(Dan Tri) - The Ministry of Finance proposed to tax personal income from real estate transfers based on ownership period to avoid speculation and real estate bubbles.

The Ministry of Finance recently submitted to the Government a proposal to develop a draft Law on Personal Income Tax (replacement), which includes content on tax rates for income from real estate transfers.

The Ministry said that our country's current personal income tax policy does not differentiate according to the transferor's real estate holding period.

Meanwhile, in order to limit real estate speculation, some countries in the world have used tax tools to increase the cost of speculative behavior and reduce the attractiveness of real estate speculation in the economy, including personal income tax.

In addition, some places also apply tax on profits from real estate transactions according to the frequency of transactions and the time of purchase and resale. If this time occurs quickly, the tax rate is higher, if it occurs later, the tax rate is lower.

As in Singapore, land bought and sold in the first year is taxed 100% on the difference in value. After 2 years, the tax rate is 50%, after 3 years it is 25%.

In Taiwan, real estate transactions made within the first 2 years after purchase are subject to a tax rate of 45%, those made within 2-5 years are subject to a tax rate of 35%, those made within 5-10 years are subject to a tax rate of 20%, and those made after 10 years are subject to a tax rate of 15%.

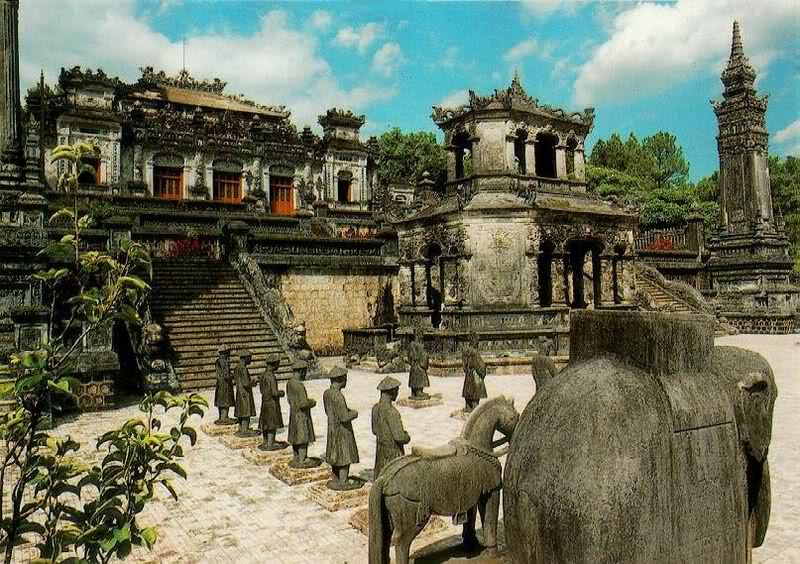

Real estate sales tax can be levied based on ownership period (Photo: Manh Quan).

Based on the above reality, in order to institutionalize the policies and orientations in the resolutions, to have a reasonable level of regulation, to avoid speculation and real estate bubbles, the Ministry of Finance believes that it is possible to study to collect tax on personal income from real estate transfers according to the holding period.

The specific tax rate needs to be studied and determined appropriately, reflecting the actual operation of the real estate market. "The application of personal income tax based on the holding period also needs to be synchronized with the process of perfecting policies related to land, housing and information technology infrastructure," the Ministry of Finance stated.

Based on the impact analysis, the Ministry proposes to study and adjust the progressive tax schedule applied to resident individuals with income from salaries and wages to suit changes in income and macroeconomic indicators in the recent period and review and adjust tax rates in the full tax schedule corresponding to the revised contents on income from capital transfer and real estate transfer.

Source: https://dantri.com.vn/bat-dong-san/de-xuat-danh-thue-mua-ban-nha-dat-theo-thoi-gian-nam-giu-20241125233208373.htm

