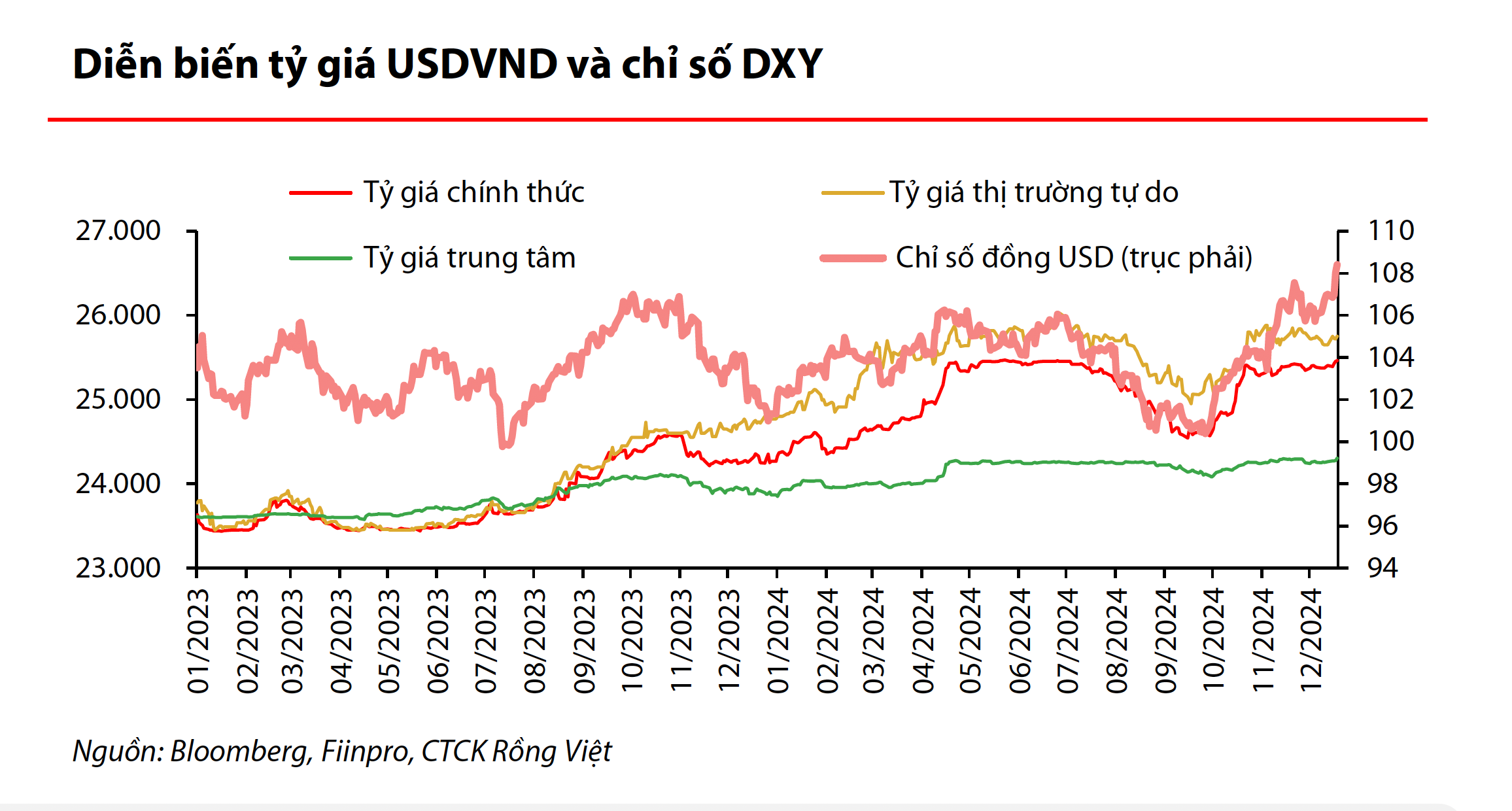

(NLDO) - The strengthening of the USD in the international market is one of the factors affecting the USD/VND exchange rate.

