The draft Decree on Vietnam's special preferential import tariff schedule to implement the Vietnam-Israel Free Trade Agreement for the 2024-2027 period (VIFTA) is being finalized by the Ministry of Finance.

According to information from the Ministry of Finance, the VIFTA Agreement was signed on July 25, 2023 and on January 5, 2024, the Government issued Resolution No. 08/NQ-CP approving the Free Trade Agreement between the Government of the Socialist Republic of Vietnam and the Government of the State of Israel (VIFTA Agreement). On that basis, the Ministry of Finance has developed a draft Decree on Vietnam's Special Preferential Import Tariff Schedule to implement the VIFTA Agreement for the 2024-2027 period (according to the current ASEAN Harmonized Tariff Schedule (AHTN) 2022).

|

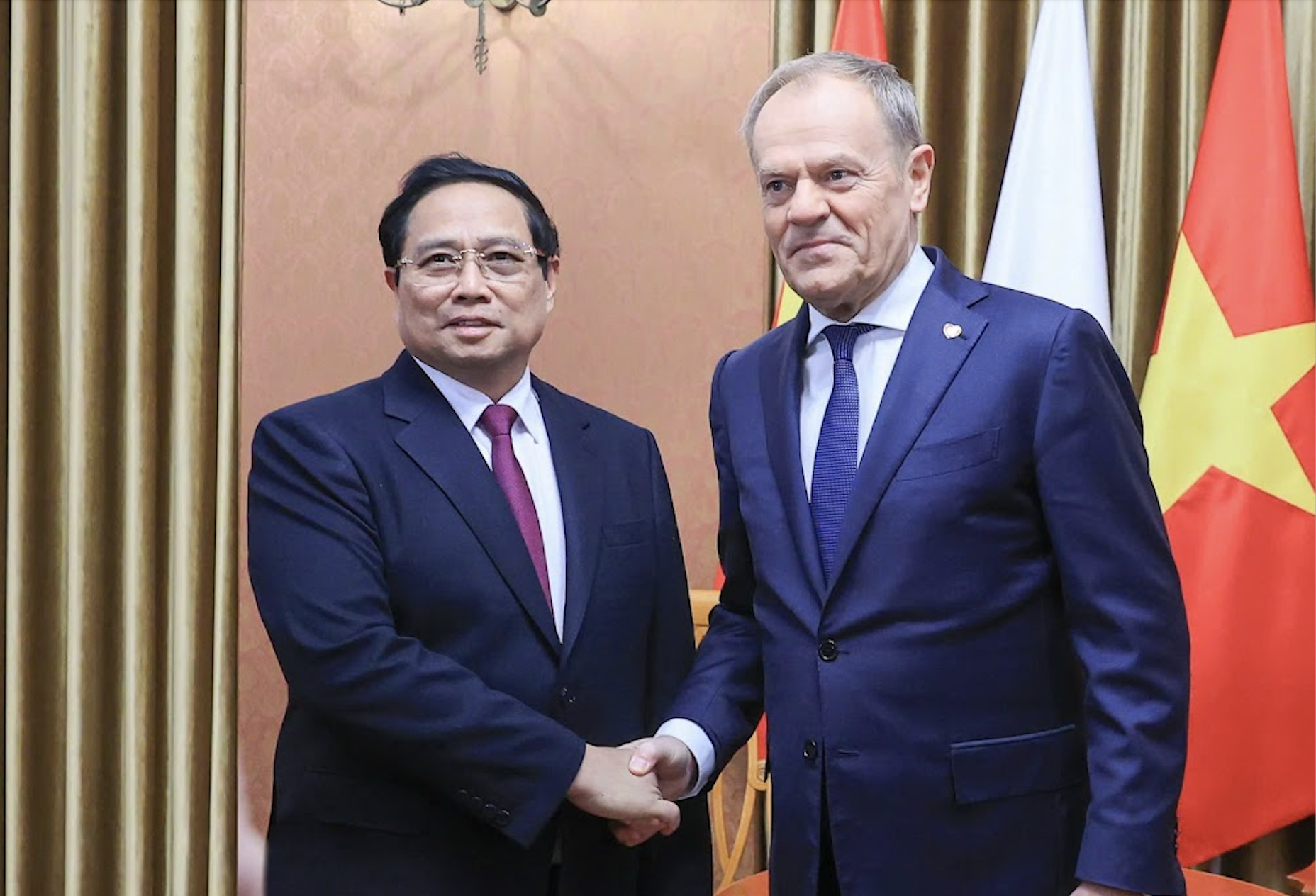

| The VIFTA agreement was signed by Vietnamese Minister of Industry and Trade Nguyen Hong Dien and his Israeli counterpart Nir Barkat in the presence of Israeli Prime Minister Benjamin Netanyahu and Vietnamese Deputy Prime Minister Tran Luu Quang. Photo: Government Newspaper |

The Ministry of Finance emphasized that the development and promulgation of this Decree aims to properly implement Vietnam's commitments at VIFTA; at the same time, ensure compatibility with international treaties signed by Vietnam; including compliance with the ASEAN Customs Agreement (Article 19 of the ASEAN Customs Agreement) on the application of the ASEAN AHTN 2022 List and the World Customs Organization's HS Nomenclature version 2022 to implement the VIFTA Agreement (the AHTN 2022 List is applied for the period 2024-2027).

