The tug-of-war situation is still dominant on the stock market this morning (August 28). VN-Index decreased by 2.64 points, equivalent to 0.21%, to 1,277.92 points, in the context of 252 stocks decreasing in price compared to 109 stocks increasing. VN30-Index decreased by 1.19 points, equivalent to 0.09%; HNX-Index decreased by 1.53 points, equivalent to 0.64%, and UPCoM-Index decreased by 0.36 points, equivalent to 0.38%.

Liquidity reached 377.73 million shares, equivalent to VND8,302.27 billion. On HNX, there were 28.24 million shares traded, equivalent to VND505.11 billion, and on UPCoM, there were 17.07 million shares, equivalent to VND263.59 billion.

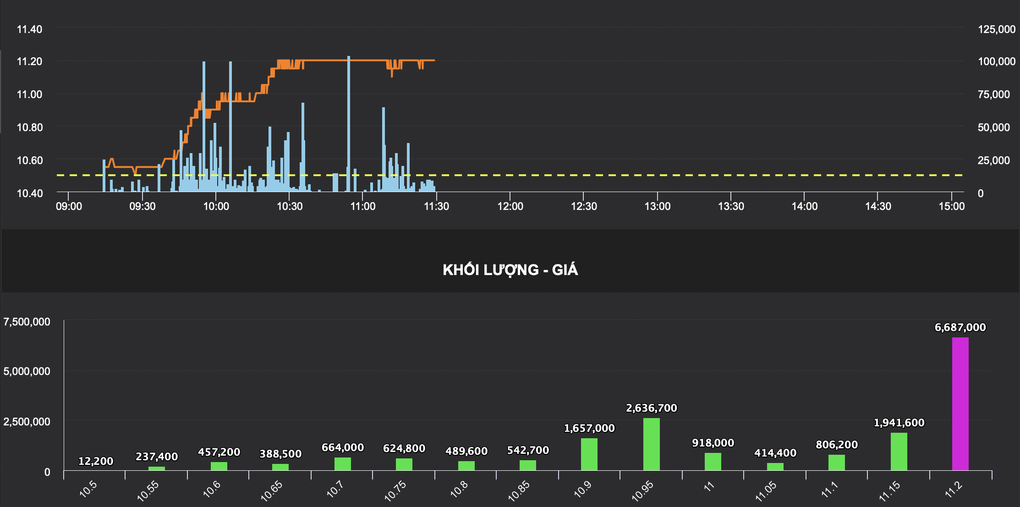

This morning, HAG attracted attention when it hit the ceiling with high matching volume. Hoang Anh Gia Lai shares reached the highest price of the session at VND11,200, with 18.5 million shares matched. Of which, nearly 6.7 million HAG shares were traded at the ceiling price, showing that investors were willing to pay the highest price to own this stock.

HAG traded strongly at ceiling price this morning (Source: VDSC).

Recently, Ms. Doan Hoang Anh, daughter of Mr. Doan Nguyen Duc (Bau Duc) - Chairman of Hoang Anh Gia Lai - has just announced that she registered to buy 2 million HAG shares during the period of August 20 - September 18 to increase her ownership from 1.04% to 1.23% of charter capital (equivalent to 13 million HAG shares).

Since the time Ms. Doan Hoang Anh announced the transaction registration (August 15) until now, HAG's market price has increased by 11.44%.

In addition to HAG, some other stocks in the food and beverage industry also increased positively: VCF hit the ceiling; HNG increased by 3.9%; ABS increased by 2.1%; SAB increased by 1.2%; MSN, VHC, DBC all increased in price.

Some chemical stocks achieved quite good growth such as DPR up 2.7%; PHR up 1.4%; GVR up 1.3% and TRC up 1.3%.

In the banking industry, although MSB and TCB increased by 1.3% and 1.1% respectively with good liquidity, reaching 9 million and 10.3 million units, some other large codes decreased in price such as VCB, CTG, HDB, ACB... Therefore, the index lacked support from "king stocks".

In addition, most financial services stocks also fell. FTS fell 2.2%; TVS fell 2.1%; CTS fell 2%; VCI fell 1.8%; BSI fell 1.8%; VIX fell 1.7%; VDS fell 1.6%...

If in yesterday's session, "Vin family" carried the index and supported the market, today they were all sold for profit. VRE decreased by 2%; VHM decreased by 1.7% while VIC stood at reference. Stocks in the same industry mostly adjusted from the initial price increase. DIG decreased by 5.4% with 24.9 million units matched; NTL decreased by 3.1%; DXG decreased by 2.8%; TCH decreased by 2.7%; SCR decreased by 2.5%; PDR decreased by 2.5%; HDC decreased by 2.4%; TDC decreased by 2.3% and NVL also decreased by 2.3%.

According to analysts, although the market recovered yesterday, the level of support is still low, so the possibility of correction still occurs in today's session. It is expected that the support cash flow will gradually increase as the market retreats and help the market have the momentum to recover in the coming time.

Investors can expect a recovery after the correction and can consider short-term corrections in stocks that have positive developments from the support level. At the same time, limit chasing high prices, consider good price areas to take short-term profits.

Source: https://dantri.com.vn/kinh-doanh/con-gai-bau-duc-mat-tay-co-phieu-hoang-anh-gia-lai-noi-song-20240828130333069.htm

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)