On February 1, the USD index (DXY) on the international market was traded around 108.2 points, up 0.55% compared to the previous session. The DXY index has remained high in recent days and is at its highest level in more than 2 years.

In Vietnam, the USD price at commercial banks is traded around 24,800 VND/USD for buying and 25,300 VND/USD for selling, down about 250 VND compared to the beginning of the year. The USD/VND exchange rate increased by about 5% last year and is forecast to continue to be under pressure this year. According to experts, the strengthening of the USD in the international market is one of the factors affecting the USD/VND exchange rate.

In the 2025 strategy report, experts from the Analysis Center of Dragon Viet Securities Company (VDSC) forecast that exchange rate fluctuations in 2025 will depend on domestic foreign currency supply and demand; the prospect of USD appreciation; and US tariff policy towards Vietnam.

The DXY index is forecast to increase by 5-10% in 2025. Although the trend of interest rate cuts by central banks creates certain advantages for exchange rate management, the pressure from the appreciation of the USD can overwhelm the positive effects from the interest rate cutting cycle.

"In the base scenario: the exchange rate fluctuates within a range of +/-5% and ends 2025 at 26,200 VND/USD. The risk of being subject to tariffs is often accompanied by devaluation pressure on the currency of the taxed country, and Vietnam will be no exception. Therefore, in the negative scenario, the exchange rate could increase beyond 26,200 VND/USD if the US imposes a 10-20% tariff on Vietnamese exports in the second half of 2025" - Rong Viet Securities forecasts.

Analysts at Vietcombank Securities Company (VCBS) also said that the strength of the USD is still a major factor influencing fluctuations in the USD/VND exchange rate this year. However, the foreign exchange market may record positive factors. Remittances continue to be a bright spot in foreign currency flows in 2025, continuously maintaining above the threshold of 13 billion USD in the past 3 years. The VND is forecast to depreciate relatively compared to the USD with a reasonable fluctuation of about 3% for the whole year.

