The central exchange rate increased by 137 VND, the VN-Index increased by 10.15 points (+0.80%) compared to the previous weekend, or the CPI in January 2025 increased by 0.98% compared to the previous month and increased by 3.63% compared to the same period... are some notable economic information in the week from February 3 to 7.

| [Infographic] CPI in January 2025 increased by 0.98% Review of economic information on February 6 |

|

| Economic news review |

Overview

The consumer price index (CPI) in January 2025 increased sharply, the Government set the 2025 inflation target at about 4.15%.

The report of the General Statistics Office released on January 6, 2025 showed that the CPI in January 2025 increased by 0.98% compared to the previous month. Compared to the same period in 2024, the CPI in January increased by 3.63%. The reason for the increase in the CPI in January was that some localities adjusted the prices of medical services according to Circular No. 21/2024/TT-BYT, and the prices of transportation services and food increased due to the increased demand for travel and shopping of people during the Lunar New Year.

In the 0.98% increase in CPI in January 2025 compared to the previous month, there were 9 groups of goods and services with increased price indexes and 2 groups of goods with decreased price indexes.

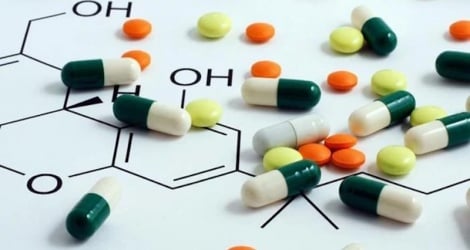

Among the 9 groups of goods and services with price index increases, the group of medicines and medical services increased the most with an increase of 9.47% compared to the previous month, causing the general CPI to increase by 0.51 percentage points. In particular, the price index of the medical services group increased by 12.57% due to some localities implementing the application of new medical service prices according to Circular No. 21/2024/TT-B yearT dated October 17, 2024 of the Ministry of Health regulating the method of pricing medical examination and treatment services. In addition, the weather turned to winter, flu and respiratory diseases increased, and people's demand for pain relievers, antipyretics, respiratory drugs, vitamins and minerals increased. Specifically, the price of vitamin and mineral drugs increased by 0.34%; digestive drugs increased by 0.16%; drugs affecting the respiratory tract increased by 0.12%.

Next is the transportation group, which increased by 0.95%, causing the overall CPI to increase by 0.09 percentage points. In particular, the increased travel demand of people at the end of the year caused the price of passenger transport by air to increase by 11.08%; passenger transport by road and passenger transport by waterway both increased by 1.73%; passenger transport by rail increased by 1.71%; passenger transport by bus increased by 0.24%. The gasoline price index increased by 2.02%, the diesel price index increased by 4.99% due to the impact of domestic gasoline and oil price adjustments. The price of auto spare parts increased by 0.66%; motorcycle tires and tubes increased by 0.28%; other motorcycle spare parts increased by 0.4%...

The food and catering services group increased by 0.74%, causing the overall CPI to increase by 0.25 percentage points. Of which, food increased by 0.3%; foodstuff increased by 0.97%, causing the overall CPI to increase by 0.21 percentage points; eating out increased by 0.33%. In addition, the beverage and tobacco group increased by 0.69% due to increased consumer demand and use as gifts during the Lunar New Year, causing the price of alcohol to increase by 0.8%; cigarettes increased by 0.7%; non-alcoholic beverages increased by 0.36%. The other goods and services group increased by 0.51%.

As Tet is approaching, the culture, entertainment and tourism group also increased by 0.27%, mainly focusing on the following items: Prices of flowers, ornamental plants and ornamental objects increased by 1.59% due to increased demand during the Lunar New Year 2025; package tours increased by 0.64% (domestic tourism increased by 0.52%; international tourism increased by 0.99%) due to people's travel demand and increased service costs; hotels and guesthouses increased by 0.43%; books, newspapers and magazines of all kinds increased by 0.12%.

According to the General Statistics Office, core inflation in January 2025 increased by 0.42% compared to the previous month and by 3.07% compared to the same period last year. The General Statistics Office stated that core inflation increased by 3.07% compared to the same period last year, lower than the average CPI (up 3.63%), mainly due to the prices of food, foodstuffs, electricity and medical services, which are factors that increase the CPI but are excluded from the list of core inflation calculations.

