(NLDO) – VN-Index suddenly fell below the 1,240 point mark, reaching its lowest level in the past 3 months with a series of banking stocks being sold heavily.

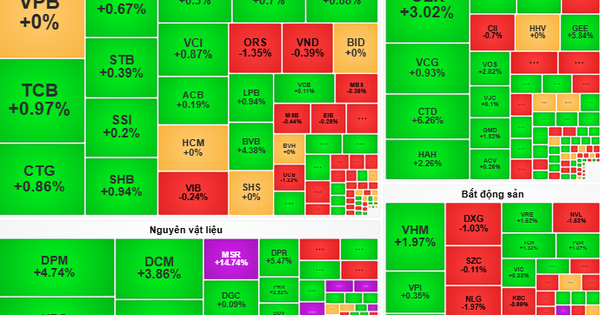

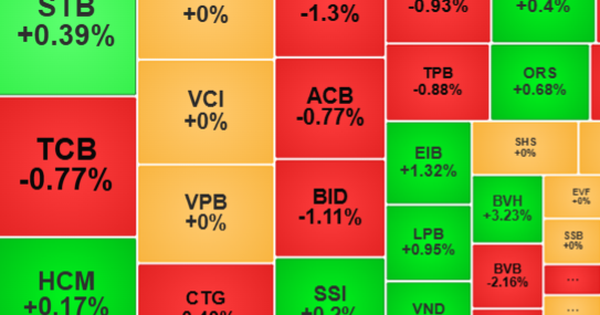

In the morning trading session of November 13, the market continued to be gloomy and worried, VN-Index broke the support level of 1,240 points, closed at the lowest level of the session, falling to 1,236.33 points, down more than 8 points compared to the previous session and breaking the strong support level of 1,240 points. HNX-Index decreased by 1.8 points to 224.89 points while Upcom Index decreased slightly by 0.31 points to 92.08 points. Liquidity increased compared to the previous session but remained low in recent days, the transaction value on HOSE was less than 7,000 billion VND.

Banking stocks contributed to the sharp decline of the market with a series of stocks in red such as STB, TCB, BID, VPB, CTG. Many other stocks in the VN30 basket also fluctuated negatively such as HPG, GVR, GAS...

