MSVN expert: Possibility of increasing operating interest rates to control exchange rate pressure

It is impossible to let VND depreciate excessively, there need to be specific measures and fiscal policies to minimize the impact of increasing operating interest rates.

SBV forecasts to raise interest rates by 50 basis points in May or June

Mr. Nguyen Thanh Lam, Director of Research and Analysis of the Personal Client Division of Maybank Investment Bank Securities Company (MSVN), forecasts that the State Bank of Vietnam (SBV) will increase the operating interest rate by 50 basis points to stabilize the depreciating Vietnamese Dong exchange rate. The interest rate hike may take place in the next few weeks, in May or June.

The SBV could adopt a wait-and-see approach, first assessing whether the rate hike (along with continued USD sales) would ease exchange rate pressure, before deciding whether to raise rates further. The rate hike would increase lending rates with some lag and could impact domestic demand.

However, the other option would be to let the VND depreciate further, which could push inflation above the SBV’s target of 4.5%, affecting household purchasing power and business costs. MSVN maintains its 2024 GDP growth forecast at 5.8%, lower than the government’s target of 6% - 6.5%.

Raising the operating interest rate is the last resort when pressure on VND and foreign exchange reserves becomes tense.

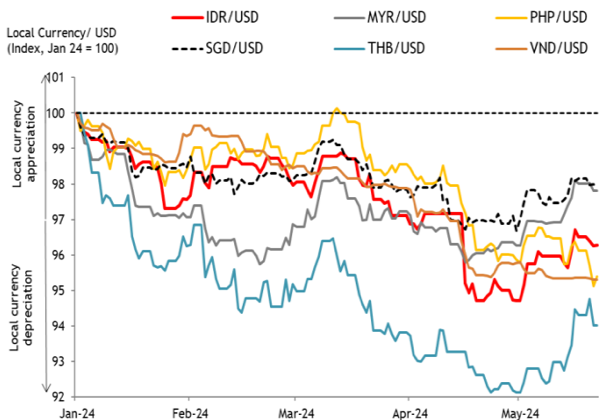

The USD/VND exchange rate has fallen by around 4.5% since the beginning of the year to a record low, making it the second worst performing currency in the ASEAN region. While there are a number of different reasons including gold speculation and recent political developments, the key factor remains the interest rate differential with the US.

|

| VND is one of the weakest performing currencies in the ASEAN region. Source: Bloomberg. Latest data point as of 22/05/2024. |

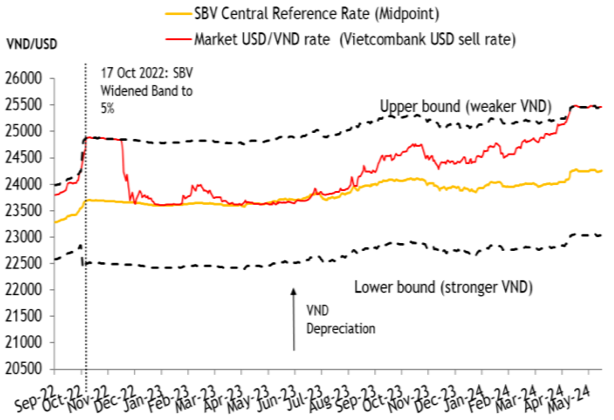

The SBV has cut its policy rate by 125 basis points in 2023 to reduce lending rates amid a struggling economy, even as the US Federal Reserve (Fed) continues to raise interest rates. Interbank interest rates have fallen due to slow credit growth and high liquidity, forcing the SBV to raise interest rates through open market operations (OMO) in the past few months. The SBV also raised the OMO interest rate for the second time to 4.5% (from 4.25%), in an attempt to push interbank interest rates higher.

The SBV has sold USD 2.8 billion of its total foreign exchange reserves of about USD 102 billion since April 19, 2024 to defend the VND, but exchange rate pressure has persisted with increased sales of USD reserves in recent days. Pressure on the SBV's foreign exchange reserves increased sharply in May with the sale of USD 2.4 billion, more than 6 times the USD 380 million sold in April.

According to Mr. Lam, unlike currencies in other countries in the ASEAN region, the pressure on VND has not shown any signs of easing, even as the USD index (DXY) has fallen further following the decline in CPI data. Moreover, there is still much uncertainty about the timing and extent of US interest rate cuts, given the strong US economy.

VND cannot be allowed to depreciate excessively , specific measures and fiscal policies are needed to reduce the impact of increasing operating interest rates .

Like other central banks, the SBV is concerned that uncontrolled depreciation of the VND will push up inflation, which is already close to the target of 4.5% (4.4% in April), said Mr. Lam. The currency could continue to depreciate if not tightly controlled, as more and more people in the country are converting their money into dollars to hedge against further depreciation of the VND. The depreciation of the VND also increases production costs for FDI investors, most of whom rely on imported input materials.

|

| Strong exchange rate pressure, with USD/VND touching the upper limit of the fluctuation band managed by the SBV (± 5%). Source: CEIC |

The State Bank will use the ceiling on short-term deposit interest rates (under 6 months) as the main policy tool to raise deposit interest rates in the market. Since deposits are the main source of funding for banks, higher deposit rates will be passed on to higher lending rates, but with a lag of about three to six months. The authorities have acknowledged that the economy still needs support and asked banks to lower lending rates.

MSVN's view is that in the context of rising policy rates, lending rates can be kept low through preferential interest rates for priority sectors (such as real estate). Fiscal policy measures, including tax deferrals and an extension of a 2 percentage point reduction in VAT to December (from June) can also be used to cushion the impact.

Source: https://baodautu.vn/chuyen-gia-msvn-co-kha-nang-tang-lai-suat-dieu-hanh-de-kiem-che-ap-luc-ty-gia-d216289.html

Comment (0)