. The continuous effort to push the number of Long Chau stores to surpass An Khang and Pharmacity has not actually brought FPT Retail the expected results.

Losses for 2 consecutive quarters, liabilities 5.5 times equity

In the third quarter of 2023, FPT Retail recorded a 6.8% increase in net revenue over the same period to VND 8,236 billion. However, financial revenue decreased by more than half to VND 21.3 billion while operating expenses increased sharply to nearly VND 1,400 billion, leading to a 98.6% decrease in net profit over the same period, down to only VND 1.4 billion.

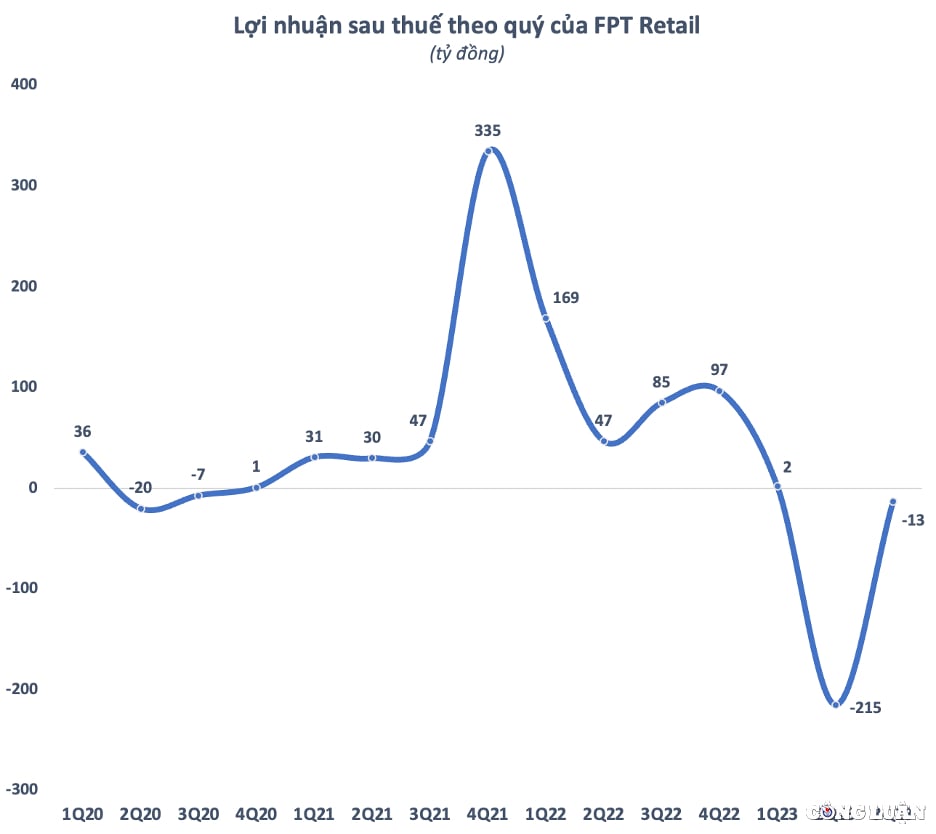

As a result, FPT Retail posted a net loss of VND13 billion while in the same period it still made a profit of VND85.3 billion. The loss after tax attributable to the parent company's shareholders was VND21.1 billion. This was FRT's second consecutive quarter of losses after a record loss of VND215 billion in the second quarter. Previously, in the first quarter of the year, the company only made a net profit of over VND2 billion.

In the first 9 months, FPT Retail recorded revenue of VND23,160 billion, up 6.7% over the same period. However, high sales and administrative expenses caused the company to change from a profit of over VND300 billion in the same period to a net loss of nearly VND226 billion in the first 9 months of the year.

In 2023, FPT Retail aims to achieve VND34,000 billion in consolidated revenue and VND192 billion in after-tax profit. With the results achieved after 3/4 of the journey, this enterprise is still far from its profit target and will likely fail the 2023 plan if there is no breakthrough in the 4th quarter.

As of September 30, FPT Retail's total assets reached VND11,720 billion, an increase of more than VND1,200 billion compared to the beginning of the year. Of which, more than 62% was inventory with a final value of nearly VND7,300 billion. Cash and short-term deposits were at VND1,580 billion, a decrease of about VND300 billion compared to the beginning of the year.

Notably, the company's liabilities at the end of the third quarter increased by nearly 600 billion compared to the beginning of the year, surpassing 9,900 billion VND, 5.5 times higher than its equity. Of which, short-term financial loans accounted for 57% with a final balance of 5,650 billion VND, an increase of nearly 300 billion compared to the beginning of the year.

Source

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

Comment (0)