(NLDO) - Cash flow is differentiated for each stock. Investors can surf some codes that attract cash flow in the oil and gas and banking industries.

At the end of the session on January 20, the VN Index closed at 1,249, up slightly by 0.44 points.

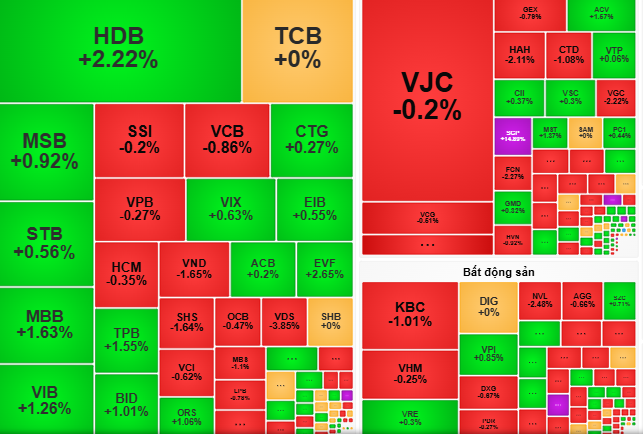

Vietnamese stocks moved positively throughout the morning session of January 20 when green covered most industry groups. Some stocks in the real estate, securities, and oil and gas sectors recovered and no longer put pressure on the market. The banking group (VIB, CTG, TCB...) also continued the upward trend.

Entering the afternoon session, VN-Index fluctuated around the reference area and at times fell into the red price zone. With low trading liquidity, the market breadth narrowed at the end of the session with 176 green codes and 240 red codes. Foreign investors net sold slightly VND 247 billion, focusing on selling VCB.

At the end of the session, the VN Index closed at 1,249, up slightly 0.44 points, equivalent to 0.04%.

According to Vietcombank Securities Company (VCBS), before the long Lunar New Year holiday, the VN Index is moving in an upward trend but is not sustainable due to low liquidity. Cash flow continues to circulate into industry groups and differentiates for each stock on the same day.

"Investors can realize part of their profits and consider short-term investments in industries that are starting to attract cash flow such as oil and gas and banking" - VCBS

Meanwhile, Dragon Viet Securities Company (VDSC) advises investors to take advantage of favorable times in each session to take profits on stocks that have increased to the resistance zone, and to exploit short-term profit opportunities in some stocks that have improved from the support zone.

Source: https://nld.com.vn/chung-khoan-ngay-mai-21-1-co-the-luot-song-co-phieu-dau-khi-ngan-hang-196250120170344288.htm

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)