According to information from the Steering Committee meeting to evaluate price management and operation in 2024 and orientation for 2025 on February 6, 2025, the Ministry of Finance assumed that price fluctuations of some essential goods will affect the CPI according to 3 scenarios: scenario 1, the average CPI in 2025 is forecast to increase by about 3.83% compared to 2024; scenario 2, the average CPI in 2025 is forecast to increase by about 4.15% compared to 2024; scenario 3, the average CPI in 2025 is forecast to increase by about 4.5% compared to 2024. The Head of the Steering Committee for Price Management proposed to choose the scenario of an average CPI in 2025 increasing by about 4.15% compared to 2024 (scenario 2) to have room to drastically implement solutions to achieve the GDP growth target of at least 8% in 2025.

Domestic market summary week from 3 - 7/2

In the foreign exchange market, during the week of February 3-7, the central exchange rate was adjusted to increase sharply by the State Bank in most sessions. At the end of February 7, the central exchange rate was listed at 24,462 VND/USD, an increase of 137 VND compared to the previous weekend session.

The State Bank of Vietnam's transaction office continues to list the USD buying and selling prices at 23,400 VND/USD and 25,450 VND/USD.

The interbank USD-VND exchange rate fluctuated between sessions from February 3 to 7. At the end of the session on February 7, the interbank exchange rate closed at 25,310, a sharp increase of 210 VND compared to the previous weekend session.

The dollar-dong exchange rate on the free market last week increased sharply at the beginning of the week and then gradually decreased again. At the end of the session on February 7, the free exchange rate increased by 130 VND in both buying and selling directions compared to the previous weekend session, trading at 25,580 VND/USD and 25,680 VND/USD.

Interbank money market, week from February 3 to 7, interbank VND interest rates fluctuated sharply up and down in all terms. Closing on February 7, interbank VND interest rates were traded at: overnight 4.50% (-0.32 percentage points); 1 week 4.68% (-0.19 percentage points); 2 weeks 4.80% (-0.13 percentage points); 1 month 4.90% (-0.20 percentage points).

Interbank USD interest rates decreased across all terms last week. On February 7, interbank USD interest rates were: overnight 4.37% (-0.01 percentage point); 1 week 4.42% (-0.05 percentage point); 2 weeks 4.51% (-0.03 percentage point) and 1 month 4.58% (-0.02 percentage point).

In the open market last week, in the mortgage channel, the State Bank of Vietnam offered 7-day term with a volume of VND109,000 billion, interest rate kept at 4.0%. There were VND95,073.92 billion in winning bids and VND73,613.26 billion maturing last week in the mortgage channel.

SBV bids for 7-day treasury bills. VND16,999.8 billion was won, with an interest rate of 4.0%. VND29,849.6 billion of treasury bills matured last week.

Thus, the State Bank of Vietnam pumped a net VND34,310.46 billion into the market last week through the open market channel. There were VND155,040.62 billion circulating on the mortgage channel, and VND16,999.8 billion in State Bank bills circulating on the market.

On the bond market on February 5, the State Treasury successfully bid for VND8,800 billion/VND12,000 billion of government bonds called for bid (winning rate reached 73%). Of which, the 10-year term mobilized VND8,000 billion/VND9,000 billion of the call, the 15-year term mobilized VND300 billion/VND1,500 billion of the call and the 30-year term mobilized the entire VND500 billion of the call. The 5-year and 20-year terms called for bids of VND500 billion each but there was no winning volume. The winning interest rate for the 10-year term was 2.88% (+0.09 percentage points compared to the previous auction), the 15-year term was 3.0% (+0.02 percentage points), the 30-year term was 3.25% (unchanged).

On February 12, the State Treasury plans to bid for VND12,000 billion in government bonds, of which VND500 billion will be offered for 5-year terms, VND10,000 billion for 10-year terms, VND1,000 billion for 15-year terms, and VND500 billion for 30-year terms.

The average value of Outright and Repos transactions on the secondary market last week reached VND10,231 billion/session, slightly down from VND11,173 billion/session the week before the Lunar New Year holiday. Government bond yields last week increased across most maturities. At the close of the session on February 7, government bond yields were trading around 1-year 2.03% (+0.01 percentage point compared to the last session of the week before Tet); 2-year 2.06% (+0.01 percentage point); 3-year 2.11% (+0.01 percentage point); 5-year 2.35% (+0.02 percentage point); 7-year 2.67% (+0.12 percentage point); 10-year 3.04% (+0.04 percentage point); 15-year 3.21% (+0.03 percentage point); 30-year 3.36% (unchanged).

