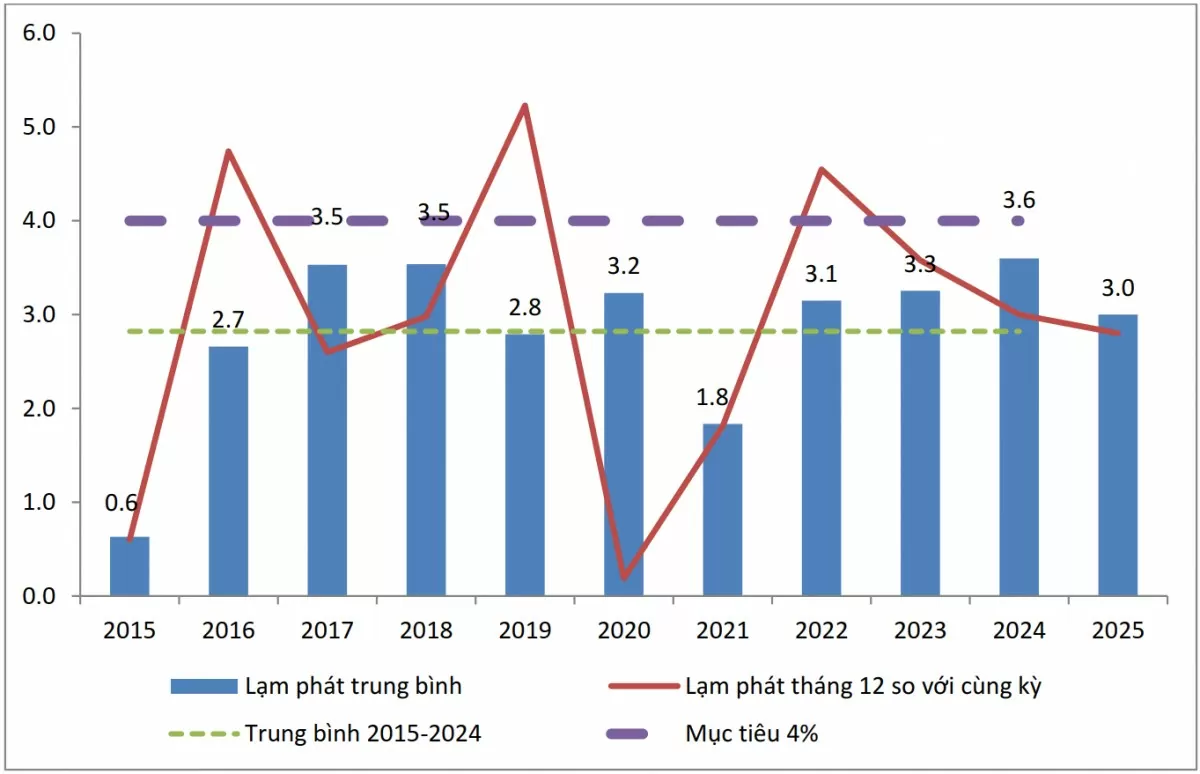

CPI in 2024 will increase by 3.63% compared to 2023. Thus, this is the 10th consecutive year that Vietnam has succeeded in controlling average inflation at below 4%.

Name the 3 main reasons

According to the latest data released by the General Statistics Office, the consumer price index (CPI) in December 2024 increased by 0.29% compared to the previous month. Compared to the same period last year, the CPI increased by 2.94%. On average, the CPI in 2024 increased by 3.63% compared to 2023. Thus, this is the 10th consecutive year that Vietnam has succeeded in controlling average inflation at below 4%.

|

| Consumers shop for Tet goods at Co.op Mart Ha Dong supermarket. Photo: Nguyen Hanh |

In the period 2015-2024, on average, inflation was only 2.8%/year, much lower than the average of 10.2%/year in the previous 10 years (period 2005-2014). According to Dr. Nguyen Duc Do - Deputy Director of the Institute of Economics and Finance (Academy of Finance), low inflation in the past 10 years is due to 3 main reasons.

First , the money supply growth rate in the 2014-2023 period (1-year lag) was only 13.8%, much lower than the average of 27.1% in the 2004-2013 period.

Second , the real interest rate in the period 2014-2024 is always maintained positive, averaging at 3.7%/year for 12-month term deposits. Meanwhile, the average real interest rate in the period 2004-2014 is 0%/year.

Third , the USD/VND exchange rate in the 2014-2024 period will also be more stable than in the 2004-2014 period. If the depreciation rate of VND against USD in the 2004-2014 period was at an average of 2.9%/year, in the 2014-2024 period it has decreased to 1.6%/year.

|

| Inflation chart in Vietnam 2015-2024 and forecast (%). Data source: General Statistics Office |

Thus, low money supply growth, positive real interest rates and stable exchange rates are the fundamental factors explaining why inflation in Vietnam has been maintained at a low level for the past 10 years.

In fact, inflation in the period 2015-2024 is basically flat (around an average of 2.8%/year or 0.23%/month), which means it is anchored by stable monetary policy and exchange rates. Fluctuations in inflation (higher or lower than average) are mainly due to fluctuations in oil prices, raw material prices as well as prices of state-controlled health and education services.

3 inflation scenarios in 2025

In 2024, money supply is controlled at 9.42%, much lower than the average of the 2014-2023 period. This is a factor that helps control inflation in 2025. However, in 2024, real interest rates, although still positive, are lower than the average of the 2014-2024 period, and the USD appreciation rate is also higher than the average of the 2014-2024 period. These are factors that can put pressure on prices in the coming time.

In addition to the above-mentioned monetary and exchange rate factors, inflation in 2025 also depends on other factors such as world economic growth and oil prices and input material prices. According to forecasts from international organizations, the world economy in 2025 will still grow steadily at 3.2%, equivalent to 2024, while oil prices and prices of basic input goods, on average, tend to decrease slightly. However, exchange rates and interest rates will be uncertain factors and will affect prices in Vietnam.

In the above context, Dr. Nguyen Duc Do presented 3 inflation scenarios for 2025. Accordingly, in the baseline scenario, the USD/VND exchange rate is stable and interest rates only increase slightly due to increased credit demand, CPI is forecast to increase by an average of 0.23%/month and the average inflation for the whole year of 2025 will be around 3.0%.

In the high scenario, the exchange rate pressure is large due to the strong appreciation of the USD in the world market, while the State Bank increases interest rates to stabilize the exchange rate and control inflation, the CPI may increase by 0.28%/month and the average inflation will be around 3.3%.

In the low scenario, the world economy and Vietnam grow weakly, oil prices decrease significantly, while the USD price and interest rates are stable or decrease slightly, the CPI may increase only 0.18%/month and average inflation will be around 2.7%.

According to Dr. Nguyen Duc Do, the above forecasts do not take into account the case where the Government increases the prices of medical and educational services according to the roadmap, as well as the possibility of the world economy falling into recession due to interest rates in developed countries remaining high for a long time. If the Government adjusts service prices in the second half of 2025, the average inflation could be at 3.5% in the high scenario.

In the low-case scenario, if the global economy falls into recession in 2025 and oil prices fall sharply, average inflation could fall to 2.5% or even lower.

| With a stable and reasonable monetary and exchange rate policy, Vietnam has controlled inflation at below 4% over the past decade. In 2025, average inflation is likely to continue to be controlled at 3.0% (+/- 0.5%), much lower than the target of 4-4.5% approved by the National Assembly. |

Source: https://congthuong.vn/mot-thap-ky-lam-phat-thap-368973.html

Comment (0)