The digital transformation wave in the banking, finance and insurance industry in Vietnam is taking place very strongly. Many businesses are willing to invest large amounts of capital to apply artificial intelligence (AI) to create, enhance experiences and reduce risks.

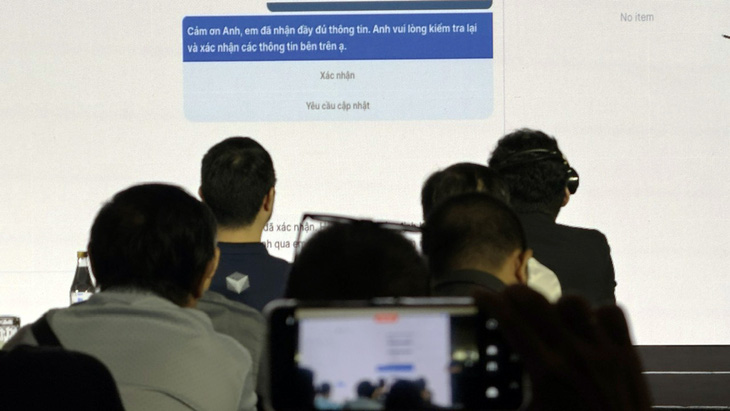

Simulating the insurance contract authentication process through virtual assistant - Photo: BONG MAI

Vietnamese business owners want to use AI

"Many financial, banking and insurance businesses in Vietnam are facing a "race" to optimize costs, processes, ensure data security, and at the same time increase customer experience, thereby creating a competitive advantage in the market" - Dr. Dao Duc Minh, General Director of VinBigData, shared. Mr. Minh cited that in Vietnam, 91% of business owners in the above three fields are interested in and want to apply AI, higher than the world average of 83%. However, digitalization has only stopped at single tasks such as customer care or sales, not really comprehensive. On the other hand, implementation costs are also a big barrier, requiring huge investments in technology, infrastructure and human training. In our country, while many companies have spent a lot of money to create virtual assistants in finance, banking, insurance, etc., many others are still "not ready to go all in". Therefore, Dr. Dao Duc Minh commented that the appearance of ViFi for the first time in Vietnam has contributed to helping businesses increase work productivity, promote business efficiency, and create a big step forward in the journey of building a digital economy. The above solution set can support both text and voice channels, integrating intelligent image processing tools, making the interaction between virtual assistants and users convenient and easy. For example, in the financial sector, virtual assistants make recommendations to customers when buying and selling securities based on individual wishes to diversify portfolios, limit risks... At the same time, virtual assistants in the banking sector also help initiate loans, evaluate credit scores...Detect and block fraud in the insurance and finance sectors

With traditional, manual processes, many scammers have found loopholes to commit fraud. However, AI is contributing to detection and prevention. For example, in the insurance sector, Dr. Nguyen Quy Ha - Director of VinBigData's image analysis technology - said that through the application integrated with AI, customers are electronically identified, using their voice to confirm personal information and content that has been consulted by the agent, and checking notes about insurance products, benefits and responsibilities. Thus, this contributes to increasing transparency, limiting insurance agents from providing ambiguous advice, and swapping concepts, causing customers to suffer losses as has been reported in the past. In case of risks when an incident occurs, customers only need to upload documents such as medical examination papers, hospital receipts, medical examination cost statements, etc. to the online application. Technology automatically extracts data, promoting the process of resolving compensation benefits quickly. Currently, AI supports the insurance industry in many stages such as: personalized consulting, contract signing (recording, biometric authentication - voice...), customer care (checking, confirming, recording information), claim processing (receiving, analyzing, processing records). Mr. Satsawat Natakarnkitkul - Head of AI and data solutions at Amazon Web Services ASEAN - shared: "Generative AI is an explosive trend globally". With a strong development trend, AI helps global GDP increase by 7,000 billion USD. Currently, many businesses such as Microsoft, Google... are investing heavily in this technology. It is estimated that by 2026, 81% of banks will deploy AI and machine learning, helping to optimize 200-300 billion USD. AI also helps increase safety in online transactions. Typically, MasterCard - a leading technology company in the payment field - is using AI to prevent fraud, detect counterfeit behavior, and fraudulent withdrawal of customers' money. Detecting and blocking financial fraud on the internet "is like looking for a needle in a haystack but it's done quickly and in a short time," said Mr. Satsawat. According to experts, the Vietnamese development of AI to create virtual assistants for the banking, finance, and insurance sectors not only contributes to promoting digital transformation of the economy but also marks sovereignty. For example, after being asked "Spratly - Paracel Islands belong to which country?", the virtual assistant created by Vietnamese people will answer that it belongs to Vietnam.Tuoitre.vn

Source: https://tuoitre.vn/doanh-nghiep-viet-dua-do-von-vao-cong-nghe-chan-lua-dao-20240914091009818.htm

Comment (0)