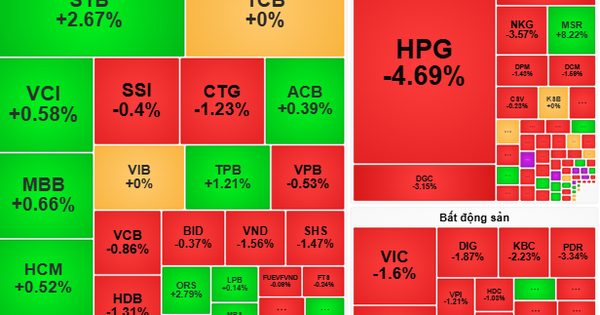

The stock market was quite positive in the week from February 3 to 7, with slight increases in most sessions. At the end of the session on February 7, VN-Index stood at 1,275.20 points, up 10.15 points (+0.80%) compared to the previous weekend; HNX-Index added 6.48 points (+2.91%) to 229.49 points; UPCoM-Index increased 2.94 points (+3.12%) to 97.24 points.

Average market liquidity reached over VND14,800 billion/session, up from VND12,400 billion/session the previous week. Foreign investors continued to net sell more than VND4,300 billion on all three exchanges.

International News

Washington and Beijing have made the first moves in the trade war, besides, the US economy received some important information. Last week, on February 3, the US government announced that President Trump decided to postpone the deadline for imposing 25% tariffs on Mexico and Canada by 1 month after reaching an agreement with these two countries on border security. However, the 10% tariff increase on all Chinese goods was still retained and officially took effect from February 4.

On the other hand, on February 5, China announced a 15% tax increase on US coal and liquefied natural gas, and an additional 10% tax on crude oil, agricultural machinery and pickup trucks imported from this country.

In addition, China also filed a lawsuit with the WTO, claiming that US President Donald Trump's trade policies are "discriminatory in nature" and go against the organization's regulations.

Regarding the US economy, the Institute for Supply Management (ISM) said that the country's manufacturing PMI rose to 50.9% in January, contrary to the forecast of a flat reading of 49.3% in December 2024. However, the country's service PMI was at 52.8% in January, down from 54.1% in the previous month and lower than the forecast of 54.2%.

In the labor market, the US created 7.60 million new job opportunities in December 2024, lower than the previous month's 8.1 million and lower than the expected 8.01 million. In January, the country created 143 thousand new non-agricultural jobs, much lower than the previous month's 307 thousand and lower than the forecast 169 thousand. The US unemployment rate last month fell to 4.0%, contrary to the forecast of a flat 4.1% as in December's statistical results.

Finally, the average income of the American people in January increased by 0.5% compared to the previous month, following the 0.3% increase of the previous month and higher than the forecast of 0.4%. This week, the world awaits information related to the US consumer price index for January, announced on the evening of February 12, Vietnam time.

The Bank of England (BoE) cut its policy interest rate at its first meeting of the year. At its meeting on February 6, the BoE said it had made progress in controlling inflation after cutting its policy interest rate twice in 2024. Inflation could rise to 3.7% in the first half of 2025, but this would be temporary due to high energy prices and household water bills could also rise. Inflation would then fall back to its long-term target of 2.0%. The UK economy may not grow in line with inflation due to global tariff shocks and complicated developments in the Middle East.

In this meeting, BoE decided to cut the policy interest rate by 25 basis points from 4.75% to 4.5% with the consensus of 7/9 members of the Monetary Policy Council (MPC), the remaining 2 members said that the policy interest rate should be cut by 50 basis points.

The MPC will continue to closely monitor risks to persistent inflation and will tighten monetary policy for as long as the risks to achieving the inflation target are removed. The MPC will rely on inflation and economic data at each meeting to make appropriate decisions.

Regarding the UK economy, the construction PMI in this country was at 48.1 points in January, down sharply from 53.3 points in December 2024, contrary to expectations of a slight increase to 53.5 points. The UK services PMI in January also only reached 50.8 points, down slightly from 51.1 points in the previous month.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-tuan-tu-3-72-160322-160322.html

Comment (0)