According to the Ministry of Finance, the drafting of the Decree also complies with the provisions of the Law on Export Tax and Import Tax No. 107/2016/QH13 dated April 6, 2016 on the authority to issue special preferential import tax schedules, ensuring the constitutionality, legality, consistency and synchronization of the current legal system.

This Decree also ensures compliance with the provisions of the Customs Law No. 54/2014/QH13, Decree No. 08/2015/ND-CP detailing and implementing measures for the Customs Law on customs procedures, inspection, supervision, and control, and Decree No. 59/2018/ND-CP amending and supplementing a number of articles of Decree No. 08/2015/ND-CP. At the same time, it complies with the principles of tax rate construction when converting in the VIFTA Agreement, ensuring benefits and reserving Vietnam's tariff commitments.

Gradual reduction of special preferential import tax until 2027

According to the Draft Decree, the Special Preferential Import Tariff includes commodity codes, commodity descriptions, and special preferential import tax rates applicable to 11,387 tax lines at the 8-digit level and 59 AHTN 2022 commodity lines at the 10-digit level (a total of 11,446 taxable commodity lines).

Regarding special preferential import tax rates: The average tax rate of committed lines in 2024 is 10.3%, in 2025 is 9.3%, in 2026 is 8.4% and in 2027 is 7.5%.

Special preferential import tax rates for some goods in groups 04.07; 17.01; 24.01; 25.01 are only applied within the tariff quota; the list and annual import tariff quota quantity as prescribed by the Ministry of Industry and Trade and the import tax rate outside the quota is applied according to the provisions in the Export Tariff, Preferential Import Tariff, List of goods and absolute tax rates, mixed tax, import tax outside the tariff quota of the Government at the time of import.

Conditions for applying special preferential import tax under the VIFTA Agreement will be similar to the provisions in the Government's Decrees on Vietnam's tariff schedules to implement current FTAs.

In addition, this Draft Decree also stipulates the conditions for goods imported into Vietnam to be subject to special preferential import tax rates under the VIFTA Agreement. The conditions include: Being included in the special preferential import tax schedule; being imported into Vietnam from the State of Israel and meeting the regulations on origin of goods and having documents certifying the origin of goods according to the provisions of the VIFTA Agreement and current regulations.

According to the Ministry of Finance, the conversion of the tariff schedule is carried out to ensure compliance with the commitments in the VIFTA Agreement, the AHTN List 2022 and relevant legal documents. The tax rates promulgated in the Decree are based on the principle of compliance with the commitments under Vietnam's Tariff Reduction Roadmap in the VIFTA Agreement. The tariff reduction roadmap in the Tariff Schedule is applied for each year, starting from December 1, 2024 (the effective date of the Agreement) to December 31, 2027.

As for tobacco products in group 2404, this is a sensitive product, therefore, the Ministry of Finance proposes that the Government apply a special preferential import tax policy similar to tobacco products in Chapter 24 according to the commitment of product code 2403.99.90 under AHTN 2017 (no commitment until the end of the roadmap). The basis for the above proposal with the VIFTA Agreement is that this Agreement does not have a mechanism for reviewing and agreeing on conversion before implementation.

Leverage to promote economic cooperation and investment

The VIFTA Agreement consists of 15 chapters and a number of appendices attached to the chapters with basic contents such as: Trade in goods, services - investment, rules of origin, technical barriers to trade (TBT), sanitary and phytosanitary measures (SPS), customs, trade defense, government procurement, legal - institutional...

With the agreement reached in all chapters of the agreement, especially the strong commitment of both sides to increase the rate of trade liberalization with the overall liberalization rate by the end of the commitment roadmap of Israel being 92.7% of tariff lines while Vietnam is 85.8% of tariff lines, the two sides expect that two-way trade will have remarkable growth, soon reaching 3 billion USD and higher in the coming time. Not only contributing to increasing the turnover of bilateral trade in goods, VIFTA is expected to be a lever to strengthen cooperation between the two countries in investment, services, digital transformation, technology, etc.

The signing and implementation of VIFTA will create favorable conditions for Vietnam to promote the export of its key products not only to Israel but also to have the opportunity to access other markets in the Middle East, North Africa and Southern Europe.

On the other hand, besides Vietnam's market of over 100 million people, Israeli goods and technology have the opportunity to access markets in ASEAN countries, Asia-Pacific and major economies in the 16 FTAs that Vietnam has participated in.

Source

Comment (0)