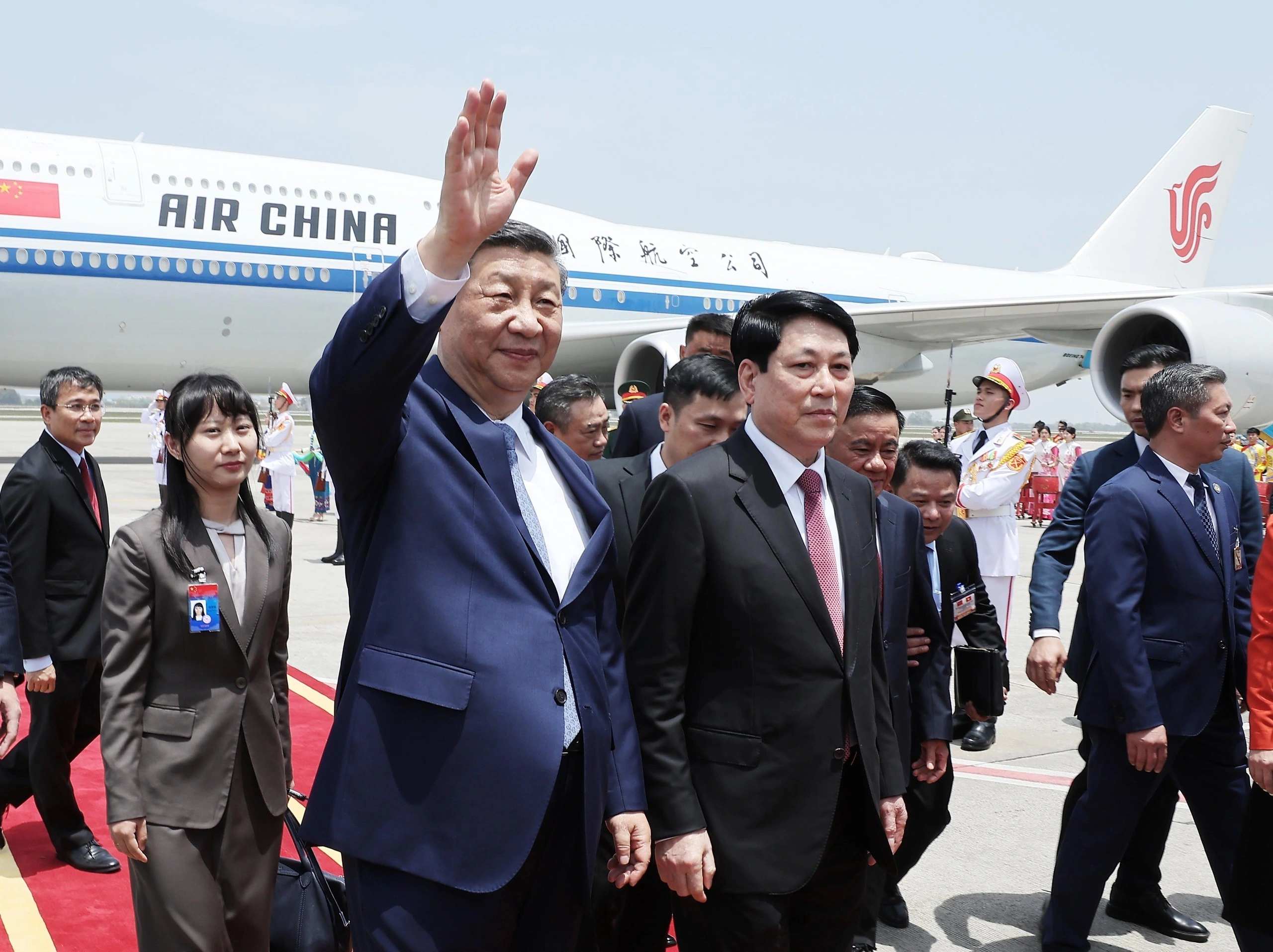

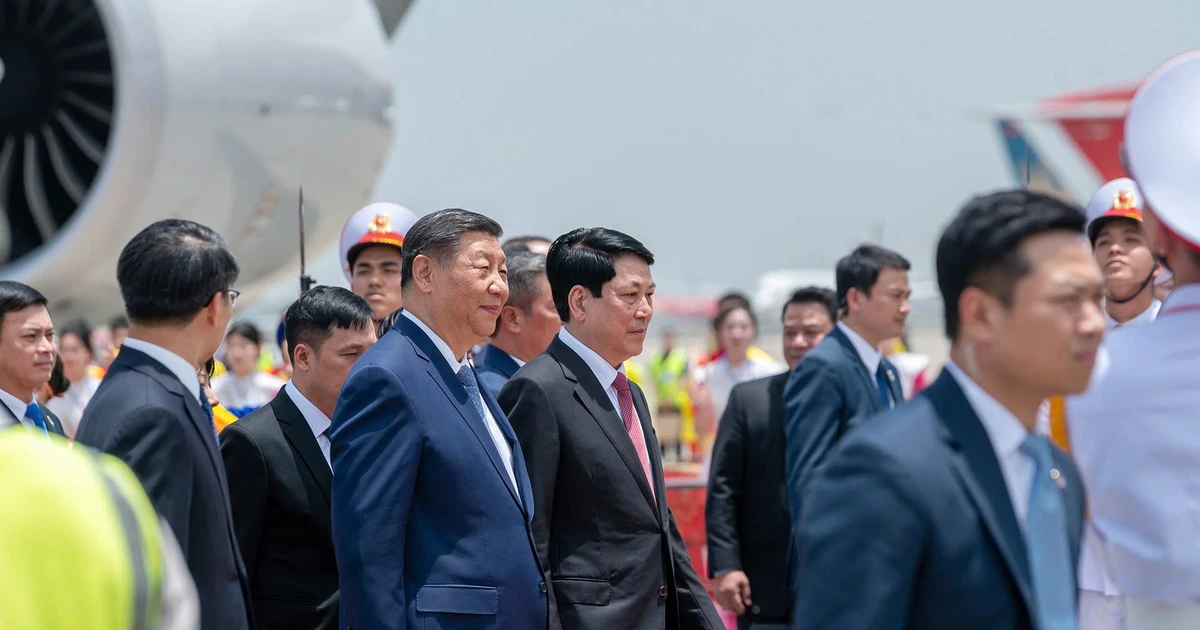

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

Comment (0)