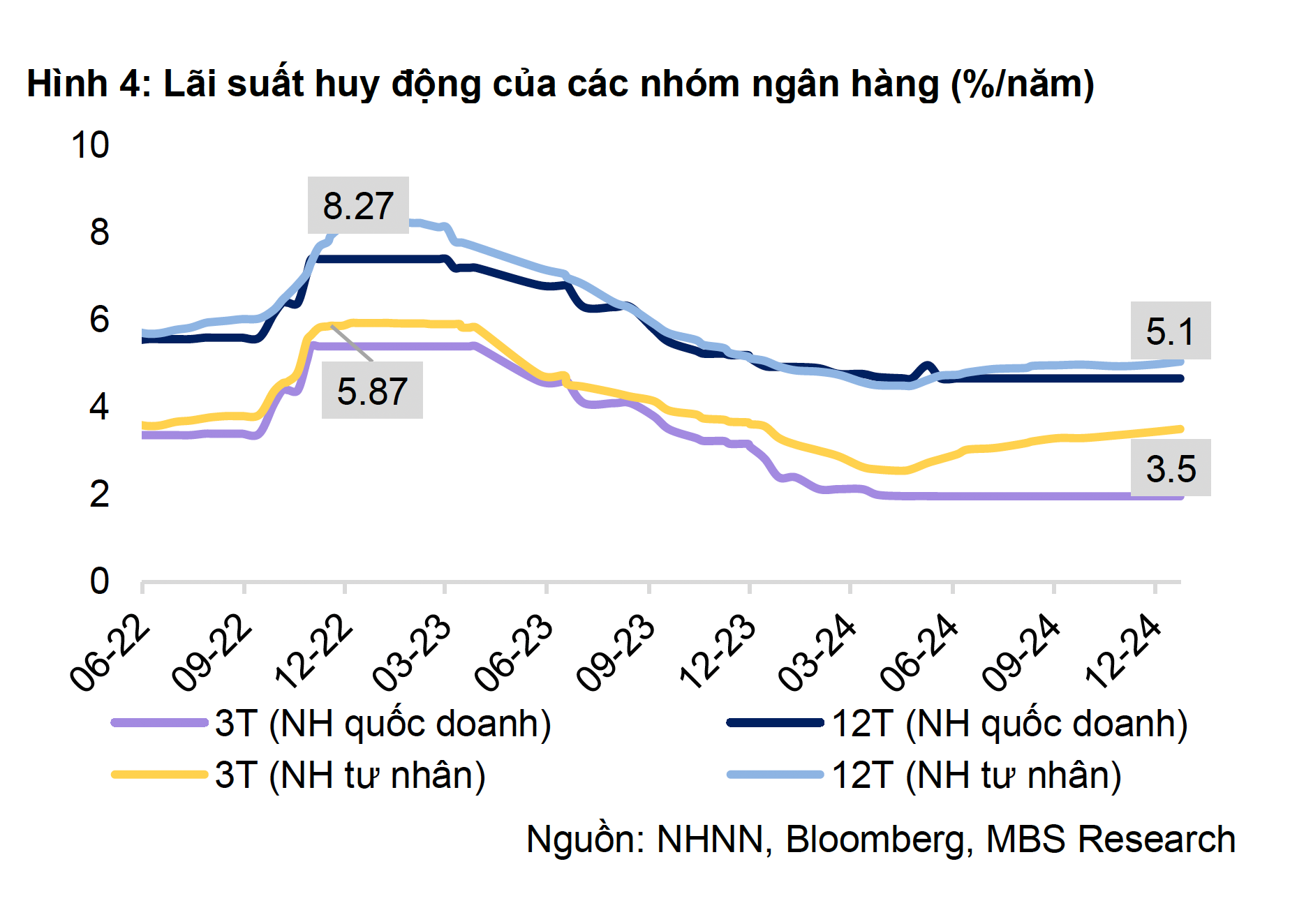

Although deposit interest rates have been continuously increasing recently, analysts believe that lending interest rates will stabilize to support businesses and the economy.

In fact, the State Bank's Standing Deputy Governor Dao Minh Tu said that by the end of 2024, although the mobilization interest rate increased by 0.71 percentage points compared to the end of 2023, the lending interest rate decreased by 0.6 percentage points compared to the beginning of the year. In managing interest rates, the State Bank continues to maintain the operating interest rates to create conditions for credit institutions to access capital from the State Bank at low costs, with conditions to support businesses, the economy, etc.

Regarding the forecast of interest rates in the coming time, Ms. Tran Khanh Hien, Director of Research at MBS Securities Company, commented that she does not expect the State Bank to cut any policy interest rates this year. The recovery of production activities and the acceleration of public investment disbursement in 2025 are expected to be important factors in boosting credit growth, thereby increasing pressure on input interest rates. However, the State Bank has issued instructions on stabilizing deposit interest rates and continuing to strive to reduce lending interest rates.

"It is forecasted that the 12-month deposit interest rate of major commercial banks will fluctuate around 5% - 5.2% this year" - Ms. Hien analyzed.

Mr. Tran Hoang Son, Director of Market Strategy, VPBank Securities Company, commented that with the growth support policy, in the first 6 months of the year, the State Bank may not increase interest rates immediately. However, in the interbank market, commercial banks have boosted credit and increased mobilization; government bond yields have increased.

"The operating interest rate will increase, but most likely not in the first half of the year. If the interest rate is not increased, the manager will have to operate more flexibly in the exchange rate story, allowing the VND to fluctuate within a larger range," Mr. Son analyzed.

In return, in the context of good economic growth, stable macro-economy highly appreciated by foreign investors, FDI growth of 9.4% in 2024, equivalent to disbursement of 25.3 billion USD, shows that foreign investors still love Vietnam. Therefore, the impact of exchange rate on Vietnam's economy in 2025 is still there, but not as strong as in 2024.

Source: https://nld.com.vn/du-bao-moi-nhat-ve-lai-suat-gia-usd-sau-tet-196250201180238746.htm

Comment (0)