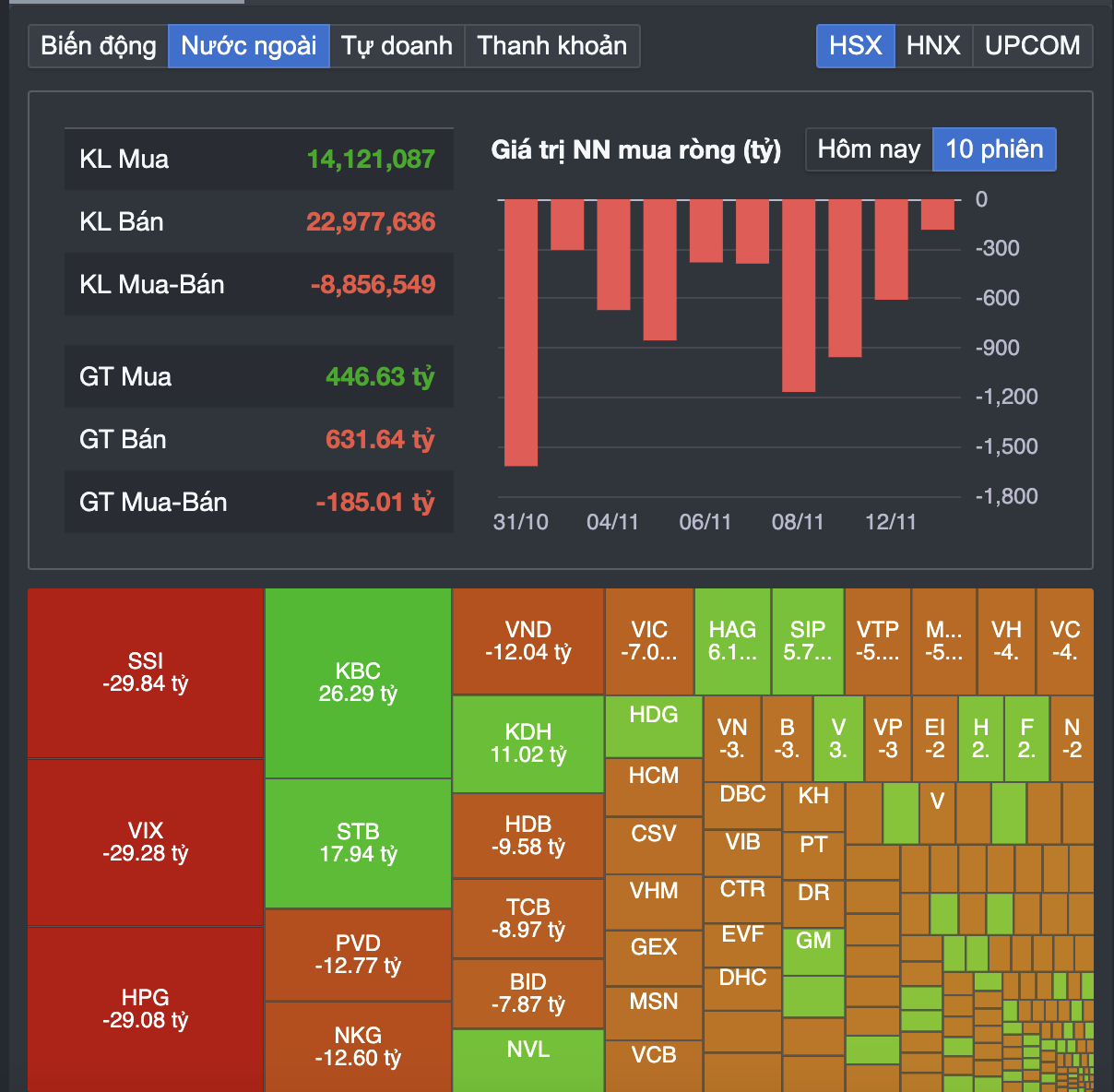

Foreign investors have not stopped their net selling streak, with the transaction value on the HOSE floor in the morning session exceeding 1,000 billion VND, of which more than 600 billion VND was sold.

Foreign investors' continuous net selling affects investor sentiment

With the current negative developments, VN-Index has had a series of 5 consecutive sessions of decline. Notably, the market also broke through the strong support level of 1,240 points, which is considered a support zone to stimulate bottom-fishing demand from the market. The stock index has now fallen to its lowest level since mid-August 2024.

On forums, associations, and investment groups, many investors expressed disappointment when the international stock market, especially the US market, continuously set new historical peaks after Donald Trump was elected President. On the contrary, Vietnamese stocks were in the red, continuously probing the bottom.

The market's performance also went against many analysts' predictions that the VN-Index would benefit from Mr. Trump's election.

In the latest update report of Dragon Capital Vietnam, this investment fund said that the Vietnamese stock market is expected to fluctuate strongly in the short term. However, the businesses in the fund's research scope are still being continuously observed and there is no immediate pressure on revenue due to this event.

"Companies in the export industry that are directly affected by President Trump's upcoming policies only account for a small proportion of the VN-Index, so the risk from this group will not significantly affect the entire market. Domestic investor sentiment remains positive, as many people have an optimistic view of Mr. Trump's election," said an expert from Dragon Capital.

According to Dragon Capital Vietnam, in the three years before the COVID-19 outbreak, under Mr. Trump, listed companies on the Vietnamese stock market achieved impressive net profit growth of up to 19.1%. However, Mr. Trump's unpredictable policies and statements have increased market volatility.

However, the VN-Index still recorded a compound annual return of about 15% during this period, only slightly lower than corporate profit growth due to the discount effect from market volatility.

Currently, Vietnam's economic and trade outlook remains relatively positive, supported by the Government's growth orientation, bringing more opportunities than risks.

On the other hand, a stronger USD could prolong the withdrawal of foreign capital from emerging markets to the US market. Emerging markets, including Vietnam, could continue to suffer from valuation discounts, as happened during President Trump’s first term. This could lead to the expected return of the Vietnamese stock market being lower than corporate profit growth.

However, the 2024 forward P/E of the Vietnamese stock market remains at 11.5x, much lower than the five-year average of 17.2x, suggesting that further declines will be limited thanks to the positive sentiment of domestic investors.

Source: https://nld.com.vn/chung-khoan-thung-moc-1240-diem-nha-dau-tu-lai-toat-mo-hoi-196241113115206853.htm

Comment (0)